Fundamentals remains unchanged

$118,448.00

0.08%$3,632.74

-0.83%$3.10

-10.05%$763.34

-4.54%$185.07

-6.44%$0.999838

-0.01%$0.2357

-7.95%$3,626.74

-0.48%$0.308494

-2.70%$0.800948

-6.92%$118,157.00

0.16%$4,377.79

-0.69%$42.21

-4.12%$0.419602

-9.34%$3.69

-5.15%$17.87

-5.25%$3,899.65

-0.92%$523.74

-0.69%$3,883.09

-0.70%$0.240272

-8.57%$23.53

-5.67%$113.06

-3.88%$9.00

0.00%$3,632.40

-0.66%$0.00001355

-8.55%$3.12

-4.89%$0.999688

-0.05%$1.002

0.14%$0.998463

-0.20%$44.15

-0.09%$118,494.00

0.24%$3.97

-8.73%$10.06

-2.56%$318.26

-2.26%$0.00001253

-8.36%$4.53

-4.98%$286.51

-4.61%$0.125321

0.81%$1.19

0.03%$416.51

-5.67%$22.65

-3.19%$0.443254

-3.79%$2.67

-8.25%$1.004

-6.42%$0.474572

1.96%$4.63

-14.15%$225.66

-6.24%$5.47

-8.66%$48.07

-2.00%$0.00003602

3.23%$0.098943

-10.36%$0.755277

-8.93%$0.03943335

-9.78%$1.00

0.00%$0.257583

-8.47%$0.429404

-5.77%$1.001

0.15%$3,622.52

-1.42%$4.60

-7.19%$0.02449442

-8.93%$4.01

-8.67%$17.24

-2.15%$0.228103

-6.80%$1.13

-11.09%$9.86

-7.81%$4.50

0.11%$0.736729

-5.05%$196.88

-6.38%$0.08555

2.15%$0.313505

-7.01%$1.06

0.01%$2.58

-7.98%$118.75

-7.78%$4,135.68

-0.92%$118,293.00

0.41%$1.77

-8.14%$3,800.92

-0.85%$0.538413

-10.05%$5.06

-2.18%$0.02268618

-13.19%$12.12

0.58%$5.08

4.36%$0.999719

-0.03%$1.00

0.25%$1.40

-15.20%$0.086448

-8.89%$3,817.92

-0.83%$1.00

0.18%$0.984992

2.56%$3,882.62

-0.92%$3,927.50

-0.45%$13.46

-6.95%$1.82

-12.96%$1.30

-2.12%$1.00

-0.00%$0.796947

-6.45%$0.0001279

-11.76%$3,817.45

-0.52%$117,768.00

-0.04%$0.68118

-9.27%$208.41

-6.12%$0.00309733

-15.07%$1.076

-13.50%$0.332133

-9.35%$1.57

-14.06%$0.54207

-11.87%$760.87

-4.67%$0.102118

-5.99%$0.996498

-0.52%$1.071

-6.94%$0.908601

-3.20%$0.162715

-6.84%$3,371.13

-1.57%$0.355468

-0.05%$118,101.00

0.11%$28.31

0.91%$0.181949

3.25%$242.86

-6.31%$0.583707

-3.74%$118,686.00

0.47%$1.11

0.05%$2.60

-10.42%$0.857584

-11.64%$0.999849

0.03%$10.70

8.99%$3,365.13

-1.60%$0.01708725

-12.72%$2.97

-8.29%$0.200191

-9.70%$3,629.22

-0.84%$0.01724111

-10.34%$3,886.90

-0.98%$0.886181

-4.78%$3,615.69

-1.02%$0.456206

10.20%$3,789.17

-1.21%$0.297086

-9.62%$4.36

-5.90%$2.02

-4.73%$0.124951

-10.21%$111.91

0.01%$0.99853

-0.05%$1.073

-1.53%$0.00000068

-5.75%$118,119.00

0.30%$40.83

-4.68%$0.999643

-0.02%$0.401434

-7.85%$3.40

-7.70%$3,634.20

-0.73%$0.00868876

-1.52%$1.88

-3.29%$0.234125

-8.90%$0.433536

-6.53%$0.30807

