When the SEC filed a federal lawsuit Monday against crypto influencer Ian Balina for his failure to register a cryptocurrency as a security before launching a 2018 initial coin offering (ICO), everything at first appeared run-of-the-mill: the SEC has, for years, filed civil suits against individuals and organizations for rolling out unregistered ICOs.

Eagle-eyed observers then read a little further into the fine print.

In a bold and potentially unprecedented move buried in the lawsuit’s 69th paragraph, the SEC today claimed it had the right to sue Balina not only because his case concerns transactions made in the United States, but also because, essentially, the entire Ethereum network falls under the US government’s purview.

There it is

The supermassive black hole sized bad take at the heart of the Balina filing

h/t @LordBogdanoff https://t.co/ZopOGQchU4 pic.twitter.com/ucn5sZkK5b

— laurence (new york variant) (@functi0nZer0) September 19, 2022

In its complaint, the regulator noted that the ETH sent to Balina was “validated by a network of nodes on the Ethereum blockchain, which are clustered more densely in the United States than in any other country.” The SEC then concludes: “As a result, those transactions took place in the United States.”

The SEC appears to be suggesting that, because more of Ethereum’s validating nodes currently operate in the United States than in any other country, all Ethereum transactions globally should be considered of American origin. Currently, 45.85% of all Ethereum nodes operate from the United States, according to Etherscan. The second-greatest density of nodes is in Germany, with only 19%, by comparison.

“Saying that enables [the SEC] to characterize doing business on the Ethereum blockchain, as doing business on a US securities exchange,” University of Kentucky law professor Brian Fyre told Decrypt. “Which, from their regulatory perspective, is convenient. It makes things so much simpler.”

If the SEC were to successfully classify activity on Ethereum as akin to that on an American securities exchange, it would amount to the regulatory body laying claim to jurisdiction over all activity on the ostensibly decentralized Ethereum network. Such a development would constitute a major escalation in the SEC’s role in overseeing both Ethereum, specifically—where the vast majority of NFT and DeFi activity takes place—and crypto as a whole.

Fyre noted that the language of today’s complaint bears no legal weight, and due to the nature of the SEC’s suit against Balina, the court in this case is unlikely to weigh in on this specific issue. But that doesn’t mean the statement holds no significance.

“I think they may be trying to get their vision of what Ethereum is, and how it works, out into the judicial ecosystem,” Fyre told Decrypt. “It’s the SEC saying, ‘This entire body of financial activity is within the scope of the stuff that we regulate, and therefore we’re going to regulate all of it.’”

Fyre considers such a full-throated claim to jurisdiction over the entire Ethereum ecosystem to be unprecedented.

“It's the first time I've seen the SEC really lay out how it understands the Ethereum ecosystem to work, and why it thinks it falls within the scope of what the SEC regulates,” he said.

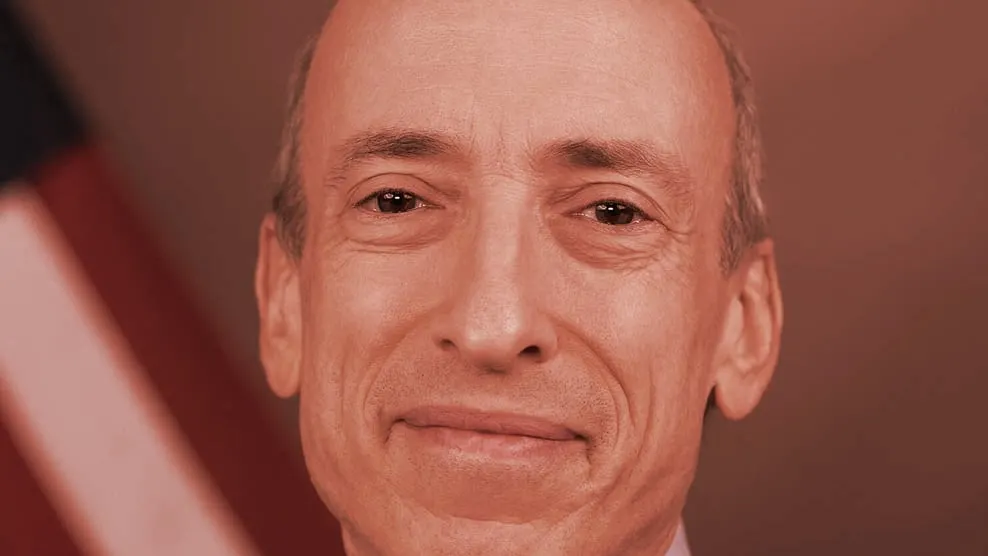

Last week, in the hours following Ethereum’s successful merge to a proof-of-stake consensus mechanism, SEC Chair Gary Gensler implied that the transition could bring the network closer to the definition of a security in the government’s eyes.

Following testimony before the Senate Banking Committee, Gensler gave his view on how “staking” (i.e. pledging assets to a crypto network in exchange for passive rewards) could be interpreted as an indication that an asset qualifies as a security under the so-called Howey Test, though he did not address any specific cryptocurrency or network by name.

Fyre thinks the proximity of that statement to today’s is no accident.

“[Today’s language] seems perfectly consistent with what Gensler was getting at in his statement [...] that the SEC sees all of this as securities and therefore is going to make regulatory decisions in relation to the entire ecosystem,” said Fyre.

2/2

Rather than take on a simple case, the SEC is trying to use this to set precedent claiming that ALL OF CRYPTO is under SEC's jurisdiction.

This is an absolutely unacceptable overstep that will have to be pushed back against aggressively.

— Adam Cochran (adamscochran.eth) (@adamscochran) September 19, 2022

Under Gensler, the SEC has yet to take an official stance on Ethereum, despite leadership within the Commission under the previous administration suggesting that Ethereum was “sufficiently decentralized” and therefore not a security. But if the SEC were to ever claim that Ethereum was an unregistered security, Fyre doubts the courts would stand in its way.

“I can see judges absolutely accepting that, sure: Ethereum is substantially located in the United States, insofar as it's run on a bunch of computers, and a bunch of those computers are in the United States,” said Fyre. “That's events occurring in the United States. No problem.”