Proposal 131 has passed with quorum. ✅

Proposal 131 pauses supply for cZRX, cBAT, cMKR, and cYFI on Compound v2.

The proposal will be applied in two days. https://t.co/WHPJVt5zyQ

— Compound Governance (@compgovernance) October 24, 2022

$118,044.00

-2.95%$3,052.61

0.09%$2.92

-3.06%$687.09

-2.25%$161.74

-3.78%$0.9999

0.00%$0.195237

-4.99%$0.296521

-1.65%$3,045.08

-0.09%$0.732362

-3.25%$47.92

-1.91%$117,881.00

-2.79%$0.452726

-4.87%$3.99

1.18%$3,691.06

0.11%$15.65

-4.06%$0.233637

-3.95%$489.79

-4.15%$21.20

-3.22%$9.01

-0.05%$3,266.81

-0.19%$0.00001322

-3.67%$3,048.68

-0.11%$3.01

-0.63%$93.67

-3.40%$0.999878

0.02%$1.001

0.18%$45.86

-0.80%$334.32

-3.80%$3.94

-3.78%$117,945.00

-3.04%$9.22

-2.75%$1.00

-0.08%$0.00001239

-1.47%$4.50

0.06%$321.58

-0.98%$433.39

3.50%$0.451852

-3.31%$0.107987

-2.14%$4.92

-3.32%$2.56

-3.72%$1.18

-0.01%$0.926972

-0.33%$5.39

-3.38%$47.46

-1.48%$1.00

0.00%$196.93

-3.46%$18.26

-3.71%$0.285364

1.02%$0.700981

-3.06%$0.00002947

9.77%$0.086046

-1.96%$0.999851

0.03%$0.346891

-0.70%$0.361414

7.06%$0.02441119

-2.60%$0.03359775

20.98%$4.56

-2.79%$0.412033

-1.95%$0.226157

-5.92%$0.00571736

5.27%$3.80

-2.04%$4.50

-0.38%$1.059

0.00%$15.61

-1.81%$9.26

-4.31%$3,060.00

0.63%$0.704966

-4.44%$1.028

-3.75%$2.54

-3.53%$118,215.00

-2.85%$0.077281

-3.27%$112.34

-4.04%$171.56

-3.54%$4.74

-1.32%$1.60

-1.80%$0.495217

-3.05%$11.58

0.98%$3,197.75

-0.06%$0.998445

0.03%$0.999669

-0.05%$3,475.29

-0.27%$0.999527

-0.11%$1.89

-3.99%$1.31

-0.95%$4.34

-2.16%$1.26

-7.43%$12.51

-1.74%$0.786321

-2.75%$0.01733598

-1.16%$0.072977

-11.84%$0.670195

-2.01%$3,202.59

-0.13%$3,261.16

-0.17%$118,227.00

-2.65%$0.346546

-2.39%$0.99992

-0.01%$1.64

-7.45%$1.041

0.33%$3,217.69

-0.25%$0.726624

6.78%$1.002

0.19%$3,290.26

-0.36%$0.524024

-3.15%$0.098974

-3.21%$117,967.00

-2.85%$3,348.66

-0.26%$0.00009662

-1.29%$1.11

0.02%$120,073.00

-2.41%$687.22

-1.93%$0.150561

-4.88%$0.545759

-2.80%$0.999686

0.01%$0.218525

-1.93%$181.90

-3.63%$2.39

-2.06%$3,342.04

-0.25%$211.78

-3.44%$2.96

2.48%$0.01619587

-4.19%$0.782821

-4.07%$0.86732

-1.90%$0.01708894

-2.87%$22.86

-0.12%$0.285374

13.24%$9.32

-13.56%$0.304563

-4.43%$10.75

0.03%$0.838785

-1.59%$111.80

0.02%$43.16

-2.58%$3,054.05

0.04%$0.412446

-11.62%$0.117818

-3.14%$0.639112

-1.64%$0.998257

0.03%$0.00000068

-2.63%$3,264.24

0.32%$1.87

-4.64%$3.99

-2.32%$0.999913

-0.01%$0.00000163

-8.99%$0.01864358

-6.61%$1.094

0.59%$3,171.24

-1.20%$0.451721

4.17%$117,691.00

-2.93%$1.93

1.14%$47.83

-1.91%$3,048.32

-0.22%$0.38414

-3.01%$0.308441

-5.26%$0.008652

-0.93%$117,701.00

-2.57%$0.997712

-0.04%$0.00626799

