Bitcoin pushed past $35,000 on Wednesday amid growing fervor for a spot Bitcoin ETF. And analysts see mounting hype as the dominant force that’s pulling crypto ahead, while stocks on Wall Street appear relatively tepid.

“You can't state that the run-up on Monday was due to anything else,” K33 Senior Analyst Vetle Lunde told Decrypt. “The market is reacting, although with a lagged effect, to the increased likelihood of a spot ETF’s approval.”

Bitcoin has surged 24% over the past week, according to CoinGecko. Meanwhile, the S&P 500 has dropped 2.5% over the past five trading days, and the tech-heavy Nasdaq Composite has slipped 3.3% during that same span.

An ETF is a publicly traded investment vehicle that tracks the price of an underlying asset. For Bitcoin, Lunde said it’s “a huge potential catalyst for inflows” because institutions and retailers would have an easier time getting exposure to the coin.

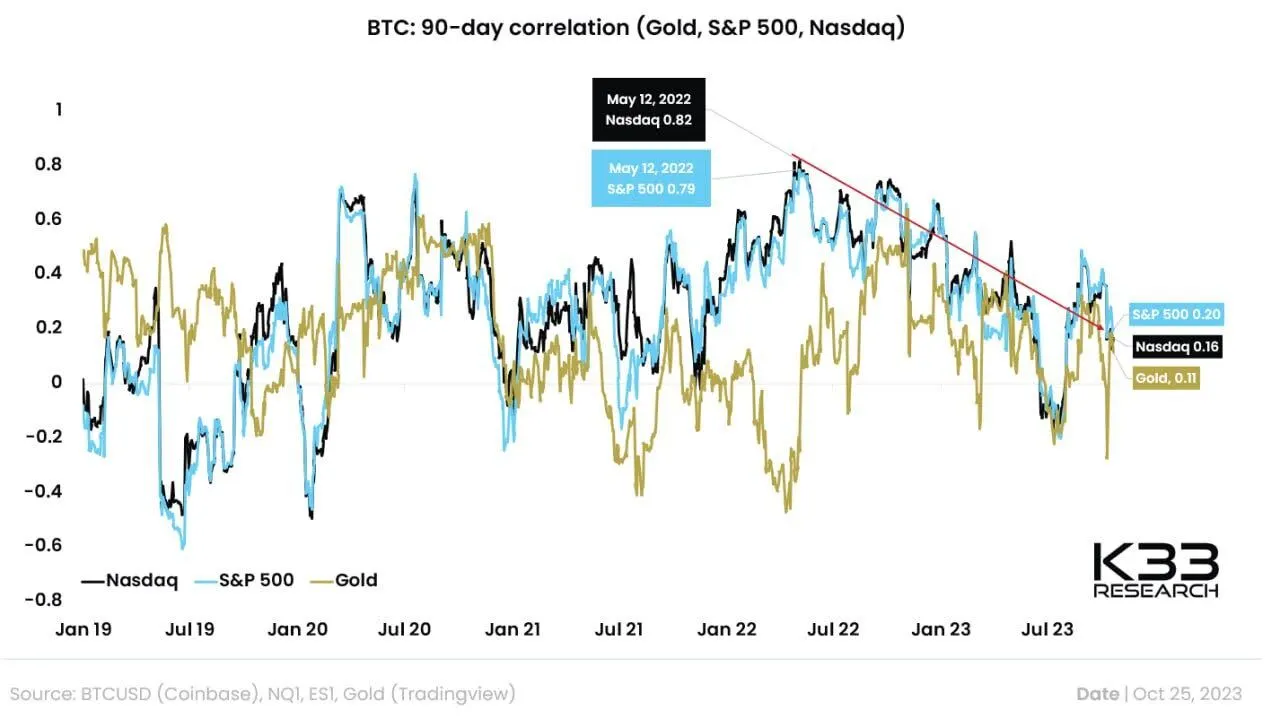

Bitcoin’s correlation to equities has trended down over the past year, but the coin moved in tandem with stocks for much of 2022, per K33 Research. Before its recent rise, Bitcoin’s correlation to stocks had already softened significantly, Lunde said.

“The correlation story has changed quite a lot in the past year, and that's something that should be acknowledged by market participants,” he said. “But it takes time.”

Bitcoin’s correlation to the Nasdaq and the S&P 500 has dropped from 0.79 and 0.82 last May to 0.20 and 0.16, respectively. A value of 1 indicates that two things always move in the same direction, and a value of -1 means the opposite.

As the Federal Reserve raised borrowing costs in 2022 to tamp out decades-high inflation, stocks and crypto both came under pressure. But it was for two different reasons, James Butterfill, head of research for CoinShares, told Decrypt.

While increased borrowing costs squeezed the margins of publicly traded companies and made them less attractive, Butterfill said a simultaneous increase in yields on assets like U.S. Treasuries gave Bitcoin stiff competition as a store of value.

At this point, Butterfill said that there’s a stronger correlation developing between stocks and bonds. As a relatively uncorrelated asset, he said Bitcoin is gaining interest among some investors—like CoinShares clients—as an asset that can offer diversity.

By raising interest rates, the Fed makes it more expensive for businesses and consumers to borrow, thus cooling down the economy. But if they’re too aggressive, steep borrowing costs could suffocate the economy.

Over the past week, expectations that the Fed could raise interest rates in December have gone down, according to the CME Group’s Fed Watch Tool. And the divergence between Bitcoin and equities will likely intensify if the Fed signals it’s ready to cut them soon, Butterfill said.

“The equities markets are likely to respond badly to rate cuts because it's an admission by the Fed that we're about to fall into recession,” he said. “Equally, an admission by the Fed that they've made a mistake would be good for Bitcoin.”

Edited by Stacy Elliott.