Sam Bankman-Fried, CEO of the fast-growing crypto exchange FTX, said that Bitcoin isn’t a suitable payments network.

“The Bitcoin network is not a payments network and it is not a scaling network,” he told the Financial Times on Monday.

Bankman-Fried qualified these statements by pointing to the network’s proof-of-work (PoW) consensus algorithm, which validates Bitcoin transactions.

In a PoW-based network, computers run non-stop to verify transactions and create new blocks for the network, a process known as mining. And as Bitcoin mining has industrialized over the years, the number of computers doing this work has also steadily risen.

This rise has led to concerns around the sheer amount of energy Bitcoin needs to maintain itself, attracting criticism from environmentalists as well as lawmakers attempting to achieve their climate goals.

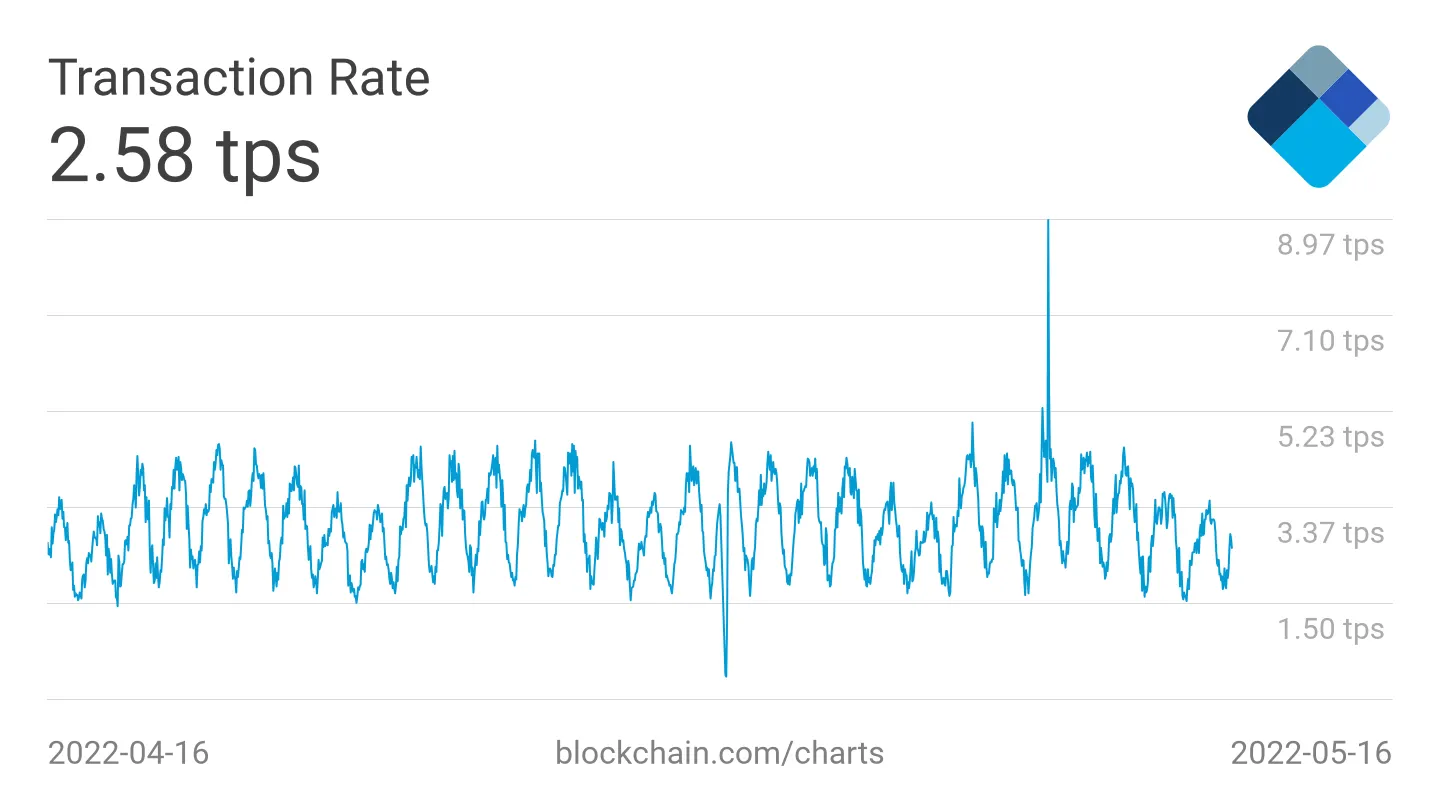

Besides consuming a large amount of energy, the leading cryptocurrency isn’t particularly speedy either. According to data pulled from Blockchain.com, the average number of transactions per second (TPS) on Bitcoin over the past 30 days is roughly 2.58.

When compared to traditional payments networks, like Visa or Mastercard, Bitcoin’s performance is orders of magnitude slower.

Still, Bankman-Fried does believe that Bitcoin can serve another key purpose.

“To be clear I also said that it does have potential as a store of value,” he tweeted in reference to the Financial Times report. “The [Bitcoin] network can't sustain thousands/millions of TPS, although BTC can be [transferred] on lightning/L2s/etc.”

The Lightning Network is a scaling solution that allows for micropayments atop the Bitcoin network.

To be clear I also said that it _does_ have potential as a store of value.

The BTC network can't sustain thousands/millions of TPS, although BTC can be xfered on lightning/L2s/etc. https://t.co/7ghQzz7eXa

— SBF (@SBF_FTX) May 16, 2022

FTX CEO turns to alternatives

All is not lost, though, for the future of cryptocurrencies. Instead, said the FTX chief, proof-of-stake (PoS) crypto networks offer the low costs and high transaction speeds needed for a payments system.

“Things that you’re doing millions of transactions a second with have to be extremely efficient and lightweight and lower energy cost. Proof of stake networks are,” Bankman-Fried said.

These kinds of networks are much less energy-intensive. Instead of maintaining a never-off computer farm to mine Bitcoin, PoS networks rely on validators that have “staked” (or deposited) a hefty amount of the network’s native cryptocurrency. As they perform their duties correctly, these validators earn a yield; if however, they validate fraudulent transactions, they’ll be punished by losing a portion of the funds they initially staked.

The second-largest cryptocurrency by market cap, Ethereum, is currently undergoing a transition from PoW to PoS. The switch to proof of stake could result in Ethereum using roughly 99.95% less energy, according to The Ethereum Foundation.

This transition, known as Ethereum 2.0 or the Merge, is expected to happen in the latter half of 2022.