Updated with response from Probit.

We now know that “initial exchange offerings” are doing terribly. Just last week, research firm Longhash found that the briefly insurgent funding mechanism—which saw hundreds of crypto startups run token sales from the “launchpads” of willing exchanges—has yielded returns of around minus 80 percent for the thousands of investors that took part in the offerings.

What fewer people know, however, is how much these failures cost the token-issuing companies in the first place. After speaking with several companies and reviewing multiple IEO prospectuses, we found that they can be costly. While the larger, more established exchanges charge no upfront fees, the other, lower-tier exchanges demand payments that can exceed tens of thousands of dollars. And for those who want their IEOs seen by more than just a handful of investors, projects have to pony up additional fees for external marketing, hemorrhaging yet more thousands.

Vanity token sales

The selling point of an IEO was brand-recognition and management—token-issuing startups could take advantage of exchanges with considerable industrial clout, who would oversee their sales. A small startup getting a Binance launch was tantamount to a glowing New York Times write-up. Hence you had obscure tokens like Ampleforth and Algorand, which ran IEOs on Binance and Bitfinex, rising to relative prominence almost overnight.

Not so for those unable to court the larger exchanges, who had to go for lesser platforms. According to The Block’s Larry Cermak, “four little known exchanges”—Bitforex, Coineal, Exmarkets, and ProBit—accounted for some 45 percent of initial exchange offerings as of late July. And not only were the returns from these IEOs poor, they cost the token-issuing companies thousands of dollars.

Of course, there's nothing illegal about upfront fees—it's just clear that, for the token-issuing companies, the amount spent has rarely been worth the amount gained.

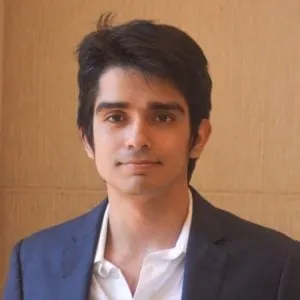

Take a look at the returns on a random sampling of 24 projects on exchanges that include ProBit, Coineal and Exmarkets, for instance, and only nine even show up on any indexes:

