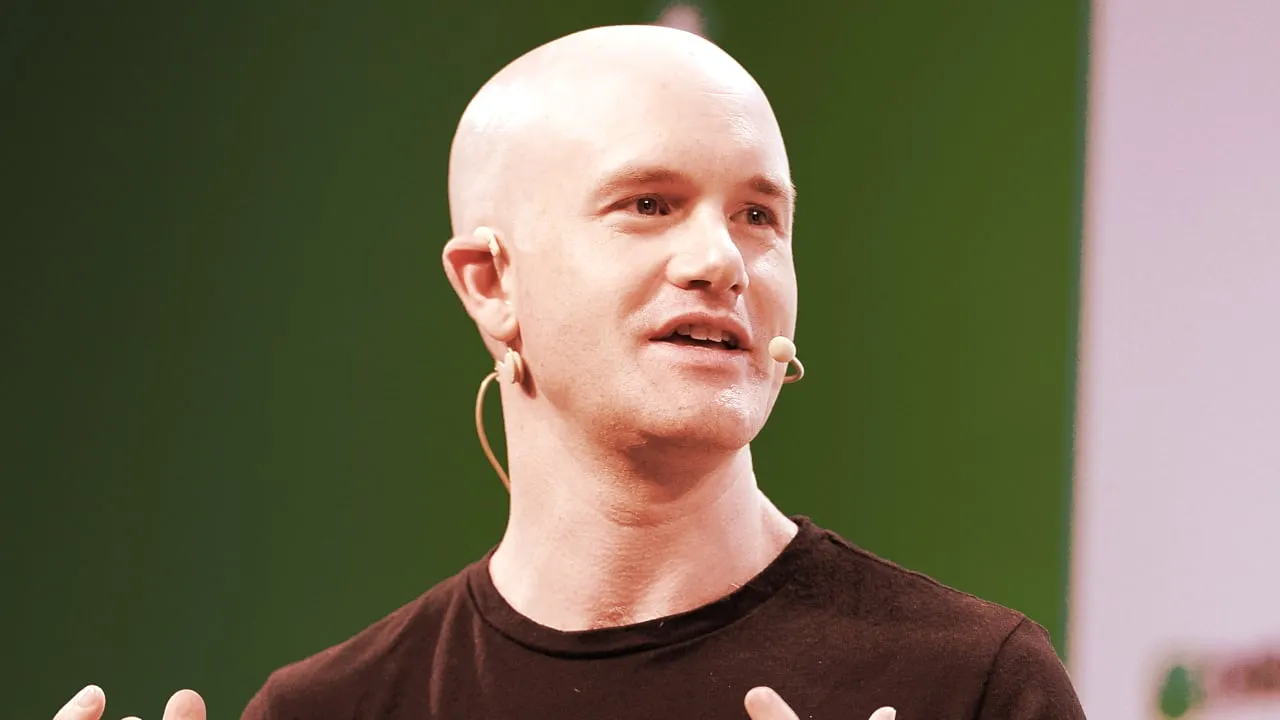

Coinbase CEO Brian Armstrong yesterday addressed concerns that traders have been taking advantage of the company’s listings process, writing in a blog post that the company will be adopting new policies and features in the coming months.

Armstrong’s message was seemingly a reaction to recent allegations that an Ethereum trader was able to gain access to a list of coins that Coinbase was considering adding to its exchange before that list had been made public in a company blog post. The trader was able to buy up $400,000 worth of the tokens that were on the Coinbase shortlist, which had then increased in value by 42% over the next day.

Now, according to Armstrong, Coinbase will stop publicizing its shortlist and instead announce assets only after it has decided to list them. Even then, the company said it will make those announcements before any technical integration has begun.

It’s meant to be a safeguard against front-running. And the piece about listing new assets before technical integration begins is an important detail.

Front-running, a term borrowed from traditional financial markets, refers to using insider information to make a trade ahead of the competition. In some cases, crypto traders will opt to pay higher gas fees (the cost of making a transaction on a blockchain) to get their transaction processed before the rest of the market because doing so will ensure greater profits.

Traders looking to front-run Coinbase listings have been able to figure out which assets will be listed before they actually appear on the platform. It’s happened before at other crypto companies—see: OpenSea’s former product head, Nate Chastain.

Chastain resigned from the popular NFT marketplace in September after a user pointed out on Twitter that he appeared to have engaged in unethical trading. Data on Ethereum block explorer, Etherescan, showed a wallet belonging to him bought NFTs before they were featured on the OpenSea homepage and resold them for a profit after the increased exposure boosted their price.

Coinbase has not said publicly, in the blog post or otherwise, whether the trader who bought up $400,000 worth of tokens before they were shortlisted was an insider. But Armstrong did say in his blog post that the company works with blockchain forensics firms to investigate whether seemingly unethical trades can be traced back to employees.

As for external front-runners, the Coinbase CEO described a few different ways they could be gaining an advantage over other traders.

“Examples of this might include using on-chain data to detect when Coinbase might be testing new asset integrations or using small differences in Coinbase API responses to detect when assets might be configured, but not yet launched,” Armstrong wrote. “While this is public data, it isn’t data that all customers can easily access, so we strive to remove those information asymmetries.”

A Coinbase spokesman declined to comment further on how the company will address that asymmetry, telling Decrypt it could tip off bad actors.

The company will also roll out a ratings system that allows its community to share information on assets, even if they’re not listed on the exchange.

“We believe ratings and reviews can help create additional consumer protections in crypto, and ideally these can be decentralized in new protocols over time,” Armstrong wrote. “We recognize that special care will be needed to avoid fake accounts or sybil attacks and to keep reviews high quality. We plan to launch a beta of this feature later this year.”