This week’s token airdrop by newcomer NFT marketplace Blur has resulted in over $4 million worth of Ethereum being burned (or destroyed) in the last seven days.

The token was airdropped on Valentine’s day to Blur users who actively traded Ethereum NFTs on the marketplace in the last six months.

The price climbed as high as $5 on launch, before quickly retreating down below a dollar within an hour. At $0.90, the BLUR token currently trades 82% short of its launch day high.

Per data from Ultra Sound Money, a culmination of Blur activity has seen more than 2,469 Ethereum burned. Since the London hard fork in August 2021, a portion of transaction fees that were previously paid to miners is now burned and removed from circulation.

The heft of this sum, roughly 1,158 ETH, appears to be directly related to users claiming their airdrop. The remaining activity stems from BLUR token transfers and activity on the Blur marketplace itself.

There may still be more airdrop fireworks yet.

As of writing, 92.5% of the airdropped tokens have been claimed by over 100,000 wallets, according to Dune Analytics.

Blur enters the chat

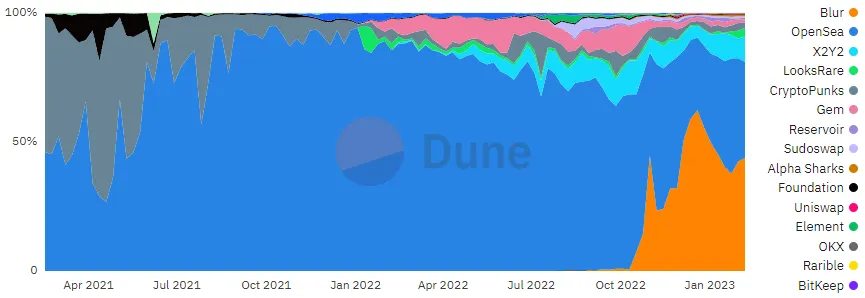

Of late, Blur has taken a large portion of the broader NFT market share.

Per Dune, Blur currently commands more than 43% of weekly volume, OpenSea enjoys 37.1%, with the next runner-up, X2Y2, boasting a mere 9.9% of trading volume.

At its peak last January, OpenSea was responsible for more than 95% of weekly volume in the sector.

Of the two leading NFT marketplaces, OpenSea has the more established name, but Blur’s airdrop this week appears to have taken the wind from the market leader’s sails.

On Wednesday, the newcomer announced that it would enforce any royalty fee requested by creators, so long as those creators block the trading of their collections on OpenSea—a marked escalation of hostility towards the competitor.

Blur, which launched last October, does not fully honor creator royalty settings—that means the platform does not enforce the fee (typically between 5% and 10%) that NFT creators can claim on secondary sales of their works.

The platform currently only enforces a 0.5% minimum creator royalty, with the option for traders to pay more.