Does the thought of missing out on the next, big thing in crypto keep you up at night? Have you ever lied to a loved one about the amount of time you spend thinking about blockchain? There’s probably a pill for that. But for now, you’ve come to the right place.

The cryptocurrency industry moves faster than a greased pig at a barbecue. Anyone who's spent more than six months here knows that today's baby-back rib dinner is tomorrow's sad and greasy paper plate. And yet, there's nothing more exciting than what's happening in the cryptoverse, right here, right now.

Except, of course, What Happens Next—you know, the Big One. The Thing That Changes Everything.

This list—our inaugural listicle—is an attempt to spot the things on the horizon that are potentially seismic. To that end, we read everything we could, spoke to anyone who would return our emails, and generally worked ourselves up to such a degree that the only thing that would satisfy us was publishing this grand, opus minimus.

1. BTC ETF

This one is so obvious, we considered keeping it off the list just for the controversy. But we’re new here and don’t want to look stupid.

While exchange-traded products are OK in other parts of the world, the US Securities and Exchange Commission’s approval of a bitcoin ETF—expected at the end of next month—is easily the most anticipated event in the crypto world. A favorable outcome could put crypto assets in the same boat as other, typical securities. Institutional investors won’t have to buy bitcoin from exchanges, nor deal with the lunacy of “cold storage” in hardware wallets. They won’t have to hold crypto at all—but can still offer the asset class to their customers, just as they do stocks and bonds. That’s why the market lurches up and down on any ETF-related news (or rumor.)

2. The Halvening

If anything is a “sure thing” in this volatile world, it’s the halving of coin rewards for bitcoin miners.

The “Halvening” is when the prize for mining a block of bitcoin drops from 12.5 BTC to 6.25 BTC. The event is baked into the protocol and there’s no uncracking these eggs. Every time 210,000 blocks are mined, or confirmed, the system cuts the reward in half. It’s happened twice before and it will keep happening, theoretically, until all 21 million coins have been mined.

While it’s impossible to predict how markets will ultimately react, the price of bitcoin has historically skyrocketed following each previous halving event.

Will BTC rally back to those late 2017 highs? If we knew that, we wouldn’t be wasting time with you grinding out copy, would we? The answer comes on or around May 22, 2020, based on current mining rates.

3. The Flippening

The “Flippening” is the point in time when bitcoin is no longer considered the heavyweight champion of cryptocurrency, and another crypto asset knocks it out. But much like wagering on a prize fight, the results of this brawl are entirely speculative.

In fact, it’s debatable whether there’s any battle at all. Bitcoin and ethereum, the second biggest currency by market cap, are so different, there may be no reason why the two couldn’t thrive and coexist. Still, Bitcoin’s shrinking market share (relative to the 80+% of one year ago) is a sign that the crown weighs heavy on the king. Then again, the champ may have a few more rounds in him yet. This could take a while.

4. Reverse ICOs

While 2017 may have been the “year of the ICO,” ICO fever was still raging through the first half of 2018, putting it on a pace to dwarf the previous year’s fundraising total, according to ICOdata.io. That train has only recently showed signs of slowing down—maybe. The Reverse ICO may keep the party going longer.

Reverse ICOs have become irresistible to some established tech companies that launched prior to the ICO craze, and raised money the old-fashioned way. The underlying process is essentially the same as a standard ICO. The twist is that these companies are typically established entities with existing user bases and revenue streams, and are now looking to “tokenize” their businesses, thereby raising new funds and hyper-activating their users.

Perhaps the best(?) example is Telegram. Though the company eventually called off its public ICO in favor of a private one, its token bake sale still brought in a staggering $1.7 billion. Other examples include Kik, Kakao, PlayChip, KodakCoin, YouNow (Props), and Cool Cousin.

And there’s a Who’s Who of possibilities on deck, including SoundCloud, Twitter, Uber, and Spotify. Not to mention the rumor turned serious rumor that Facebook may try its hand at the Game of Coins.

5. Centralized banks, governments dance with decentralization

We’re not just talking the government of Estonia here. Even though the proud “people of the soil” were among the first to announce plans for a state-backed crypto, Estonian officials have recently walked backed those proposals. Dubai turned out to be the first country to do more than talk about it: It went out and did the damn thing with Emcash, the world’s first state-issued digital currency, followed by Venezuela’s (cough, cough) petro. And now, a raft of other countries are actively exploring crypto, including Sweden, Russia, China and Israel.

As for the central banks, they already know a thing or two about printing money out of thin air. In Sweden, where physical cash has seemingly evaporated, a central bank digital currency (CBDC) is starting to make a lot of sense. CBDCs have the benefit of lowering transaction costs and would allow central bankers to get even more creative with monetary policy.

