Previous examples

The situation on the ground

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$63,417.00

-2.61%$1,835.31

-1.73%$1.34

-0.41%$593.34

0.07%$0.999901

-0.01%$77.16

-0.80%$0.281859

-1.90%$1.031

1.49%$0.091508

-1.19%$47.57

-2.31%$0.999884

0.04%$490.54

-9.09%$0.258793

-1.30%$7.73

-3.47%$26.32

-3.89%$0.999087

0.03%$0.161654

-0.20%$8.20

-0.52%$308.90

-1.26%$0.150029

-0.40%$0.999037

-0.01%$0.00915896

-2.20%$1.001

0.07%$0.093998

-1.32%$50.88

-0.78%$233.15

-1.91%$8.29

-1.42%$0.00000595

-0.68%$0.861891

-1.65%$1.34

0.86%$0.07418

1.16%$0.107242

-5.69%$5,151.57

0.19%$1.39

0.65%$5,190.97

0.35%$3.33

0.61%$1.25

-0.14%$1.00

0.00%$0.577702

-1.86%$0.997039

-0.01%$113.21

0.07%$0.695033

-0.01%$0.99977

-0.01%$0.00000391

0.17%$167.72

0.78%$1.12

0.00%$0.999851

-0.01%$2.21

-0.42%$73.22

-2.47%$0.00000166

-1.16%$0.163718

3.77%$0.0636

3.47%$0.998944

-0.02%$8.23

0.57%$0.976886

-1.47%$0.24575

-1.98%$11.00

0.01%$6.76

-2.43%$0.105952

2.27%$2.04

-0.59%$8.18

-0.79%$0.368682

0.11%$0.00175355

-7.03%$2.09

-4.93%$0.057623

0.12%$0.01715763

-3.57%$62.47

-0.83%$1.00

-0.00%$0.814294

-2.56%$0.09619

-0.58%$1.23

-0.37%$0.02953655

-0.77%$3.28

0.97%$0.00897866

-1.36%$0.999703

-0.04%$0.083313

-0.61%$0.736079

12.89%$114.39

0.02%$1.027

0.04%$1.36

-0.81%$1.11

-0.16%$0.03357647

0.46%$0.87723

-1.49%$0.813236

-0.22%$0.00721014

0.05%$0.080136

-0.04%$1.095

0.03%$0.998354

-0.09%$1.57

1.25%$0.092259

1.38%$0.999481

-0.04%$0.02857927

-1.32%$0.01302175

0.62%$0.00000577

-1.28%$0.998705

-0.11%$1.089

0.19%$0.999555

-0.02%$1.18

-0.51%$0.142672

0.06%$26.54

0.28%$0.06595

-1.52%$0.240408

-7.36%$0.23406

-0.79%$1.21

-1.75%$31.70

-0.08%$0.369866

1.24%$166.24

0.16%$0.04505303

4.87%$0.999175

0.04%$0.00623779

0.61%$0.585343

-1.97%$1.018

-1.10%$0.03395761

1.68%$0.152251

-0.85%$1.02

0.00%$0.077662

-1.70%$0.999764

0.02%$1.34

-2.35%$0.443402

3.03%$0.00000033

-0.77%$0.220604

-0.78%$0.00000033

0.23%$3.24

-4.73%$0.01654325

-1.15%$118.22

1.06%$0.052709

-1.07%$3.14

-1.97%$1.50

-0.24%$14.94

-1.43%$0.999692

0.08%$0.04995927

