It’s been a bumpy few weeks for crypto hacks.

The fallout from the recent Solana hack has again reminded folks about the importance of hardware wallets, for example. We now know that more than 15,000 crypto wallets were affected, and roughly $4.6 million nabbed. Yikes.

Another recurring misfortune has been bridge hacks. Bridges are key pieces of crypto infrastructure that let users move funds between blockchains. Native assets on Avalanche, for instance, can’t exist on Harmony without the help of a bridge.

And if you’re a believer in the so-called multi-chain universe, bridges are essential to that thesis. Unfortunately, these platforms have been taking an absolute battering of late.

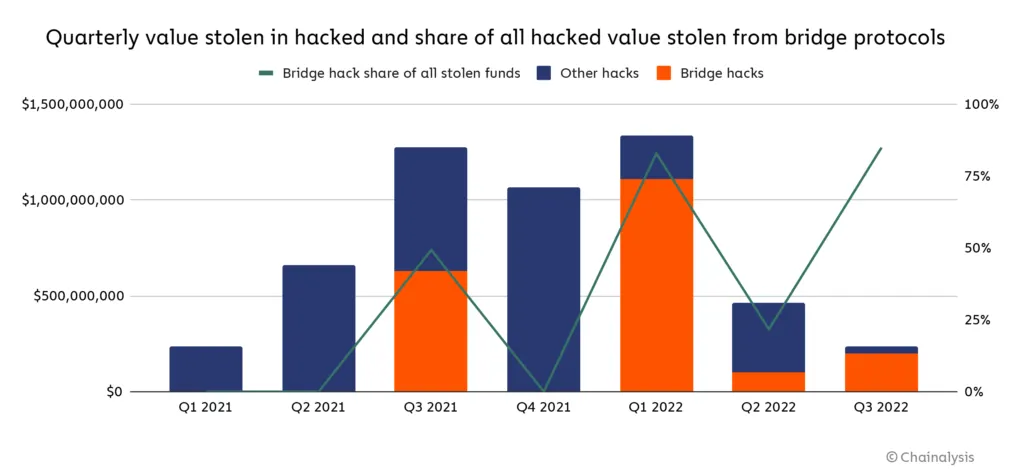

The latest episode revolved around a roughly $190 million hack of Nomad earlier this week. But there have been many others, like Axie Infinity’s Ronin bridge ($622 million), the Wormhole hack in February ($320 million), and the hack of a bridge between Harmony and Ethereum ($100 million).

More than $1 billion was stolen in just those three hacks, although the blockchain firm Chainalysis estimates that across all 13 bridge hacks this year, that total is closer to $2 billion.

With so much money at stake, at least one DeFi project is taking steps to mitigate this risk.

A recent proposal on lending and borrowing protocol Aave suggests the community pause all Fantom-based integration.

“This action would protect users by disabling the ability to deposit or borrow assets in the Aave V3 Market on Fantom, while still allowing repayment of debt, liquidations, withdrawals, and changes to the interest rates,” it reads.

If you’re just catching up, Aave lets you lend out idle crypto to earn a percentage minus a small fee paid to the protocol for doing so. Fantom is a layer-1 blockchain built using the proof-of-stake (PoS) consensus mechanism and is optimized for speed.

Fantom, like Ethereum, has a ton of different DeFi apps. So even a ton of Ethereum-first DeFi apps, such as Aave, have made their services available on Fantom.

The list of networks where Aave is available currently includes Avalanche and Fantom, as well as a few layer-2 networks like Optimism, Arbitrum, and Polygon.

Integrations with these other blockchain networks rely on bridges. And in the eyes of the latest Aave proposal, the risk of relying on this bridge outweighs the reward (at least on Fantom).

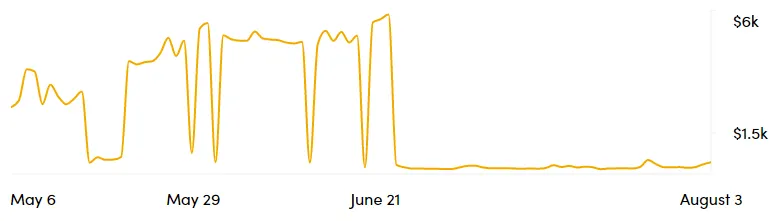

The proposal also points out that Fantom doesn't generate much in fees for Aave's treasury anyway: a mere $30.

“The Fantom Aave V3 market did not gain noticeable traction with a current market size of $9M and $2.4M of open borrowing position; this led to a market generating on average $300 of fees daily for the protocol (~$30 of daily fees for the Aave treasury),” the proposal reads, adding that if the Fantom bridge breaks or gets hacked, users will be left with nothing.

Just for reference, Aave on Ethereum currently rakes in $327,000 per day, followed by Aave on Avalanche which earns $133,366 per day.

This wouldn’t be the first time Aave has closed a crypto bridge. Following that Harmony bridge hack, Aave did the same; unfortunately, they’d already been affected.

The discussion is still in the proposal phase. On Monday it'll move over to the DAO voting platform Snapshot for an official vote on the outcome.

Regardless of the outcome on this particular proposal, the broader point here is that the multi-chain narrative is sinking fast.

Aave is a large community and currently DeFi’s fourth-largest by total value. And with a birthplace on Ethereum, it's backed by an even larger community.

Plus, the Ethereum merge is on the horizon and layer-2 networks on Ethereum are gaining traction. Insofar as a multi-chain future promised low fees and high speeds, maybe it won’t matter in the end.

Crypto bridges are crumbling. Should they be rebuilt?

Decrypting DeFi is our DeFi newsletter, led by this essay. Subscribers to our emails get to read the essay first, before it goes on the site. Subscribe here.