Adoption of a wider range of decentralized finance (DeFi) applications has pushed up the amount of Ethereum (ETH) currently being used by them. The total figure has reached an all-time high of 2.36 million ETH, according to DeFi pulse, worth $420 million.

DeFi apps allow you to lend money, borrow money or make a range of other financial agreements with strangers around the world, without a third party involved. Often, funds are required to be locked up as collateral—using tools known as smart contracts—in order to give both parties reassurance that they won’t lose out unfairly. As a result, these apps can end up with a lot of ETH locked up in them.

By locking up a bunch of ETH, this reduces the circulating supply—which, some argue, puts upwards pressure on the price. But more importantly, it shows that the mavericks building such protocols are not wasting their time, since people are actually using the apps.

MakerDAO has always been one of the most popular DeFi apps out there. It’s responsible for DAI, a stablecoin with its price pegged to the US dollar. But it’s backed, not by real dollars in a bank, but by people locking up ETH in smart contracts. And, it’s worked fairly well. DAI keeps its price relatively stable.

The majority of ETH locked in DeFI apps has typically been within MakerDAO. But recently, a rise of other DeFi apps caused its dominance to briefly drop below 50 percent—although it has risen back up to 51 percent.

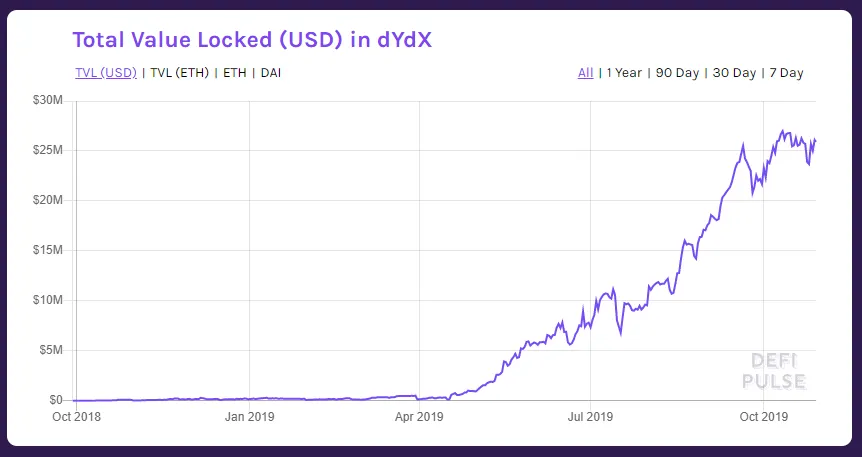

These newer apps include InstaDApp, an interface built on top of MakerDAO, and dYdX, a non-custodial trading platform. The amount of ETH locked up in dYdX has grown from $14.2 million two months ago, to $25 million today.

While the amount of ETH locked in InstaDApp briefly peaked in July at $40 million, since it fell to a low of $23 million, it has been steadily growing. It now sits at $32 million, up 40 percent.

Earlier this month, it was reported that the total decentralized app (dapp) ecosystem saw a quarter over quarter decline—from $3.28 billion in Q2 to $2.03 billion in Q3 activity. In that period it was reported that the DeFi segment was the only area showing positive growth. So, armed with a range of new DeFi apps taking off, it seems like the decentralized revolution is still on the cards after all.