Rate hikes on the horizon

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$117,486.00

-0.24%$3,721.75

1.60%$3.14

0.89%$782.77

2.01%$186.29

2.72%$0.999834

-0.00%$0.236033

3.73%$3,715.94

1.62%$0.317105

1.25%$0.818774

2.17%$117,451.00

-0.28%$44.04

5.60%$4,496.15

1.88%$3.98

8.01%$0.432782

3.03%$18.27

3.21%$4,002.58

1.76%$554.98

8.36%$0.258969

9.27%$3,988.06

1.83%$23.97

2.29%$113.23

2.04%$3,723.85

1.68%$8.98

0.05%$0.00001402

4.34%$3.19

2.75%$0.999848

-0.00%$1.001

-0.09%$1.001

0.16%$43.95

-0.02%$10.45

5.13%$4.09

3.16%$117,551.00

-0.27%$322.12

-1.80%$0.00001258

3.55%$4.57

-0.01%$294.93

3.60%$0.131757

4.40%$1.19

0.00%$425.88

2.91%$0.606327

27.90%$2.87

6.80%$22.64

2.35%$0.44022

-0.68%$1.037

3.48%$4.75

3.23%$5.61

2.73%$226.94

2.95%$48.18

0.27%$0.00003594

10.47%$0.099799

2.98%$0.764566

2.97%$0.03878378

4.49%$1.00

0.00%$0.266078

3.12%$0.442792

3.76%$3,726.17

1.85%$0.02570375

4.73%$1.002

0.04%$4.24

5.44%$4.70

2.13%$0.233657

2.92%$17.57

0.96%$1.16

3.21%$10.09

2.00%$0.092967

10.72%$4.54

1.00%$0.73729

2.07%$0.331552

4.72%$198.19

2.71%$1.99

14.82%$2.64

3.10%$121.36

2.33%$4,240.28

1.64%$117,404.00

-0.26%$3,902.67

1.58%$1.06

0.01%$0.550024

3.11%$5.43

6.50%$5.08

1.19%$0.02238282

-2.00%$12.04

-0.01%$0.999489

-0.02%$1.032

8.64%$1.95

7.02%$3,911.32

1.57%$0.085651

2.52%$3,976.12

1.64%$14.04

4.58%$1.001

0.10%$0.998233

0.55%$1.36

2.54%$4,020.26

1.91%$1.31

0.42%$0.805599

4.68%$0.0001313

6.59%$0.720578

4.85%$3,916.43

1.66%$1.00

-0.02%$117,274.00

-0.52%$209.66

2.58%$0.333792

2.72%$1.072

4.20%$0.564026

3.86%$0.104987

3.18%$784.53

2.26%$1.57

3.15%$1.001

0.16%$0.00276394

6.63%$1.097

3.86%$0.163194

1.01%$0.185918

6.65%$2.75

4.79%$28.56

3.62%$3,716.82

1.71%$3,352.83

-0.77%$117,238.00

-0.44%$244.08

2.47%$0.890296

3.23%$0.351765

-1.17%$118,973.00

1.32%$1.11

-0.00%$0.575145

1.47%$0.999765

0.04%$0.880381

3.42%$0.01719686

3.52%$3,353.40

-0.54%$0.207081

4.53%$3.01

0.64%$3,720.39

1.82%$0.01758675

2.98%$3,974.04

1.50%$0.895578

1.88%$3,876.78

-0.60%$4.52

7.15%$0.30431

2.95%$0.128453

4.74%$9.02

-15.61%$1.97

1.36%$111.94

0.02%$1.086

-0.63%$0.998562

-0.02%$0.00000068

0.51%$40.84

2.90%$117,142.00

-0.40%$0.999534

-0.06%$0.411703

2.61%$0.544336

13.62%$0.394171

4.57%$0.461433

8.93%$3,718.48

1.65%$3.40

2.13%$1.94

2.54%$0.317327

3.00%$0.0087303

-0.26%$0.235813

3.21%$0.00000151

6.76%$0.997548

-0.01%$3,956.60

1.59%$0.999969

0.00%$28.84

0.99%$0.574051

-0.90%$117,581.00

-0.11%$0.555464

1.11%$116,524.00

-0.96%$0.055883

4.60%$3,720.00

1.45%$0.00588259

-0.14%$4,102.46

1.64%$0.01563276

3.00%$1.00

-0.03%$0.074067

0.17%$0.654991

2.86%$1.48

2.71%$0.00872263

2.54%$44.14

6.02%$7.72

7.04%$1.18

6.62%$0.998145

-0.10%$4,017.78

1.20%$0.406674

1.67%$0.634825

3.85%$0.132277

5.24%$16.36

2.81%$6.56

1.12%$0.184934

6.41%$1.16

0.00%$48.86

2.84%$0.00000046

-0.31%$1.004

4.33%$4,501.91

1.54%$5.51

16.18%$0.00002261

2.50%$3,713.86

1.52%$0.400589

1.22%$1.36

6.05%$2.60

3.97%$3,722.03

1.59%$0.00828395

5.07%$0.419341

4.83%$7.38

1.98%$10.76

0.01%$0.04232234

2.68%$1.094

0.00%$0.056104

3.48%$43.86

5.53%$0.996505

-0.32%$13.63

0.78%$0.999823

0.00%$0.190633

-6.14%$0.083894

5.26%$0.999859

-0.00%$0.998697

-0.46%$0.27865

2.69%$203.91

2.54%$23.97

2.61%$0.574938

2.05%$145.74

2.02%$29.16

2.01%$1.37

1.85%$0.381105

5.71%$0.01939568

3.63%$0.142567

1.64%$0.559502

0.70%$0.03701493

0.11%$0.03419105

3.24%$22.18

0.66%$0.00000086

8.46%$0.00361299

-1.67%$0.362277

23.04%$0.00521718

5.55%$0.790517

0.99%$116,891.00

-0.29%$0.00006312

2.84%$0.863234

9.21%$117,472.00

-0.09%$0.00399383

-1.98%$0.744524

-1.20%$0.233381

2.93%$0.802485

1.93%$1.38

3.16%$0.999823

0.02%$0.00388638

0.07%$3,901.88

1.65%$4,191.73

1.36%$0.00359975

6.25%$0.999365

0.02%$0.997851

0.00%Reading

Ethereum’s post-Shanghai bull run has hit a lull.