-9.68%$0.00634539

-7.13%$0.997671

0.00%$0.00000145

-8.92%$118,252.00

0.33%$118,202.00

-0.12%$3,856.97

-0.85%$0.55685

-5.03%$0.558029

0.21%$0.999855

-0.02%$27.92

-5.96%$0.01589658

-12.14%$3,632.69

-0.65%$0.054505

-13.26%$1.00

-0.03%$0.074248

1.28%$4,006.49

-0.77%$0.482376

11.83%$0.644949

-9.98%$1.43

-10.42%$0.00844461

-9.21%$0.999918

0.04%$42.28

-3.94%$0.402224

-9.82%$7.32

-7.04%$1.16

-0.02%$3,940.68

-1.60%$1.11

-9.58%$16.19

-9.02%$0.609631

-7.87%$6.49

-10.01%$0.126557

-10.15%$48.33

-6.74%$0.00000046

-0.80%$4,379.74

-1.08%$0.00002197

-6.95%$3,586.15

-1.79%$10.76

0.01%$0.206653

-2.55%$0.172932

-8.92%$0.396904

-7.15%$0.939293

3.56%$0.999799

-0.01%$3,634.46

-0.87%$2.50

-10.22%$1.002

0.07%$1.30

-7.74%$7.20

-1.88%$1.094

-0.05%$0.994512

-0.87%$13.59

0.45%$0.04098551

-8.30%$0.00772442

-10.41%$4.81

-3.84%$0.054478

-8.70%$0.390042

0.30%$42.09

-3.90%$0.999835

-0.02%$0.583082

-3.92%$202.91

-6.31%$0.275713

-9.57%$23.38

-6.49%$0.080891

-9.16%$0.144822

-17.70%$141.92

-4.17%$0.382081

-12.33%$1.34

-6.95%$28.42

-6.44%$0.553278

-5.39%$0.0368137

-4.98%$22.08

0.55%$118,652.00

1.40%$0.00357624

-8.04%$0.01836584

-3.42%$118,219.00

0.04%$0.763343

-5.95%$0.766336

-7.88%$0.03249313

-2.86%$0.00006163

-7.89%$0.00498523

-7.55%$0.227995

-6.78%$0.00378437

-7.41%$0.784113

-5.63%$0.00000077

17.13%$1.35

-15.68%$0.00382691

-8.59%$3,805.96

-0.91%$4,082.01

-0.84%$0.99821

-0.00%$0.996596

-0.95%$0.999727

0.01%$0.00346681

-11.59%$0.307435

-5.52%$208.98

-6.46%Reading

Monday’s carnage in the crypto market on Monday caused the market cap of Arbitrum to slip below that of rival project Optimism.

Arbitrum’s governance token ARB dropped to a new all-time low of $0.745, according to data from CoinGecko, while Optimism’s OP token gained 6.8% in the past 24 hours to trade at $1.33. Currently, ARB has recovered some of its losses and is trading at $0.782, at par with yesterday’s price.

The flipping of the two projects’ market caps occurred due to considerable liquidations of ARB long orders. CoinGlass data shows $2.2 million longs were liquidated on Sept. 11, levels not seen since August’s flash crash.

The bullish hype prior to the liquidations can be attributed to PlutusDAO’s introduction of an ARB staking proposal on Sept. 9.

Notably, the total market caps of Arbitrum and Optimism layer-2s are separated by just $66.9 million, with both holding around $1 billion.

