A letter signed by 26 computer scientists, tech bloggers, and academics, including many former employees of FAANG firms and notable crypto skeptics, lobbying against crypto has been presented to U.S. lawmakers, according to the Financial Times.

The letter urges regulators to “take a critical, skeptical approach toward industry claims that crypto-assets are an innovative technology that is unreservedly good” and “resist pressure from digital asset industry financiers, lobbyists, and boosters to create a regulatory safe haven for these risky, flawed, and unproven digital financial instruments."

It then challenges the idea that blockchain offers advantages over the current financial system.

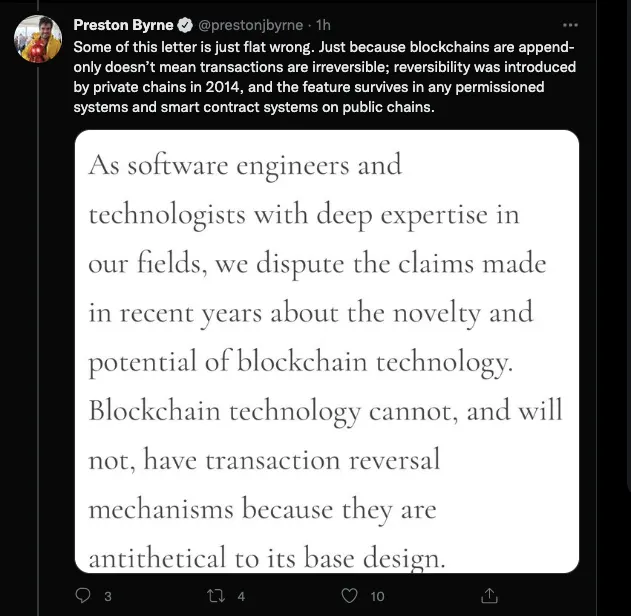

“Blockchain technology cannot, and will not, have transaction reversal mechanisms because they are antithetical to its base design. Similarly, most public blockchain-based financial products are a disaster for financial privacy; the exceptions are a handful of emerging privacy-focused blockchain finance alternatives, and these are a gift to money-launderers,” the letter reads.

It calls blockchain “a solution in search of a problem” and concludes that the technology "has severe limitations and design flaws that preclude almost all applications that deal with public customer data and regulated financial transactions and are not an improvement on existing non-blockchain solutions.”

Harvard cryptographer and computer security expert Bruce Schneier, one of the letter’s signatories, told the Financial Times: “The claims that the blockchain advocates make are not true. ... It’s not secure, it’s not decentralized. Any system where you forget your password and you lose your life savings is not a safe system.”

Former Microsoft engineer Miguel de Icaza and Google Cloud principal engineer Kelsey Hightower also signed the letter, which is addressed to the Senate's majority and minority Leaders, Charles Schumer and Mitch McConnell.

Pro-crypto Senator Patrick Toomey (R-PA) is also addressed, as is Ron Wyden (D-OR), who worked with the crypto-friendly Republican senator for Wyoming, Cynthia Lummis, to oppose provisions in a 2021 infrastructure bill that many perceived as damaging to the crypto industry.

Other signatories of the letter include distinguished Canadian coder and activist Tim Bray, Canadian/British tech blogger Cory Doctorow, and notorious no-coiner David Gerard. There was a notable absence of representation from people who have worked in or researched blockchain.

Decrypt has reached out to several signatories of the letter for additional comments.

Crypto community pushes back

The letter was quick to stoke the critical flames of several blockchain experts, including Preston Byrne, a blockchain lawyer at Anderson Kill, a firm that has its own Blockchain and Virtual Currency group. Byrne took umbrage with the fact that so few of the letter's signatories had blockchain industry credentials. In a now-deleted tweet, he also argued that blockchain transactions are reversible.

Matthew Green, who teaches cryptography at Johns Hopkins university, argued in a similar vein to Bryne. He took issue with the language of the letter, which makes arguably misleading claims about the capabilities of blockchain technology.

The problem I have with this letter is not that it identifies some limitations of current systems. It’s that it claims those limitations are *fundamental* rather than application choices. This is just false. pic.twitter.com/r01pusSlVF

— Matthew Green (@matthew_d_green) June 1, 2022

Crypto gains ground in Washington

Crypto has scaled to the point where it’s attracting a lot of attention from U.S. lawmakers.

In March, President Joe Biden signed an executive order that laid out a nationwide strategy for crypto regulation. He called on federal agencies—the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) among them—to coordinate crypto regulation efforts.

While there have been no substantial fruits of this order yet, in terms of legislation or directives, Washington is clearly watching the blockchain sector keenly.

Last month, Treasury Secretary Janet Yellen pointed to Terra’s historic collapse to argue for stablecoin regulation.

According to Bloomberg, crypto companies spent around $9 million on lobbying last year—more than triple the $2.8 million spent last year.

Coinbase is by far the crypto’s biggest supporter in Washington, accounting for $1.5 million of last year's total. Ripple was second at $1.1 million.