Massachusetts Senator Elizabeth Warren and a group of six other U.S. lawmakers have requested information on the energy usage and potential environmental impact of Bitcoin mining operations in the state of Texas.

In a letter to Pablo Vegas, CEO of the Electric Reliability Council of Texas (ERCOT), the senators called Texas a “deregulated safe harbor” for crypto mining firms, adding that the state’s “cheap power and laissez-faire regulation” are raising concerns about the potential for mining operations “to add to the stress on the state’s power grid.”

One specific piece of information the senators requested relates to how much electricity crypto mining operators in Texas have consumed and how much carbon dioxide emissions they’ve released over the last five years.

The lawmakers also want to know how much Texas regulators are paying Bitcoin mining companies in subsidies to turn down energy consumption during periods of peak demand.

“In simple terms, the Bitcoin miners make money from mining that produces major strains on the electric grid: and during peak demand when the profitability of continuing to mine decreases, they then collect subsidies in the form of demand response payments when they shut off their mining operations and do nothing,” reads the letter.

Among the companies running a Bitcoin mining business in Texas, the letter cites Riot Blockchain, the operator of a 750 MW facility in Rockdale, which in July this year announced it made around $9.5 million by shutting down operations and selling electricity back to the grid.

The senators noted that this was more than the $5.6 million the company made from actually selling Bitcoin that month.

Texas energy grid and Bitcoin mining

The letter further estimates that Texas is responsible for about a quarter of all U.S.-based Bitcoin mining operations, and 9% of the crypto mining computing power worldwide, ”a share that is expected to reach 20% by the end of next year.”

Around 30 crypto mining companies have come to Texas over the past decade, encouraged by vast amounts of open land, easy access to affordable power, and low state taxes, according to a recent report by The Texas Tribune.

The increased demand raised fears that the state’s already fragile electricity grid, which crashed during an extreme winter storm in February 2021, could cripple further.

“Cryptomining is adding significant demand to an already unreliable grid, posing enormous challenges to the transmission and distribution system… and contributing to the global climate crisis,” the lawmakers wrote in the letter.

Bitcoin requires so much computing activity that it eats up more energy than entire countries. One of the easiest and least disruptive things we can do to fight the #ClimateCrisis is to crack down on environmentally wasteful cryptocurrencies. pic.twitter.com/derGr1bjuq

— Elizabeth Warren (@SenWarren) June 9, 2021

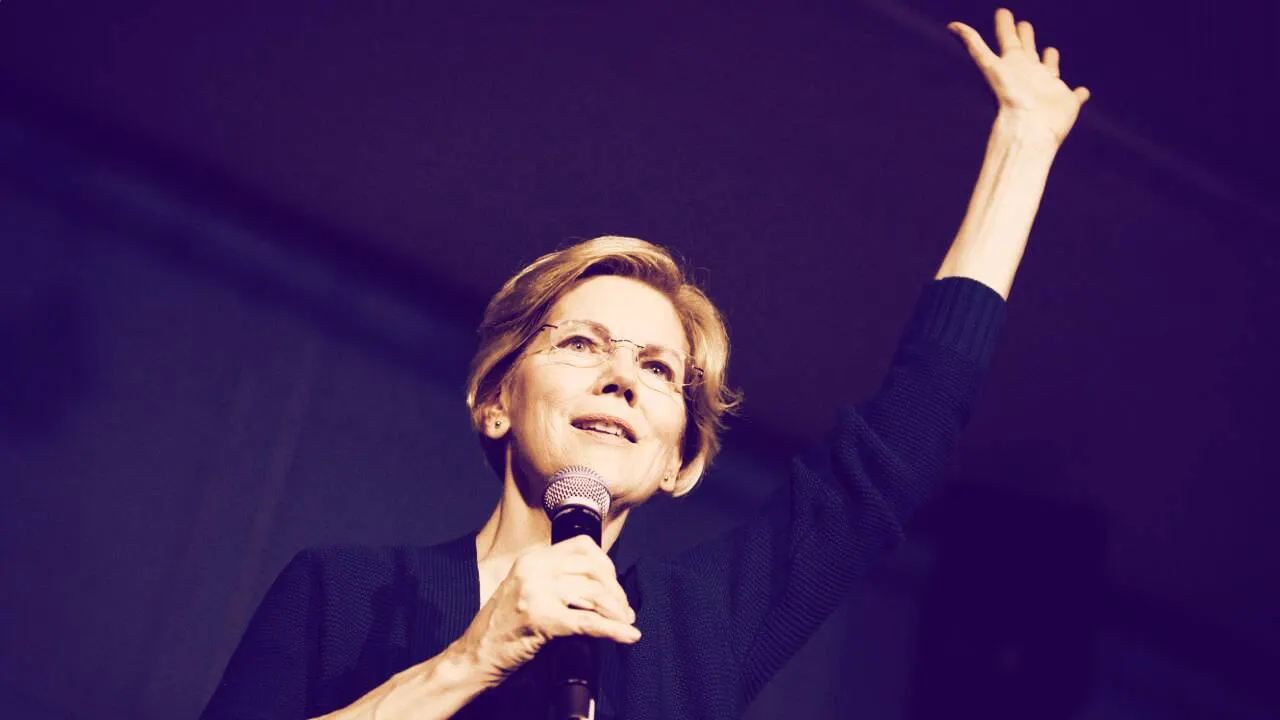

This is not the first time Elizabeth Warren, a staunch critic of cryptocurrencies, has spearheaded attacks on the industry, including Bitcoin mining activities.

In July, the senator took aim against New York-based Bitcoin mining firm Greenidge Generation, raising concerns about the company’s impact on the environment.

Prior to that, Warren took to Twitter to state that “one of the easiest and least disruptive things we can do to fight the Climate Crisis is to crack down on environmentally wasteful cryptocurrencies.”