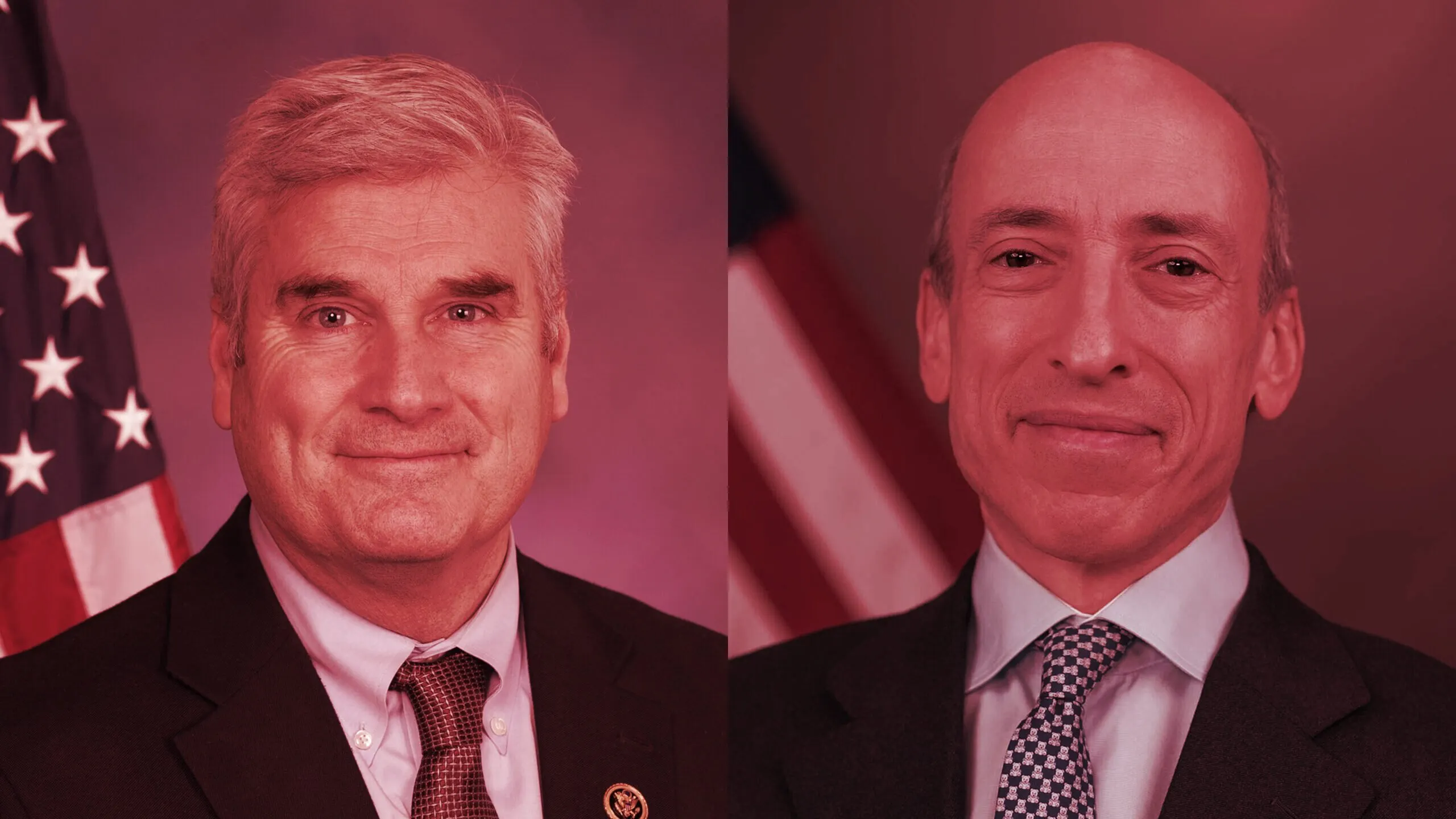

Minnesota Representative Tom Emmer called out Securities and Exchange Commission Chairman Gary Gensler on Sunday, demanding that the official speak before Congress about his approach to regulating crypto.

“@GaryGensler must testify before Congress and answer questions about the cost of his regulatory failures,” he wrote in a thread on Twitter.

Emmer says the SEC had failed to gather the information needed from crypto companies that would have prevented disasters like the $32 billion dollar collapse of cryptocurrency exchange FTX.

“We now know Gensler's crypto information-gathering efforts were ineffective,” he stated.

He argued that the SEC has displayed a consistent lack of clarity regarding its approach and has been unwilling to provide useful insight. He referenced a letter sent to Gensler in March that asked specific questions about the financial watchdog’s policies and procedures—questions he said were sidestepped in Gensler's response.

“[Gensler] declined to provide Congress with the information requested in the letter, which would've informed Congress of the apparent inconsistencies in Gensler's approach that caused him to miss Terra/Luna, Celsius, Voyager, and FTX,” he said.

Emmer also claimed that the Congressional Blockchain Caucus, which he co-chairs, has received reports of SEC inquiries and investigations that warrant concern.

“Efforts to gather info on crypto companies were not targeted, intentional, or clear," Emmer said. "Rather, the SEC's requests were haphazard and unfocused."

Gensler’s lack of transparency is ultimately hurting investors, Emmer stated. He pointed out that Gensler hasn’t made a public appearance before the House Financial Services Committee since October of last year.

“Gensler has repeatedly dodged Congress at the expense of investors… leaving us to learn about the SEC's crypto investigations, like the one into FTX, through the media,” he said.

Emmer’s criticism of Gensler on Sunday wasn’t the first time the member of Congress has taken aim at the SEC Chairman.

In March, Emmer raised concerns about the SEC’s interactions with crypto companies. He was focused on the SEC’s information gathering then, too, but said at the time that the agency was stifling innovation with an “overburdensome” approach.

“Crypto startups must not be weighed down by extra-jurisdictional and burdensome reporting requirements,” he wrote in a subsequent Tweet. “We will ensure our regulators do not kill American innovation and opportunities.”

Last month, he also weighed in on the implosion of FTX. He described the company’s swift demise as not a failure of crypto but rather a failure of Sam Bankman-Fried, the exchange’s founder and former chief executive, as well as Gensler’s leadership.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.