6. A moment of regulatory clarity

Depending on which crypto circles you truck in, your stance on the pros and cons of government regulation will differ just a tad. But if there’s one thing we can all agree on, it’s the need for answers.

For the business and investor class, the question more or less boils down to: “Precisely which t’s do we need to cross and which i’s do we need to dot to resume making truckloads of cash?” For example, is crypto a commodity or a security?

In the United States, the SEC has said—in incredibly uncertain terms—that while bitcoin and ether are not securities, Ethereum-based tokens are securities, right up until they aren’t. Why? Because “the analysis of whether something is a security is not static and does not strictly inhere to the instrument,” as William Hinman, director of the SEC’s division of cooperation finance, explained in a statement in mid-June.

Yes, “inhere” is actually a word, despite what spellcheck says.

A cloud of confusion also hangs over the mess of reporting cryptocurrency gains and losses to the US Treasury Department and IRS.

The rest of the world appears to be equally confused and looking to the United States for guidance.

7. Decentralized exchanges for dummies

A bunch of decentralized exchanges (DEX) are already in use and gaining in popularity, including IDEX, Waves DEX, and OpenLedger Dex, with plenty more on the way.

There are several reasons crypto traders may prefer a DEX over a traditional exchange such as Coinbase. But the fundamental difference comes down to the question of custody: Who controls the funds? A peer-to-peer system eliminates the need to store crypto with centralized third parties that are vulnerable to hackers. For those of you worried about an extinction-level hack on the order of the DAO or Mt. Gox, this may be your ticket to sleeping through the night.

This increased level of autonomy, however, is not without its downsides. DEXs are still in their infancy, so there are liquidity issues from a lack of trading volume. They are also much more difficult to navigate, and—since there is no central authority involved—if you find yourself in choppy waters, well, that’s the price of freedom. You’re on your own.

And there’s the rub. Convenience is king (see: bitcoin ETF), and until a “DEX to end all DEXs” comes along that’s as easy to use as Coinbase, they’re likely to remain on the fringes. But when it does (and there are some big promises being made), we may see this whole peer-to-peer economy thing start in earnest.

8. Real crypto in the real world

Going about your day-to-day life without ever spending a nickel of that filthy, filthy fiat—that’s the crypto-dream. Crypto “debit cards” attempt to turn that dream into a reality. They’re one of the very few ways people can quickly and easily use cryptocurrency to directly purchase goods and services.

But while there are over a dozen of these cards on the market, not a single one of them is the genuine article. They all involve a middleman. They all convert crypto to fiat to conduct a transaction. They all fall short of the real thing.

Instead, the way forward—in the short term—may be for merchants to find creative ways to manage in-store crypto purchases without introducing a middleman and compromising the integrity of the transaction. Long term, the crypto community may have to wait until a coin arrives that people can actually use instead of hodl. When that happens, the need to convert crypto to fiat will disappear, and these “debit cards” will be remembered for the training wheels that they are.

9. The second coming of Satoshi Nakamoto

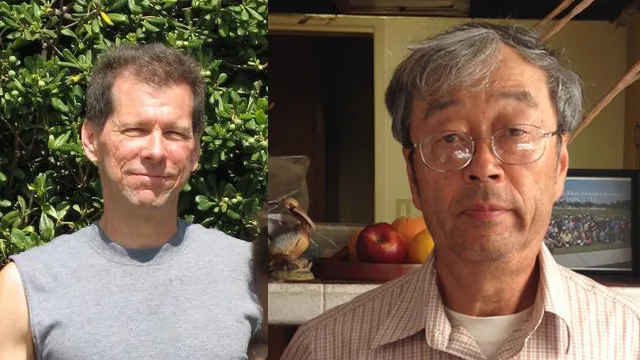

The identity of the father of Bitcoin and all-time Crypto King is the best part of crypto’s creation myth, with no fewer than four, major attempts to solve this mystery. From Nick Szabo and Craig Wright to Hal Finney and a guy actually named Satoshi Nakamoto: Each theory has its share of disciples, but every attempt to prove it comes up short.

Many of the cognoscenti think it was Finney, a brilliant cryptographer and the first person to communicate with Satoshi. Finney’s death also provides a pretty good explanation for why Satoshi “disappeared” before Finney died of ALS.

Perhaps, if we live long enough, this mystery will be solved: Finney, famously, was cryogenically preserved. If he is the real Satoshi, as some pundit pointed out on Twitter recently, Satoshi’s (presumably) uncashed 1 million BTC would certainly make it worthwhile to figure out how to, er, reanimate Finney.

That’s crazy talk, though, as nutty as inventing a whole new world based on digital currency.

Read Next: The Shifting Sands of Shape Shift