$66,778.00

-0.47%$1,965.43

-0.54%$1.42

-3.03%$605.80

-1.38%$0.999909

-0.01%$81.70

-2.89%$0.279617

-0.63%$0.098441

-1.83%$1.032

0.04%$559.93

-0.19%$50.64

-0.37%$0.274584

-1.82%$0.999141

-0.03%$8.59

-2.43%$28.51

-1.83%$0.998863

0.00%$0.165603

-1.00%$8.65

-1.53%$329.56

-0.89%$0.161278

-2.32%$0.9994

0.01%$0.00958981

-2.46%$266.62

-8.10%$0.099421

-1.84%$53.49

-0.66%$0.999531

-0.00%$8.88

-2.26%$0.0000063

-2.56%$0.933253

-2.93%$1.41

-0.35%$0.118696

10.92%$0.078548

-0.43%$4,949.58

1.70%$1.43

-7.27%$4,973.74

1.70%$1.31

-2.05%$3.44

-1.71%$0.621209

-1.59%$1.00

0.00%$123.39

-1.44%$0.00000424

-2.76%$185.08

-2.07%$0.996774

0.27%$0.70639

0.09%$0.187535

0.92%$77.73

-2.17%$2.32

-1.43%$0.999747

-0.01%$1.12

0.00%$0.00000169

-1.16%$0.066968

9.20%$0.999796

-0.01%$0.998743

-0.02%$8.45

-2.21%$1.012

-2.68%$0.265654

-2.52%$10.99

0.04%$2.25

-4.20%$0.00203063

-5.89%$2.34

4.79%$0.107907

-0.06%$7.09

-0.73%$8.27

-1.06%$0.380418

-3.19%$0.01815005

-10.92%$67.94

-3.47%$0.057676

2.67%$0.114534

-4.18%$0.865213

-2.92%$0.03132607

-0.85%$0.99913

-0.05%$0.091534

-1.31%$1.47

-1.72%$0.00936641

-3.31%$3.41

-1.59%$1.23

-0.45%$1.44

-0.35%$0.03621118

-1.78%$1.027

0.00%$114.33

0.01%$0.930748

-2.39%$1.11

0.20%$0.999574

0.00%$0.882007

-3.13%$0.0078486

-2.99%$0.107635

-4.14%$0.080098

-0.19%$0.995946

-0.33%$1.095

0.01%$0.00000623

-3.73%$0.999619

-0.01%$0.999973

-0.06%$0.02836071

-1.59%$0.01287348

-0.76%$0.493798

2.02%$0.152672

-6.31%$0.998221

0.05%$0.072302

-2.52%$1.088

0.00%$1.18

-0.40%$35.74

-4.45%$0.252479

-3.21%$0.00679274

-3.62%$1.28

-1.31%$0.386712

-2.53%$0.61578

-3.29%$0.03940748

-2.24%$0.221528

7.21%$0.998393

-0.03%$22.54

-2.72%$1.10

-3.28%$159.54

2.59%$0.04245148

-0.54%$0.16404

-3.73%$1.47

-3.59%$0.24539

-1.85%$0.082461

-1.54%$0.163954

-11.90%$0.466932

-1.43%$0.999655

-0.01%$0.00000034

-1.27%$0.00000034

-2.54%$0.056665

-1.28%$0.01725195

0.82%$16.28

-2.31%$0.054007

-4.83%$1.02

0.01%$1.65

16.63%$116.13

-9.23%$3.33

7.86%$1.48

-5.23%$0.322161

-6.62%$3.04

0.97%$0.00003057

-3.39%$0.161293

-10.24%$0.997734

0.05%$0.328143

-3.59%$0.02689149

-2.51%$0.066665

-3.42%$0.00578471

-1.84%$0.306688

-1.91%$0.331474

-1.77%$17.55

1.33%$0.991096

0.02%$0.052508

-3.39%$0.233353

-3.20%$0.00271814

-1.05%$0.073356

-5.71%$0.04622956

-3.80%$6.58

-1.71%$1.54

2.33%$0.00252378

-1.67%$0.0205271

-5.32%$0.545278

-2.32%$0.998622

0.00%$5,986.36

1.92%$0.083854

-1.80%$0.02054569

-4.97%$0.222651

-2.40%$0.999997

-0.00%$1.075

0.01%$0.98397

-0.03%$0.999649

0.01%$1.26

-5.78%$22.86

0.00%$0.0020745

1.97%$0.103724

23.46%$0.092821

-2.94%$0.00000095

1.25%$0.19772

-3.32%$1.19

-1.69%$1.02

-30.72%$2.72

-2.52%$0.00512802

-2.80%$0.098401

-1.97%$1.00

0.00%$0.052525

0.05%$2.04

-3.64%$0.187069

-2.57%$0.190113

-0.42%$0.00003414

1.60%$0.079528

-0.87%$0.999954

0.01%$0.00389121