0.55%$0.065947

-0.23%$0.00564758

2.58%$0.02571576

-1.30%$0.992634

-0.23%$0.297043

-1.78%$0.00002773

-0.68%$17.06

-1.48%$1.62

0.83%$0.294922

0.20%$0.272773

-3.09%$1.36

-0.33%$0.295915

0.10%$0.04838302

-1.96%$0.117758

0.90%$0.00248029

0.46%$0.00250258

-2.39%$0.128787

-18.80%$0.067349

0.26%$0.201727

-4.12%$1.001

0.11%$5.98

-0.41%$0.310637

10.23%$0.0402102

-3.07%$0.999996

0.01%$0.02020494

4.80%$0.988106

-0.01%$1.075

0.03%$0.999676

-0.03%$1.68

2.39%$1.24

0.60%$0.078221

-0.11%$0.500534

1.69%$22.79

-0.31%$0.099874

-0.67%$0.00000096

0.91%$0.19906

-1.35%$1.19

4.90%$0.00201197

-0.04%$5,161.27

-3.33%$0.00003471

0.88%$1.00

0.00%$2.65

1.88%$0.051767

0.13%$0.08591

2.60%$0.185371

-1.22%$0.184636

-2.87%$1.00

0.00%$0.07609

-1.60%$0.0190301

3.72%$0.090654

-0.22%$0.00471056

-2.31%$0.114823

0.74%$0.758362

-3.58%$1.001

0.08%$0.02040843

2.07%$17.16

0.30%$0.02298318

9.74%$2.06

-4.46%$1.79

-0.07%$0.00343427

-1.34%$8.25

3.32%$47.98

-0.01%$0.994354

0.24%$3.62

-1.21%$1.72

-3.89%$0.587037

-0.23%$1.26

0.17%$0.04952775

-2.29%$0.02782575

57.10%$0.997471

-0.06%$0.0000075

-0.47%$1.91

-4.82%$1.002

-0.02%$1.013

-0.05%$0.149703

-3.68%$0.149162

-7.17%$0.03924594

-1.42%$0.31118

0.93%$0.141234

-10.50%$3.00

14.71%$0.312645

0.34%$0.134996

2.34%$0.382996

-0.15%$8.71

0.18%$0.617967

0.20%$1,097.35

0.02%$12.30

-11.33%$0.318655

-2.05%$0.151977

-2.22%$0.073264

-4.28%$0.127082

2.24%$0.994735

-0.02%$0.253098

0.50%$0.077667

1.02%$4.27

-0.44%$0.124329

-6.36%$0.13066

-0.01%$0.357367

-13.11%$0.278828

-0.93%$0.087165

-1.24%$0.565179

0.82%$1.85

-1.50%$0.00143253

-1.48%$0.217361

3.40%$1.001

-0.02%$1.014

0.65%$0.240605

-2.28%$0.999811

0.01%$0.00382056

-0.45%$0.072524

-0.67%$12.08

18.17%$0.336479

-1.18%$1.44

12.67%$2.26

3.61%$0.999711

0.01%$1.063

0.11%$0.184466

6.17%

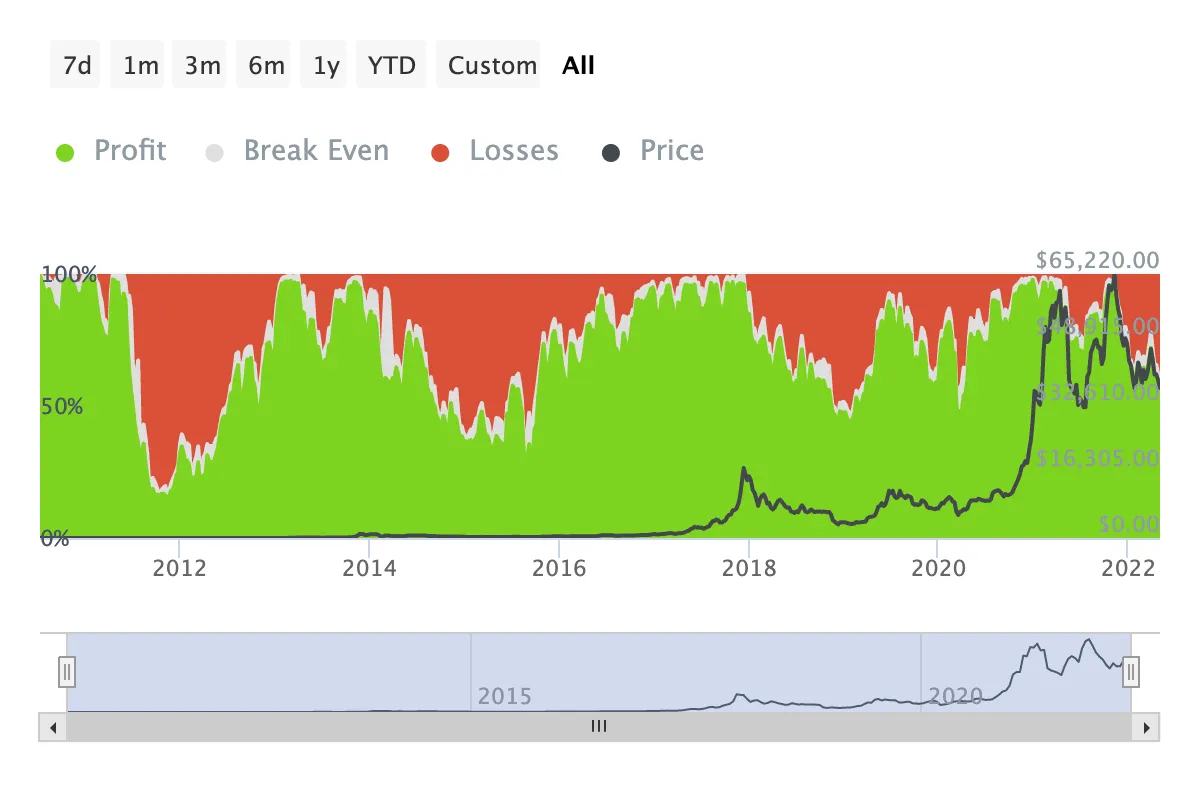

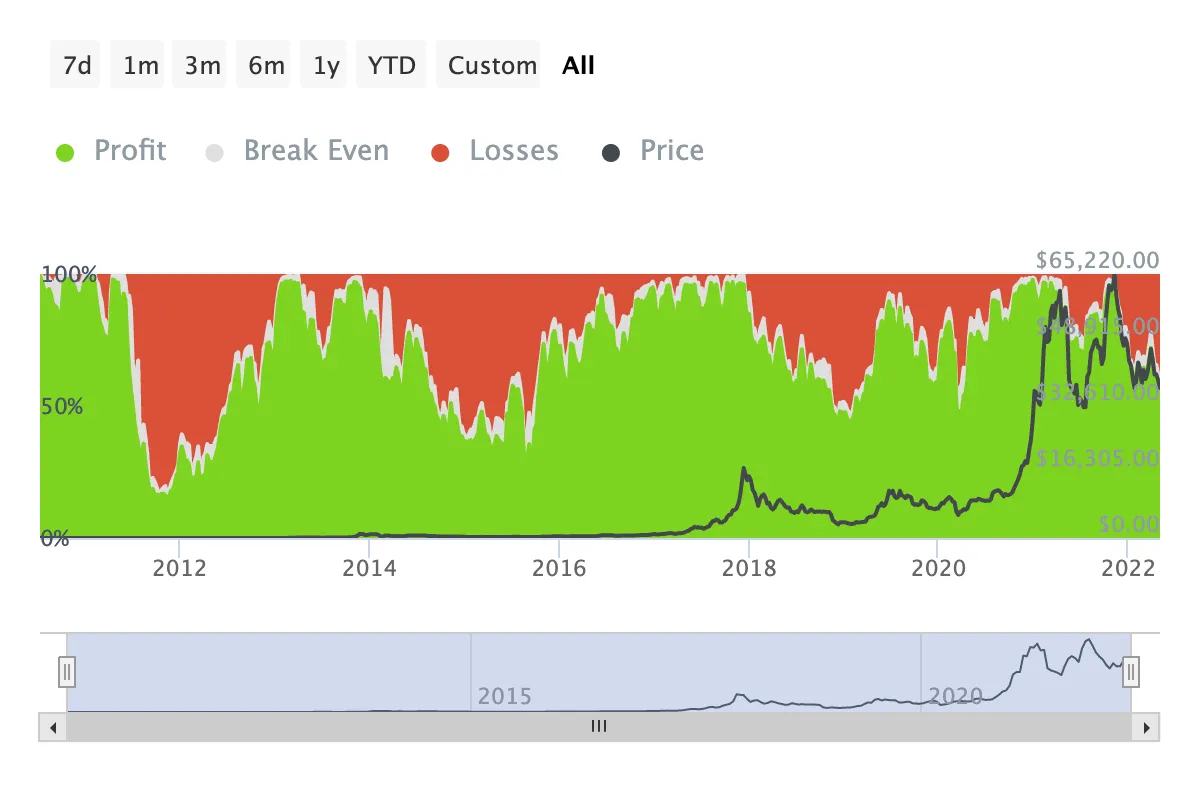

Nearly half of all Bitcoin holders are underwater today as the price of the world’s largest cryptocurrency continues to crash. It briefly plunged below $30k in the early hours on Tuesday, before recovering slightly.