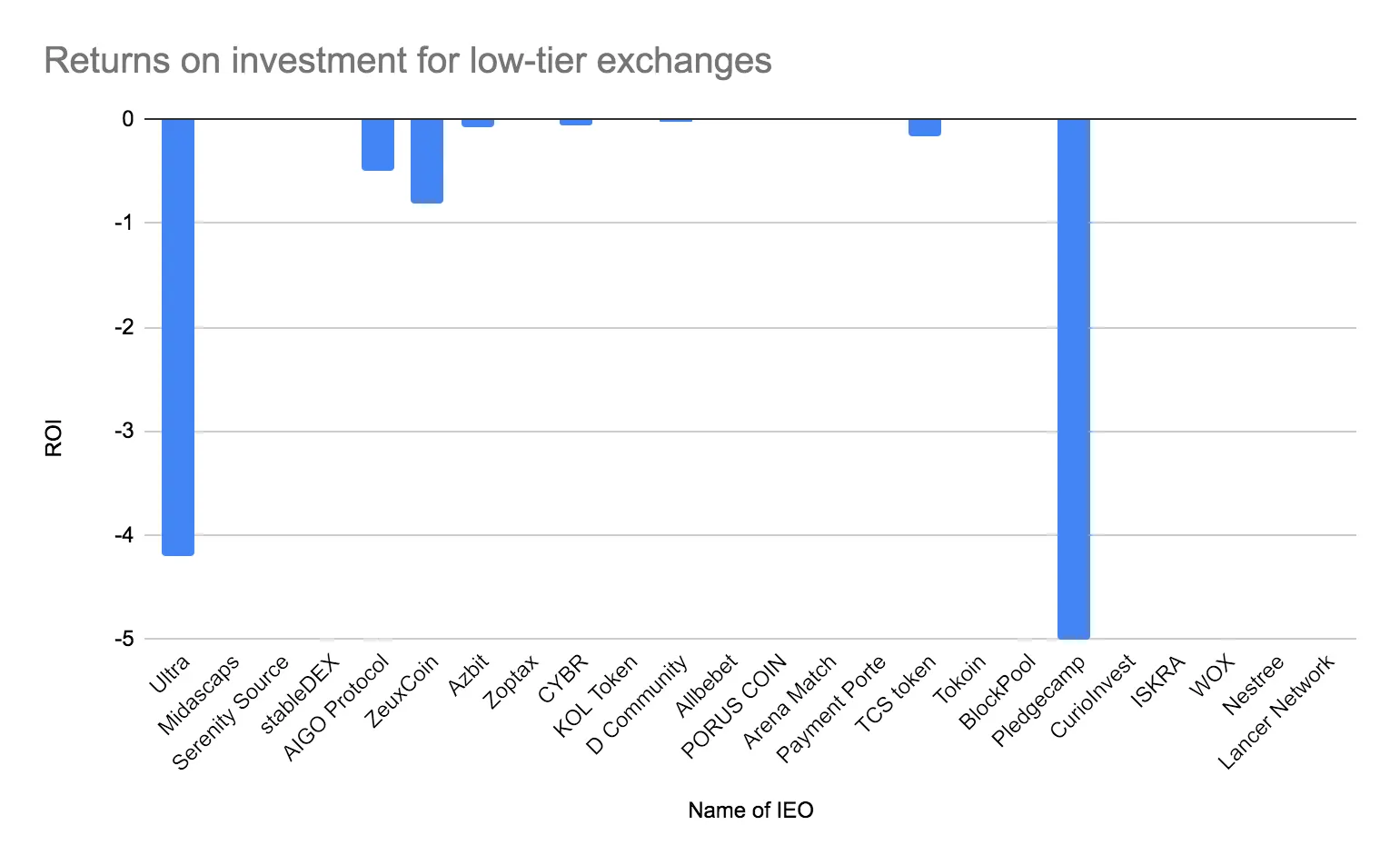

Bittrex IEOs fared equally badly:

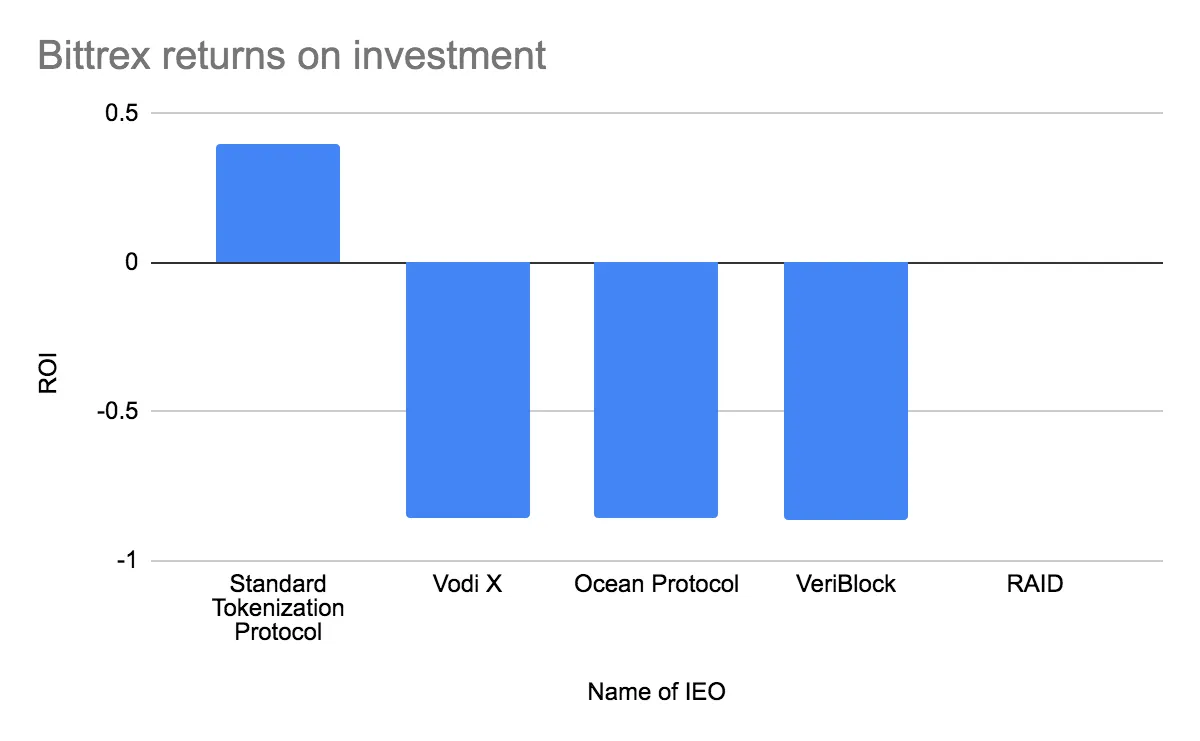

And even Binance IEOs were only half successful:

