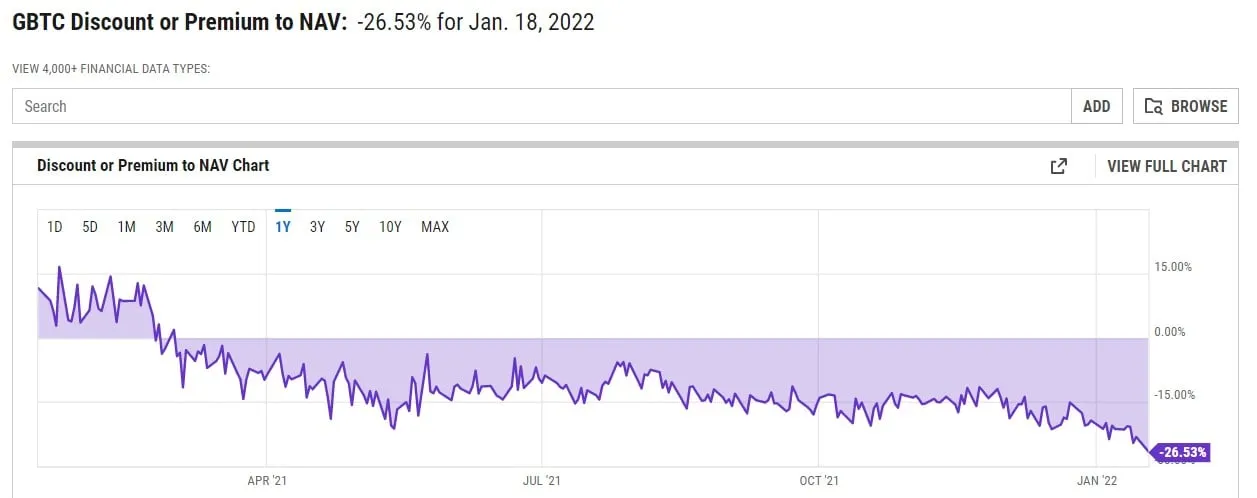

Investors in the Grayscale Bitcoin Trust (GBTC) face more losses as the popular investment product hit its record discount of 26.53%, per data from YCharts.

GBTC has long been an investment tool of choice for many institutional investors, offering exposure to Bitcoin without the need to purchase the actual underlying asset.

It comes with several drawbacks though, including an annual management fee of 2% and a six-month lockup period.

A hefty discount to net asset value (NAV) not only means that GBTC's existing holders are running at a loss but may also be seen as a bearish indicator of wider institutional sentiment towards Bitcoin.

In other words, the current discount potentially means a weakening interest in the asset, as there's more GBTC supply than demand.

Due to how the fund is structured, the shares in the trust can't be redeemed for the underlying either, meaning that the only way to cash in is to sell the shares; however, as said above, this is only possible only after six months.

GBTC's record low comes as Bitcoin struggles below the $43,000 mark, down 9% over the last month, and nearly 39% from its November all-time high of $69,044, according to CoinGecko.

Grayscale’s battle for a Bitcoin ETF

Some recently-launched Bitcoin futures exchange-traded funds (ETF), such as ProShares Bitcoin Strategy ETF (BITO), have also faced hefty criticism.

Still, the asset offers investors exposure to the leading cryptocurrency without a lockup period and at lower fees.

$GBTC just closed with a ~26.5% discount..... a new low. Brutal. https://t.co/xhR50Litmn pic.twitter.com/kggc9o15zT

— James Seyffart (@JSeyff) January 18, 2022

Despite the poor performance of Grayscale's Bitcoin instrument, the firm has a plan: To Convert the GBTC into a spot Bitcoin ETF.

However, the U.S. Securities and Exchange Commission (SEC) has already delayed the firm's Bitcoin ETF application last month.

And given the hard-line approach of the Commission's chair, Gary Gensler, to investment products backed by physical Bitcoin, it seems unlikely that Grayscale will be able to execute the conversion.

According to James Seyffart, a Bloomberg Intelligence ETF analyst, another option for Grayscale to close the gap between the underlying value of Bitcoin and the market price of GBTC could be to lower the fees and offer a redemption program.

As an extreme measure, he also suggested an option of closing the fund for good, returning the funds to investors.

However, this "would be quite bad for BTC," he said, adding that he doesn't think such a scenario is possible in the near future as Grayscale will do everything they can to get a Bitcoin ETF approved.