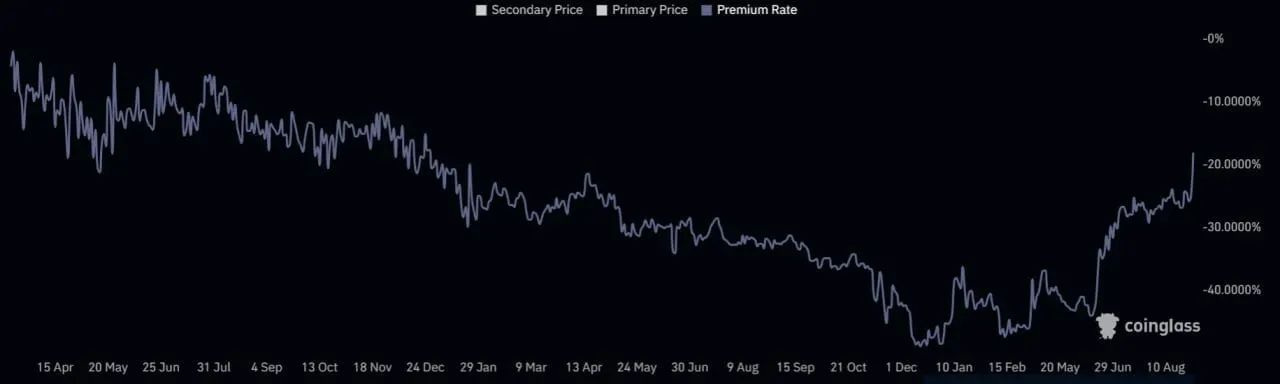

The discount between Grayscale’s Bitcoin Trust (GBTC) price and the value of Bitcoin has dropped to its lowest level since December 2021, hitting 18.06% this morning, per Coinglass data.

Currently, Grayscale Bitcoin Trust holds $17.10 billion worth of Bitcoin.

The move came after Grayscale won a landmark victory against the SEC yesterday. A D.C. circuit court explained that the Commission lacked a coherent explanation for blocking Grayscale’s move to convert its GBTC product into a spot Bitcoin ETF.

One GBTC share represents 0.00090089 BTC. The price of the Bitcoin represented by 1 GBTC share as of August 29 was $25.09 compared to the GBTC price of $20.56.

The shares have traded at a discount to Bitcoin’s market value since February 2021, reaching lows of nearly 50% in December 2022.

The inability to easily convert GBTC to Bitcoin in a closed-end fund like Grayscale, reduces its demand significantly compared to other alternatives like leveraged futures Bitcoin ETFs and ProShares Bitcoin Strategy ETF, giving rise to the infamous discount.

Europe also recently saw its first spot Bitcoin ETF, the Jacobi FT Wilshire Bitcoin ETF, which kicked off trading on Amsterdam’s stock exchange on August 15.

SEC still needs to weigh in on Bitcoin ETF

While the court ruled in favor of Grayscale, calling the SEC’s reasons for blocking a Bitcoin ETF “unlawful,” the decision still falls on the SEC to approve, deny, or delay on making a decision.

Grayscale CEO Michael Sonnenshein said that the legal win brought the first “one step closer to making a U.S. spot Bitcoin ETF a reality.”

Grayscale’s chief legal officer Craig Salm added that the firm “will be working closely with the SEC on next steps to bring GBTC to NYSE Arca as a spot Bitcoin ETF.”

However, the continued decrease in the discount will depend on the SEC's final decision.

“The chances have increased, but the SEC can still appeal or deny applications for other reasons,” ETC Group CEO Tim Bevan, told Decrypt. “The discount which has narrowed significantly this year could widen again if the market gets clear signals that the SEC simply isn’t going to move on this.”