-3.34%$0.122911

-3.79%$1.00

0.00%$1.44

-0.63%$0.177271

-0.03%$2.19

-1.48%$18.05

-4.18%$0.759848

-2.08%$0.633307

-3.15%$2.16

-4.97%$0.04400078

-8.67%$15.12

-0.71%$1.80

-0.11%$0.05261

0.17%$47.98

-0.01%$3.68

-11.32%$0.02221231

1.57%$0.2203

4.76%$1.013

-0.19%$1.28

0.87%$0.994326

0.26%$0.00000788

-2.58%$8.01

-13.59%$0.997748

-0.05%$0.999927

-0.28%$0.333097

0.86%$0.976424

-0.15%$0.311006

0.78%$1.82

5.05%$0.398722

-0.69%$0.137745

0.22%$0.161016

-2.40%$8.99

-0.48%$0.082358

-2.48%$0.265861

-1.80%$4.52

-2.70%$0.616088

-6.25%$0.092617

-2.09%$0.074277

1.02%$0.319949

1.61%$0.129314

-11.68%$1,097.01

-0.08%$0.080117

-3.88%$1.97

-2.83%$0.262622

0.51%$0.00152645

-1.03%$0.596866

-9.51%$0.00414742

-0.70%$0.288082

-6.88%$0.99535

0.05%$0.369436

-2.56%$0.130669

-0.01%$1.057

-0.02%$1.001

0.00%$0.118972

9.92%$0.00230758

-2.32%$0.197871

-3.69%$2.36

-3.68%$0.115455

0.50%$0.999731

-0.01%$0.99826

-0.11%$0.117727

-0.32%$1.00

0.02%$0.02812312

-5.15%$1.063

0.11%

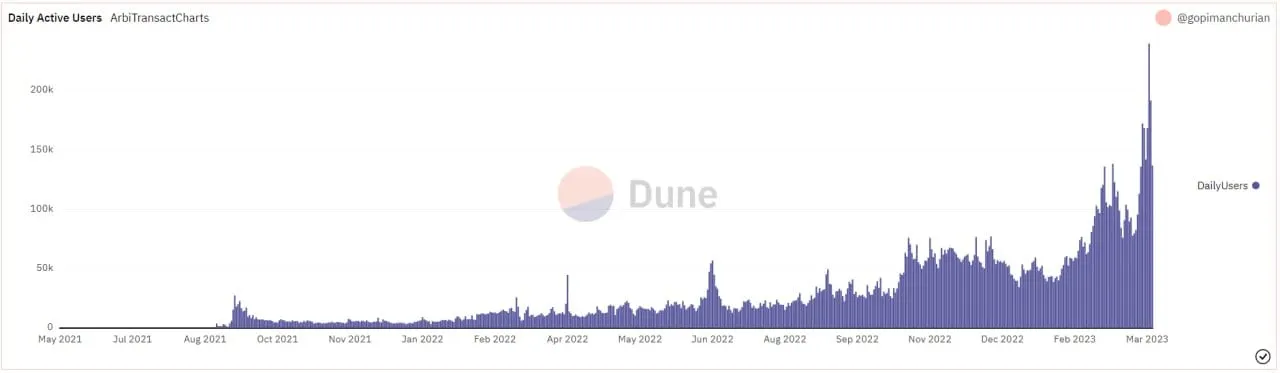

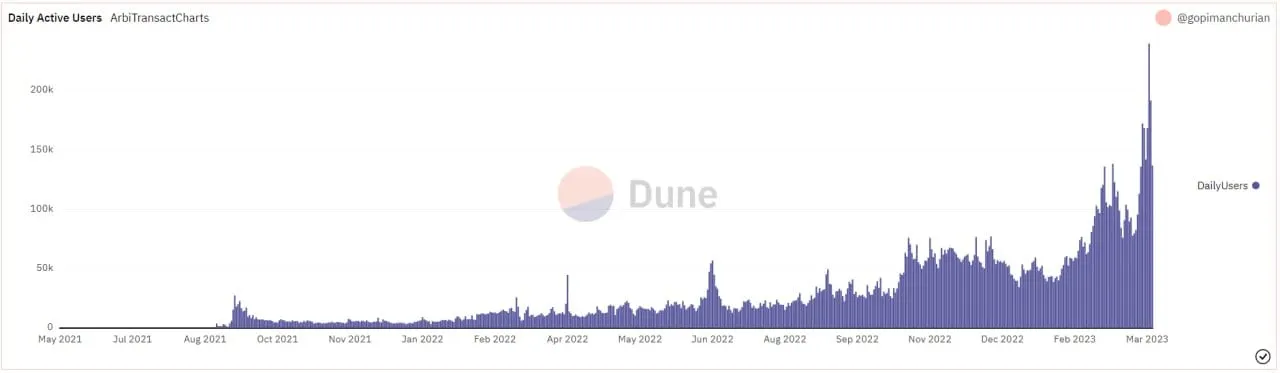

Arbitrum, a layer-2 rollup on Ethereum, has hit an all-time high in daily transactions and unique wallets interacting with the network ahead of its airdrop.

Dune analytics show that close to 240,000 unique wallets interacted with Arbitrum on March 21, nearly twice its previous peak in February 2023.

On March 21 and March 22, the network hosted roughly 1.66 million and 1.56 million transactions, respectively.

Over those same two days, there were also more transactions on Arbitrum than on the Ethereum mainnet. Etherscan reports that Ethereum hosted just over 1 million transactions each day.

It’s likely these metrics will continue to surge after users can begin claiming their airdropped tokens. There are more than 625,000 eligible addresses.

Arbitrum first announced the launch of its along with an airdrop of ARB governance tokens to early users and developers on March 16.

The airdrop is slated for 9 am EST today, with a live countdown appearing on Arbitrum’s site.

Following the airdrop announcement last week, the network also saw a massive spike in its DeFi liquidity. The total deposits on DeFi platforms on Arbitrum reached a new peak of nearly $2 billion, per DeFi Llama.

The layer-2 network is ranked fourth in DeFi liquidity after Ethereum, Binance Chain, and Tron.

The futures contract for the ARB token started trading on BitMEX on March 20. The contract last traded for $1.38, aligning with the popular ARB token market estimations.

The peak exchange price of ARB futures on BitMEX was $1.5.

Top crypto exchanges in Binance, Bybit, BitMEX, Kucoin, and many others will enable trading on the platforms right at launch time to benefit from the trading volumes that the token will bring.

Analysts expect the ARB token to rake in over $1 billion in trading volume on launch day.