Sandra Lee of the FSOC said that the collapse of FTX could’ve been avoided the following month had the recommendations of a report from last October been more closely studied.

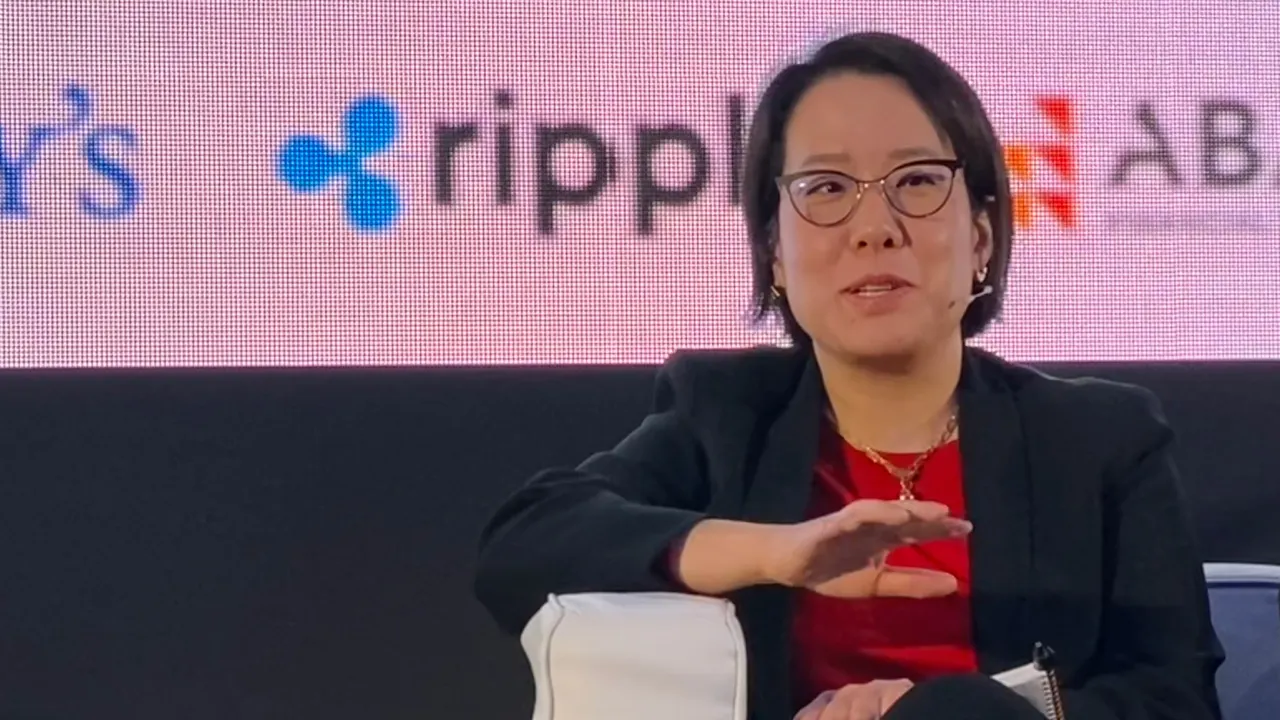

Speaking at a Financial Times panel on crypto regulation this morning, Lee said “last fall, the council published a report on digital assets and instability and identified various risks and potential recommendations.”

The FSOC was established in 2010 by the Dodd-Frank Act and it works under the U.S. Treasury. It comprises fifteen members, ten of which vote, and they represent the top financial regulators, including the Fed, the SEC, and the CFTC. Their primary goal is to convene and identify emerging risks to U.S. financial markets and make policy recommendations.

“I do think some of the themes and risks identified in the report were borne out by what was observed with FTX,” Lee said, adding as an example that there were “market integrity issues prior to regulation impacting consumers. That definitely, unfortunately, came to pass.”

Once one of the industry’s largest cryptocurrency exchanges, FTX collapsed last November after it was hit by a multi-day bank run.

In the process of unraveling, it came to light that FTX executives had been misusing customer funds to make whole its trading arm Alameda Research, which had been over-leveraged due to risky trades and a bear market prompted by the collapse of Terra earlier that year.

Former CEO Bankman-Fried now faces 13 criminal charges—with eight charges from an earlier indictment—including wire fraud and conspiracy to commit money laundering. His case has also prompted U.S. regulators to tighten their crackdown on crypto companies.

According to Lee, the FSOC had already made recommendations that could have helped too, “one of the recommendations in the report talks about the importance to supervisors and regulators of being able to see into affiliates and subsidiaries of certain cryptoasset firms.”

The FSOC and crypto

Their October report was released in response to President Joe Biden's executive order from March 9, 2022, "Ensuring Responsible Development of Digital Assets.”

While far from being as comprehensive as the EU’s recently-passed MiCA bill, it provided potential regulators with some general thoughts and guidance from the White House.

The report flagged four key issues in crypto: “amplified instability” within the ecosystem, prices pumped by speculation rather than fundamental underlying economic utility, “repeated significant and broad declines,” and—most relevant to FTX—tokens issued by or associated with entities with "risky business profiles and opaque capital and liquidity positions."

In retrospect, the FSOC’s wording here can neatly be applied to FTX’s native FTT token.

A bank run on FTT catalyzed FTX’s demise. It started when rival Binance CEO Changpeng Zhao declared he would move to liquidate his exchange’s entire FTT holdings citing “recent revelations” about FTX allegedly lobbying “against other industry players behind their backs.”

As the price of FTT plummeted, it became apparent that FTX was massively overleveraged.

Within a week, the firm had filed for bankruptcy, taking 130 affiliated companies with it in a mess so large that regulators and industry alike are still trying to parse it through the wreckage.