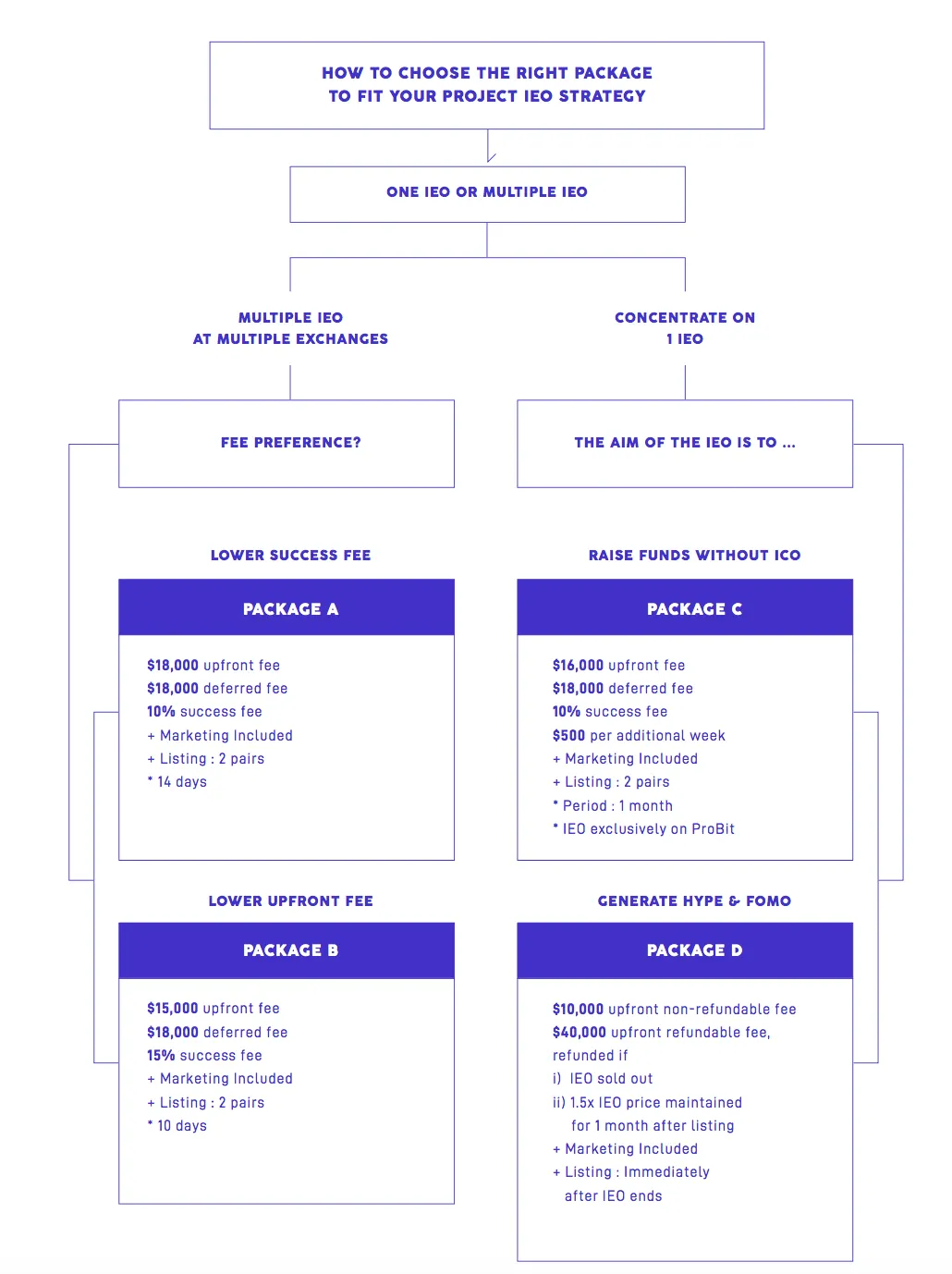

On the lesser exchanges, these failures have been costly: Coineal, for instance, charges ten to twelve bitcoins (between $100,000 and $120,000 at current prices) to its clients upfront, a Coineal spokesperson told us. Exmarkets, an Estonian exchange, charges two bitcoins ($20,000 at current market price), according to screenshots of a conversation between the exchange and Greg Pwol, a client. And Probit, according to a prospectus obtained by Decrypt, asks for up to $18,000 in advance in fiat—and another $18,000 if the sale is a success.

