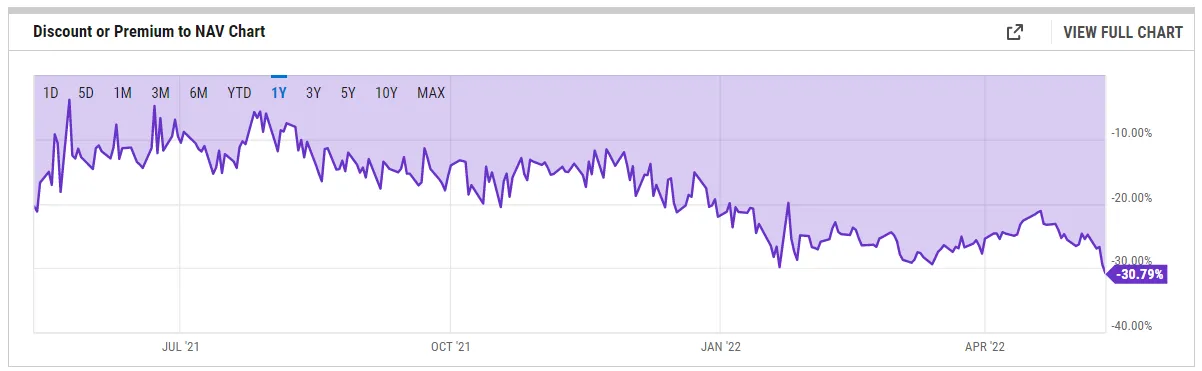

Shares of the Grayscale Bitcoin Trust (GBTC) hit record lows against its net asset value (NAV), trading at a 30.79% discount, data from YCharts shows.

GBTC is a private-placement trust that trades like a stock and allows investors to get exposure to Bitcoin without actually having to buy the asset. The firm takes care of the custody in exchange for an annual management fee of 2%, while buyers acquire shares in the fund.

A massive discount to NAV may seem like a bargain, as it allows investors to buy “shares” in Bitcoin below the actual market value, however, it also comes with a catch, as GBTC has a six-month lockup period.

This means that the fund’ existing holders are running at a loss as the only way for them to cash in is to sell shares.

According to Grayscale’s website, GBTC currently holds $18.3 billion in assets under management.

Converting GBTC into a Bitcoin ETF

The Connecticut-based firm believes that the only way to get rid of the deepening discount is to convert GBTC into a Bitcoin ETF—an exchange-traded fund backed by physical Bitcoin—and has been working hard to achieve that goal.

Should the U.S. Securities and Exchange Commission (SEC) approve Grayscale’s pending application, it would effectively reset the GBTC discount to zero.

The problem is that the SEC has yet to greenlight a single spot Bitcoin ETF, citing the twin risks of price manipulation and Bitcoin’s volatility. At the same time, the agency has already approved a number of Bitcoin futures ETFs, tied to futures contracts.

In a letter sent last month to the SEC, Grayscale argued that the manner in which the regulator approved the fourth Bitcoin futures ETF, Teucrium, opened the door for a spot Bitcoin ETF.

The reasoning is that the first three Bitcoin futures ETFs—Proshares (BITO), Valkyrie (BTF) and VanEck (XBTF)— were approved by the SEC under the Investment Company Act of 1940. The Teucrium ETF, however, was approved under the Securities Act of 1933, which offers more investor protection and could be used as grounds for launching a spot Bitcoin ETF.

According to a recent CNBC report, Grayscale met privately with the SEC last week in an effort to persuade the regulator to approve the conversion of its flagship fund into an ETF.

“The SEC is discriminating against issuers by approving bitcoin futures ETFs and denying bitcoin spot ETFs,” Grayscale stated in a presentation made to the SEC.

The deadline for the regulator to approve or reject Grayscale’s application is July 6.