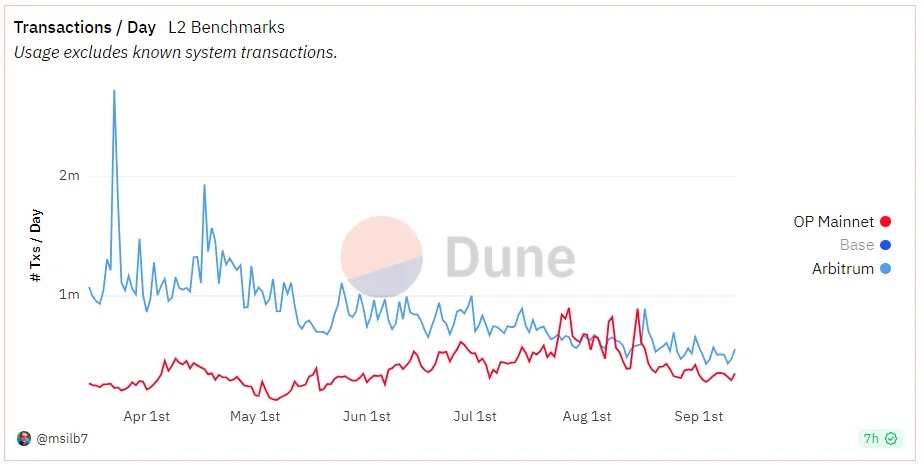

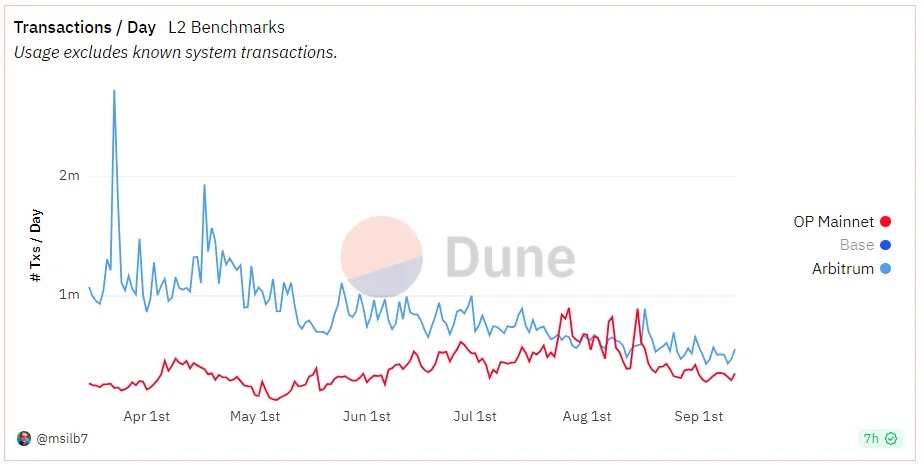

The number of transactions and daily addresses interacting on Arbirum and Optimism has remained consistent since the start of September, with Aribtrum total transacting continuing to lead Optimism, according to a Dune dashboard by pseudonymous data analyst @mslib7.

It suggests that the price surge was primarily due to the futures liquations.

Optimism’s transactions briefly outpaced Arbitrium during the hype around the launch of global ID project Worldcoin, which is built atop Optimism's infrastructure. However, they slipped back below Arbitrum's transactions as the hype around Worldcoin faded.

According to data from DeFiLlama, the total value locked (TVL) in DeFi applications on the two protocols has been on a downward trend. However, there haven't been significant moves to outperform each other.

Arbitrum’s TVL of $1.67 billion stands at more than 2.5 times that of Optimism's TVL at $0.63 million.

Several leading altcoins that rallied amid Bitcoin’s recent consolidation have stalled, prompting signs of fatigue across the broader market. But is the sector nearing a pullback, or are current moves just macro tremors ahead of another upward leg? Bitcoin is trading in a narrow range between $117,000 and $120,000, entering a period of consolidation following a strong rally. In its wake, major altcoins have surged, with Ethereum up 24%, Solana 20%, and XRP 12% since the July 15 low. The patte...

Ethereum has made a comeback, recently hitting its highest price this year—but it still has plenty of room to run, according to crypto mogul Arthur Hayes. In a new blog post by the co-founder and former chief of crypto exchange BitMEX, Hayes argues that the second biggest digital coin by market cap could reach $10,000 by the end of the year. That's more than double the coin's all-time high price. ETH was recently trading for $3,590 per coin, according to CoinGecko, down slightly after hitting t...

Jack Dorsey's Block (XYZ) has started adding the first customers for its Bitcoin payments service, just as the firm joins the S&P 500. Shares of the NYSE-listed company, which owns Square, Cash App, and TIDAL, closed up 0.5% but have risen more than 14% over the past week. Dorsey stepped down as CEO Twitter, the company he founded, in 2021 to focus on making Bitcoin the world's dominant currency. Block's executive officer and head of business, Owen Jennings, said on X Tuesday that Block's point...