13.59%$0.078794

22.14%$3.00

-2.75%$117,595.00

-3.11%$0.535809

-4.78%$1.53

-3.53%$0.05373

-5.79%$47.80

-1.78%$3,048.07

-0.28%$0.102021

-3.89%$26.19

-0.94%$0.522449

12.36%$1.00

0.02%$0.999976

0.01%$0.635508

-5.24%$0.239274

6.11%$0.195723

-4.45%$0.138252

-3.29%$0.996364

-0.30%$0.448982

-6.50%$7.27

3.05%$3,257.67

0.47%$0.18978

0.39%$0.336839

3.42%$0.00797316

-3.54%$0.608008

-1.34%$0.421725

-4.53%$0.380294

-1.91%$47.92

-5.18%$3,367.58

-0.15%$6.27

-3.85%$0.00000045

-0.97%$1.15

-2.56%$15.17

-4.63%$1.36

-0.88%$7.45

-1.49%$0.00002078

-3.79%$119,794.00

-1.20%$1.093

-0.01%$2.46

-3.09%$0.00408098

-10.19%$3,339.98

-0.07%$0.998385

0.55%$0.999906

-0.00%$0.055622

-1.57%$1.001

0.12%$0.03984597

-3.76%$3,046.45

0.43%$0.00558095

-5.53%$0.545408

-3.02%$0.147146

-3.33%$0.081221

-1.34%$3,049.63

-0.13%$1.55

-2.18%$1.36

-0.98%$1.00

0.03%$3,042.24

-0.16%$0.376856

-2.40%$0.809575

-0.60%$0.00705213

2.79%$0.361026

23.22%$0.999827

-0.03%$117,837.00

-2.90%$0.03565621

-2.55%$0.01841642

-1.66%$0.351541

-3.13%$0.00006224

-1.82%$0.03282372

10.56%$11.70

-0.13%$176.78

-3.23%$3,690.87

0.35%$0.520361

-2.39%$4.19

8.56%$20.86

0.17%$128.09

-1.35%$0.826635

-7.67%$25.62

-3.97%$0.225881

-5.87%$1.11

-5.54%$0.703311

-3.13%$0.764896

-0.77%$21.06

-3.71%$0.997981

-0.15%$0.00372841

-2.41%$1.002

0.29%$0.998924

-0.07%$0.999501

-0.11%$3,200.60

0.47%$117,922.00

-3.05%$0.646836

3.51%$2,369.95

-2.80%$0.00336781

-0.82%Reading

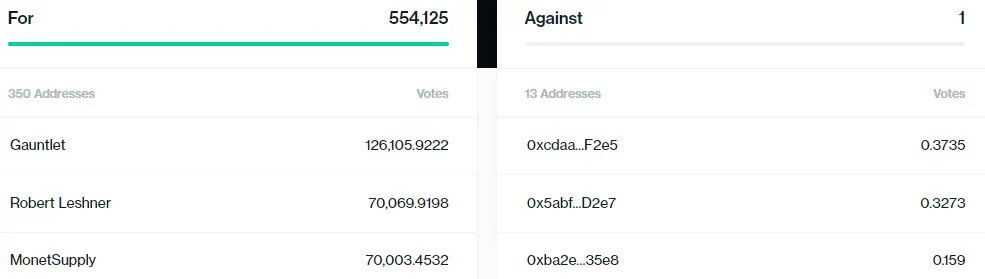

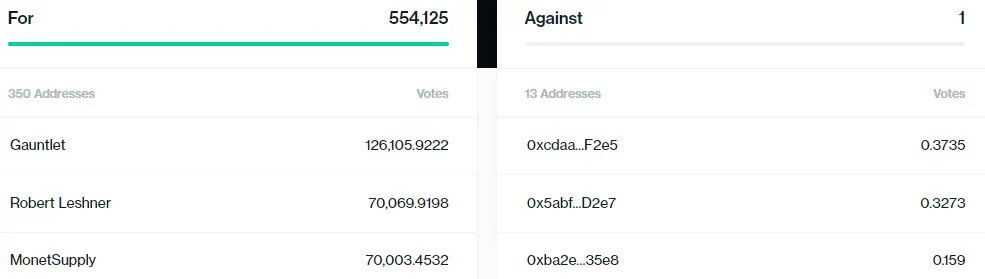

After two days of voting, the DAO powering Compound Finance has approved “proposal-131,” which will prevent users from being able to lend relatively illiquid assets on the protocol.

In this case, Illiquid assets are cryptocurrencies that cannot be readily sold or exchanged without a substantial loss in value.

Generally, these types of assets are volatile and can be easily manipulated.

Compound founder Robert Leshner joined Decrypt's Dan Roberts and Stacy Elliott at Chainlink SmartCon 2022 to talk about the shift Compound has seen in borrowing demands and how it has adjusted accordingly, why he believes stablecoins "will win and conquer everything," and how regulators are approaching the space.

This initiative to remove illiquid assets is also expected to protect the protocol against market manipulation like the $100 million exploit on Mango Markets, claims the proposal.

Nearly 99.9% of all voters supported the proposal, with 554,126 Compound (COMP) tokens used in the voting process.

Robert Leshner, the founder of Compound Finance, also voted in favor of the proposal.