One of ProBit’s offerings, called “Package D—General Hype and FOMO,” includes marketing and an “immediate” post-IEO listing, but demands $50,000 upfront. Around $40,000 of this is refundable, but only on the condition that the IEO sells out and remains at 1.5 times the selling price for at least a month after launch. If neither of those things work out...tough luck. That’s $50,000, down the drain.

In its separate listing deck, meanwhile, Probit tells clients it will help get them “1 step closer” to appearing on popular index CoinMarketCap. However, we found that of the some 54 projects that have run or are currently running IEOs on ProBit, only seven are listed on CoinMarketCap, two of which have “no data available.”

(Probit said projects listed on CMC require two exchange listings, making it difficult for the exchange to unilaterally guarantee anything. "Probit has project friendly terms that allow projects up to 6 weeks after their IEO to go to other exchanges to conduct other IEOs before getting listed on Probit," said Director of Strategic Partnerships Ronald Chain. "CMC needs price data from 2 exchanges which are on CMC. Some projects may still remain unlisted at the IEO phase, and some may still require 1 more exchange listing.")

Still, given the failure rate, these upfront fees inevitably leave token issuers empty handed. Shawn Key, who launched the CYBR token, put in $143,000 for a sale on Coineal and said he got nothing in return, losing the IEO fee also. Another entrepreneur, Pwol, who listed on Exmarkets and sent us screenshots of the exchange promising him thousands of dollars’ worth of returns, said that he was left with a whopping $7.50—after pitching in $6,000 for an IEO.

And after these unsuccessful raises? Pwol says his token was immediately delisted, all mention of it expunged from Exmarkets’s website. According to Volodomyr Malyshkin, the CEO at IEO consultancy Illuminates, this is par for the course on the more obscure exchanges, which don’t want faded tokens staining their reputation.

We reached out to Probit, Coineal and Exmarkets: Coineal explained how its listing process works, but didn't go into the concerns raised by its clients, Exmarkets didn't respond for comment, and Probit responded after this article was published, questioning the source of our data, CoinCodex, and saying that its clients generally had positive experiences and did not blow thousands of dollars.

No news is bad news

After the initial payment, these exchanges often leave token-issuers dissatisfied with the level of marketing. Pwol said his $6,000 only covered an unsuccessful internal campaign pushed out to Exmarkets’s 2,500 or so Telegram users. (After which, his token was purged from the exchange and its associated social channels, he said.) Another entrepreneur, Shawn Key of crypto startup CYBR, meanwhile, says that he found the marketing efforts of Coineal similarly wanting. “They did zero advertising apart from their [announcements] on their website,” he said. “Total joke.”

That’s not to say exchanges are obliged to cover extensive marketing campaigns. But without such a campaign, according to Malyshkin, a project can barely expect to make $1,000. “[An] IEO listing is completely useless without a marketing campaign,” he said.

Those seeking marketing via third-party services may be squeezed even further. A pitch-deck for consultancy “Easy Listing,” obtained by Decrypt, describes expensive services indeed: overhead includes a “turnover fee” at 0.2 percent of a token’s monthly trading volume, a “brokerage fee” at seven percent of the total volume, and fees of $5,000 and $3,000 covering “market-making” for “crypto-pairs” and “additional crypto-pairs” respectively. And that’s before the exchanges themselves bring their own expenses. (A spokesman for Easy Listing confirmed that this was accurate. He also said that, for some companies, the costs have paid off, but acknowledged that smaller IEOs using marketing techniques "from 2017-2018" do struggle to generate any meaningful publicity. He went on to add that many of the figures online are "fake," but agreed that at least half of the raises he's witnessed have flatlined.)

At the heart of it, the low-tier IEO scene is rather like vanity publishing: pay bigger bills, foot greater risk. For the few that make back the initial costs, it’s a boon. But for the rest, it’s a waste of money.