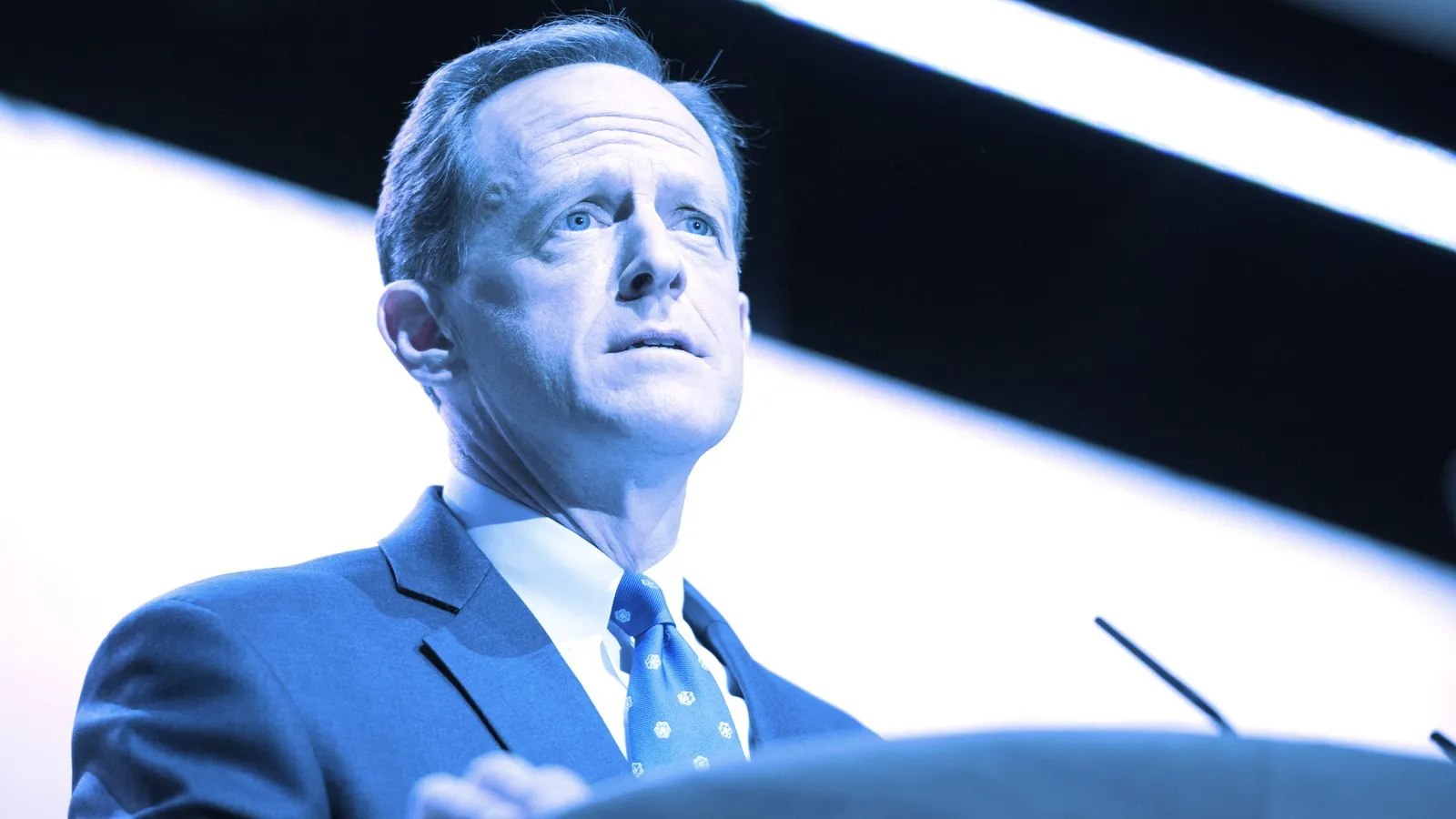

Senator Pat Toomey (R-Pa.) on Wednesday unveiled a draft of the Stablecoin Transparency of Reserves and Uniform Safe Transactions Act.

The TRUST Act states that stablecoin issuers must adhere to certain rules. The bill also refers to stablecoins as “payment stablecoins”—digital assets that can be “convertible directly to fiat currency by the issuer” and that have a “stable value relative to a fiat currency or currencies.” And stablecoins would not be treated as securities.

Toomey’s bill, which very well may be modified before votes are counted as to whether it becomes law, says only three entities would be eligible to issue stablecoins: a money transmitting business or person who's authorized by a state banking authority (or similar), a national limited payment stablecoin issuer, or an insured depository institution.

Perhaps most notably, those issuing stablecoins will have to publicly disclose the assets that back them—be it cash reserves or something else.

A stablecoin is a cryptocurrency designed to have low volatility compared to assets like Bitcoin or Ethereum—which both have wild price swings. The idea is that payments can be made with such digital assets. Stablecoins, Toomey added in a statement, can “speed up payments and automate transactions.”

The most popular stablecoins are pegged to the U.S. dollar, but others are backed by gold, other fiat currencies, or even algorithms, and they are the backbone of the crypto economy.

When talking about regulating the crypto world, U.S. lawmakers refer to stablecoins a lot. In fact, Decrypt in January uncovered that the Biden Administration was planning to completely regulate stablecoin issuers.