Its price touched lows of $2,080 on Monday morning, while Bitcoin struggled to hold onto the $30,000 support level.

The bullish run-up may have been paused in part due to the U.S. Federal Reserve's statements regarding one more rate hike in the upcoming May policy rate meeting.

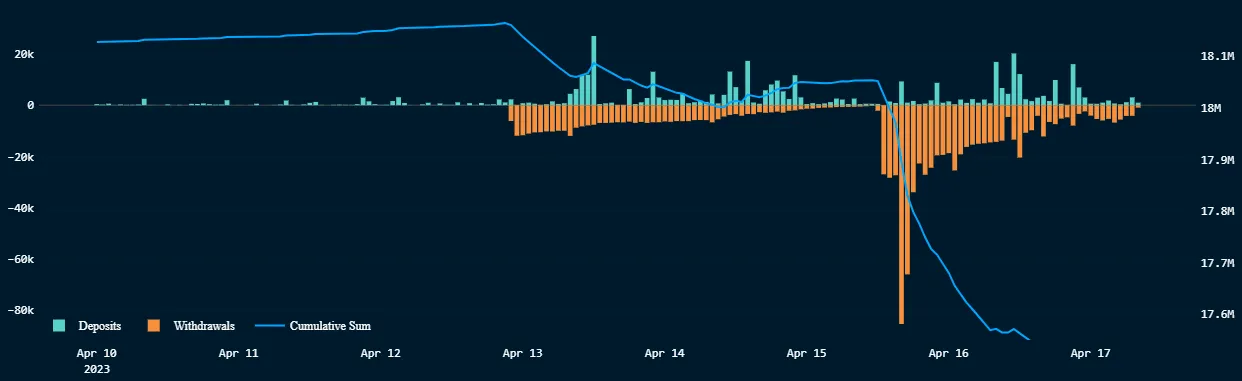

Additionally, withdrawals from Ethereum staking contracts continue to outpace deposits, potentially adding sell pressure to the asset, per data from Nansen. On April 15, there was also a massive 85,393 ETH withdrawal executed at 10 am ET followed by another 66,030 ETH withdrawal an hour later.

Ethereum's price has risen roughly 12% since last week’s Shanghai upgrade. It enabled withdrawals of staked ETH from the proof-of-staking chain, a feature not available since staking was first launched in December 2020.

The network quickly saw a hefty inflow of deposits to the staking contracts and the market reacted positively to the successful change, with Ethereum propelled to new yearly highs above $2,129.

However, on April 14, statements from Fed officials that hinted at another rate hike in May strengthened the dollar. A strong dollar can have a negative impact on other, more risky assets such as cryptocurrencies and stocks.

Christopher Waller, a member of the Fed’s governing board, and Atlanta Fed President, Raphael Bostic, told Reuters on Friday that the Fed may go through one more quarter-percentage gain before ending its quantitative tightening to curb inflation.

The CME FedWatch tool, a survey of CME’s interest rate traders, currently places an 88.2% chance that the Fed will increase its rate.

Fresh off its climb past $30,000 the day before, Bitcoin inched higher after a widely-watched inflation gauge showed rising prices continued to cool in March. The Consumer Price Index rose 5% in the 12 months through March, the Bureau of Labor Statistics (BLS) said Wednesday, coming in lower than economists’ forecasts. On a monthly basis, the index rose 0.1%, a notable deceleration from 0.4% in February. Bitcoin rose .6% to $30,276 while Ethereum was down 1.5% to $1,887 ahead of the network’s Sh...

Another rate hike makes the dollar an attractive investment in annual returns, too, potentially diminishing the appeal of top cryptocurrencies like Ethereum to investors looking for stable yields.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

Public Keys is a weekly roundup from Decrypt that tracks the key publicly traded crypto companies. ETHA hits warp speed BlackRock’s iShares Ethereum Trust, which trades under the ETHA ticker, just became the third-fastest ETF to reach $10 billion. It reached the milestone in 251 days. And was beat by BlackRock’s iShares Bitcoin Trust and Fidelity’s Wise Origin Bitcoin Fund—which did it in 34 days and 53 days, respectively. There was much hand wringing and head scratching on Wall Street when the...

Sen. Elizabeth Warren (D-MA) has slammed the recently passed GENIUS Act, saying the American people will “pay the price” for the groundbreaking crypto legislation. The act, which was signed into law by President Donald Trump earlier this month, provides legal clarity for stablecoins. It establishes a framework for issuing and trading stablecoins, which has prompted increased interest in them from banks and major retailers. In an interview with Vanity Fair, Warren acknowledged the U.S. needs “str...

Analysts warned that large scale Bitcoin holders moved billions in Bitcoin to exchanges early Friday morning. Popular CryptoQuant analyst Maartunn said on X that crypto financial services firm Galaxy Digital shifted $3.7 billion worth of Bitcoin early this morning. He said of the 35,568 BTC that had been moved to exchanges in the past 10 hours, 26,100 worth of Bitcoin—including a portion moved by Galaxy—was moved by short-term holders and sold at a loss. Galaxy oversees asset management and cust...