Figment, the blockchain infrastructure company, announced today that it will support Ethereum validators in their pursuit of MEV once the network moves to proof of stake.

MEV, or “maximal extractable value,” refers to the process by which individuals who create new ETH can further profit by manipulating their control over the network and prioritizing certain users’ transactions.

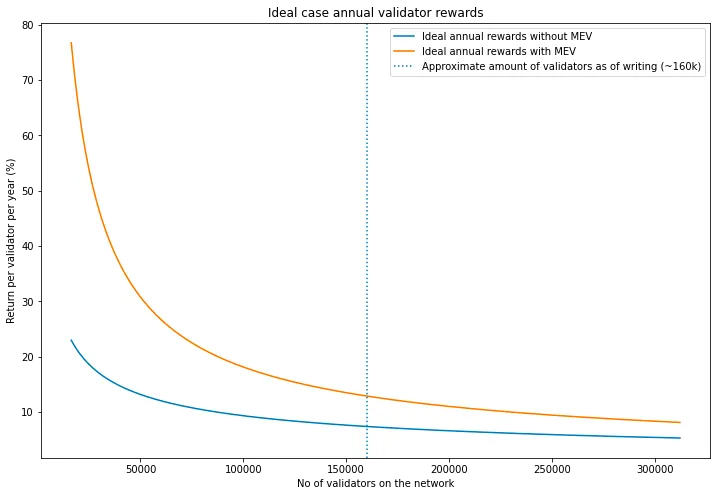

Clayton Menzel, head of protocols and opportunities for the company, wrote that Figment plans to leverage the Ethereum network’s new MEV boost feature to allow ETH validators to participate in MEV. Figment anticipates that this will increase user rewards by up to 50%.

ETH is currently created by “mining” with energy-intensive, specialized hardware. But after the Merge—Ethereum’s much anticipated, oft-delayed transition to proof of stake—new ETH will be earned by “validating,” or pledging large quantities of pre-existing ETH.

After the Merge, Ethereum will require validators to stake a minimum of 32 ETH, or just over $50,000 at today's prices, to begin receiving rewards.

Figment offers a staking service that pools users’ ETH, earns large yields in bulk for validating, and then doles the new, earned ETH back out to users. This allows retail validators to earn rewards while pledging much less than the minimum amount.

Those users will also be able to earn an even greater return on their staked ETH, according to Figment’s announcement.

MEV, however, presents risks along with rewards. Mal-intended ETH miners have historically been able to manipulate the speed and order of transactions on the Ethereum network, using MEV to profit off of constantly-fluctuating cryptocurrency prices.

With the transition to proof of stake, Menzel explains, MEV will become more decentralized as validator and block builder roles are separated.

Meanwhile, validators will be able to offer space within blocks they create to other validators, a mechanism meant to encourage competition and decrease the risk that any one validator could control enough of the network to manipulate transactions. Even so, that risk will always be there.

“There have been criticisms leveled at MEV, some of which are well-founded,” Menzel wrote. He clarified that by earning users more ETH, those users can then recommit it to staking.

Embracing MEV would, in the company’s opinion, “thereby increas[e] the security of the network.”

“MEV is inevitable, but there are ways to democratize access to the value that is extracted,” Menzel said. “The most obvious path towards democratization is through sharing rewards with our delegators.”

Teased by core developers for years, the Merge is finally expected to take place in September. The transition, according to the Ethereum Foundation, will decrease the network’s energy consumption by 99%.