Starker still, data from IntoTheBlock suggests a staggering 47.2% (or 21.68 million) of wallets holding Bitcoin are currently down on their investment, forming a slight majority compared with the 46.5% (21.39 million wallets) which are in the green.

Roughly 6.3% of holders, or 2.88 million wallets, are neither up nor down.

Bitcoin is now trading hands at $31,457 at the time of writing, according to CoinMarketCap.

This figure puts Bitcoin more than 50% shy of the all-time high of $68,789 set on November 10, 2021.

Historically, occasions when the majority of Bitcoin holders have been out of the money have been rare.

It happened for the first time in late 2011 and early 2012 during the first major Bitcoin crash, when hackers attacked and looted the then-biggest crypto exchange Mt. Gox, depressing Bitcoin’s price from $17.50 to a penny.

While Bitcoin rallied and crashed sporadically through 2014 and 2015, there were several points when out-of-the-money Bitcoin holders formed the majority.

It happened again in December 2018 going into January 2019 and once more on March 16, 2020, following a brief price crash where Bitcoin fell from intraday highs of roughly $8,000 down to $5,385.

Since the month began, there’s been a massive inflow of Bitcoin into exchanges, suggesting that investors are moving their holdings onto exchanges to sell for fiat or fiat-pegged stablecoins.

Still, the industry’s bigger players appear to be capitalizing on the opportunities created by the sinking prices.

Over the past week, crypto investment products saw net inflows of $40 million, a sign that investors are taking advantage of the market to trade exchange-traded Bitcoin products at reduced rates.

Meanwhile, there’s been a flurry of price speculation. Investors use futures contracts, a type of derivative, to bet on whether assets will increase or decrease in price. A record $4 million flowed into short Bitcoin contracts (a bet that the price will continue to fall) over the last week.

Still, one person’s losses are another’s gains, right?

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.