Four tokens, namely 0x (ZRX), Basic Attention Token (BAT), Maker (MKR), and Yearn Finance (YFI), are to be paused temporarily from Compound finance.

According to the proposal, these tokens have less liquidity in open markets and are vulnerable to price manipulation that could exploit the protocol.

Proposal 131 has passed with quorum. ✅

Proposal 131 pauses supply for cZRX, cBAT, cMKR, and cYFI on Compound v2.

The proposal will be applied in two days. https://t.co/WHPJVt5zyQ

— Compound Governance (@compgovernance) October 24, 2022

Since September 2, Compound’s governance has scrutinized the manipulation risk involved with less-liquid assets.

On October 11, Mango Markets, a Solana-based trading platform was exploited for nearly $117 million. The exploiter used a combination of efforts to drive the price of MNGO (Mango Market’s native Token) higher.

Later, using the over-valued MNGO, the exploiter took out a $117 million loan, wiping Mango’s treasury.

The exploiter then drained the assets, which included Solana, USDC, USDT, BTC, and MNGO.

Shortly after the exploit, the MNGO price hit rock bottom before the exploiter staged an artificial pump.

The exploit was made possible because of the illiquid nature of the MNGO token.

British banking giant Standard Chartered became the first "too big to fail" bank to offer Bitcoin and Ethereum trading through traditional currency platforms on Tuesday, crossing a line that its peers have cautiously approached for years. The bank will run Bitcoin and Ethereum spot trading services for institutional clients from its U.K. branch, enabling them to execute trades through the same foreign exchange systems they already use. “Digital assets are a foundational element of the evolution...

Grayscale has confidentially submitted preliminary paperwork with U.S. regulators that could lead to the listing of its shares on the public market, the asset manager said Monday in a statement. The firm filed a draft registration statement on Form S-1 with the U.S. Securities and Exchange Commission, according to the press release. Grayscale did not disclose the number of shares it plans to register, nor the price range for the proposed registration. Draft S-1’s are introductory filings, enabl...

Metaplanet CEO Simon Gerovich is helping to advance a Bitcoin treasury strategy campaign in Asia through a newly approved acquisition of a South Korean public firm, following a similar move in Thailand earlier this month. South Korea's SGA Co., a systems integrator serving government and education clients, has received board approval to issue more than 58 million new shares to a group led by Sora Ventures and KCGI, including Gerovich in an individual capacity. The issuance, approved by its boar...