The DeFi-focused startup Common has raised $20 million in its latest funding round, with Longhash, Polychain, Dragonfly, Wintermute, Mirana Ventures (BitDAO's venture arm), and others participating.

Common’s new funds will go toward the further development and decentralization of its platform, also known as Commonwealth, which aims to become the ultimate community management platform for DAOs.

A DAO, or decentralized autonomous organization, is a collective of individuals allied around a common goal who use governance tokens for decentralized voting.

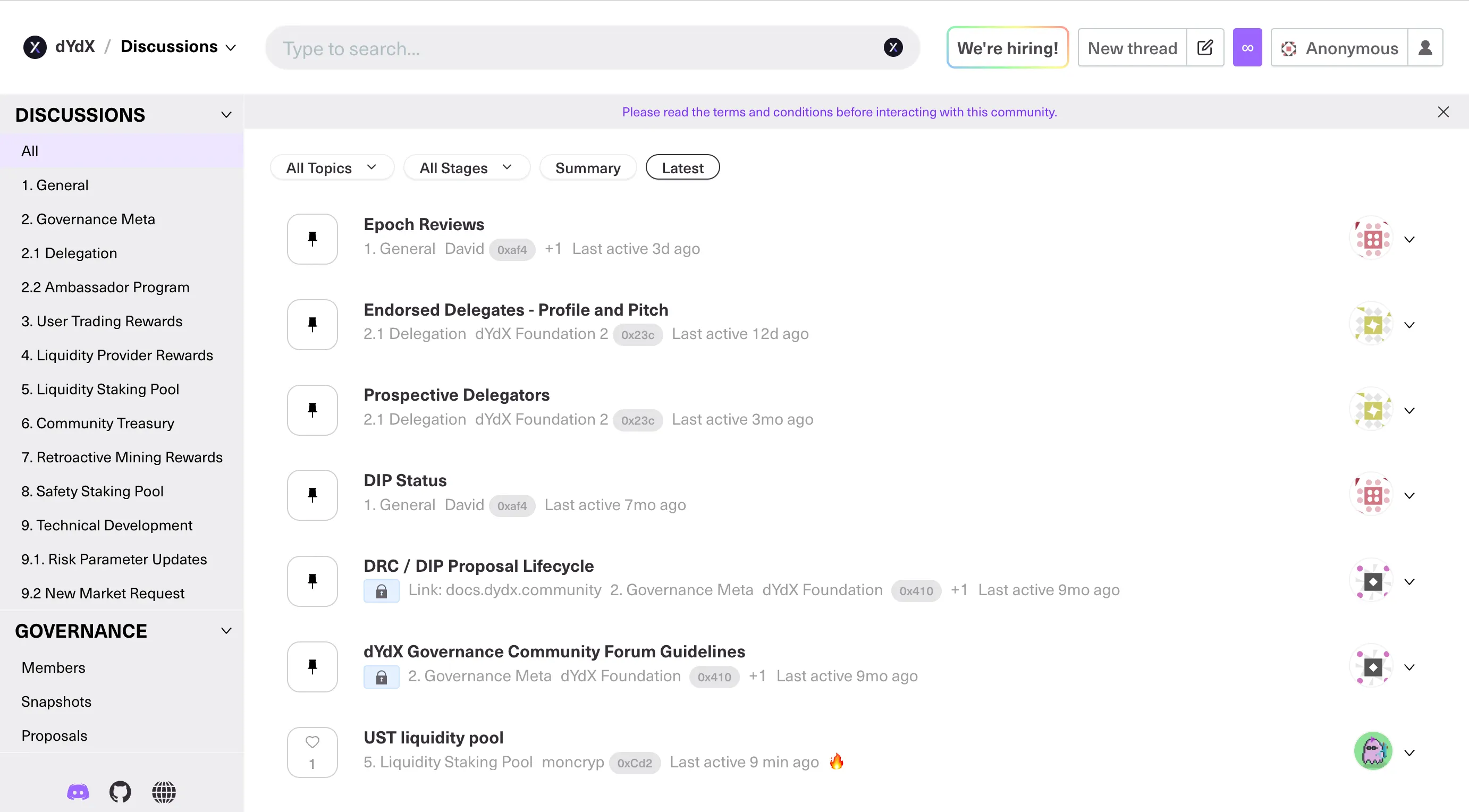

Common allows DAOs to easily deploy governance contracts, crowdfund for new initiatives, and offer a chat feature for DAO members to interact. In the future, it plans to launch an app store for DAOs, allowing each community to choose its own features.

CEO Dillon Chen said in a statement he believes Common will make Web3 governance easier because of its multi-chain functionality.

“The crypto space is too fractioned between multiple blockchains, which presents a growing challenge for token holders to keep track of governance discussions. With so many proposals happening at this point, it’s crucial to have one cross-network governance dashboard,” Chen said.

The platform already has over 60,000 active users across more than 700 decentralized communities for projects like dYdX, Axie Infinity, NEAR, Solana, BitDAO, and Polygon.

In an effort to become more decentralized itself, Common plans to launch its own token, $CMN.

A year ago, Common raised $3.2 million in a round led by Dragonfly Capital and ParaFi Capital, with the now-infamous Do Kwon among its angel investors.

Editor's note: This story was updated after publication to correct the list of investors. A spokesperson said that two of the firms previously listed were not ultimately part of the funding round.