A “stablecoin” called BitShares (BitUSD) was trading at an impressive premium yesterday. On the exchange OpenLedger, lucky traders could sell their BitUSDs for a whopping $34, a 3,400 percent surge from the token’s previous price at roughly $1, according to CoinMarketCap.:

Look at it go! (Briefly.)

But BitUSD, of course, isn’t supposed to trade that high. As a stablecoin, it’s designed to be stable and buffered against market volatility.

This isn't such a problem for traders, who aren't really paying $34 for a single BitUSD. But any aggregators, trading bots or price feeds that use CoinMarketCap's rendering of the BitUSD price—and the coin mainly trades on automated, "decentralized" exchanges—could find themselves making decisions based on questionable pricing data. So we decided to investigate.

Ross Walker, a representative from Bitshares, the open source community behind BitUSD, helpfully explained to us what he thought was going on. The trouble, Walker told us, was not caused by market manipulation or BitUSD’s own confused fundamentals, but by CoinMarketCap itself.

CoinMarketCap, Walker explained, is rolling out “Phase 1” provisions to make its index of cryptocurrency prices more transparent. Normally, when there’s no dollar market for a cryptocurrency, CoinMarketCap derives the USD price of an asset from the dollar-traded asset most closely connected, or "paired," with it. (CoinMarketCap itself confirmed this: see its methodology here.)

But in light of CoinMarketCap’s Phase 1 rollout, said Walker, the index excluded some of the more liquid BitUSD pairings. This means low-liquidity “outliers” dirty the index’s assessment. “Resulting in a very wrong price for BitUSD,” Walker explained.

This appears to be a credible—if incomplete—explanation. CoinMarketCap, in an email to Decrypt, confirmed that it had indeed excluded some BitUSD market data, saying Bitshares had failed to meet certain transparency requirements required for the Phase 1 update. And other indexes that do list the relevant data show BitUSD trading at near dollar-parity.

But CoinMarketCap also says that it excluded the data way back in June, while the recent chaos began on Monday.

What on God’s green Earth is going on? We called up blockchain consultant Colin Platt, whose proficiency with the juicing up of crypto markets once made him an ersatz shitcoin quadrillionaire. Platt helped us out, trawling through block explorers when he could have been spending time with his loved ones.

And what he found was (mildly) astonishing.

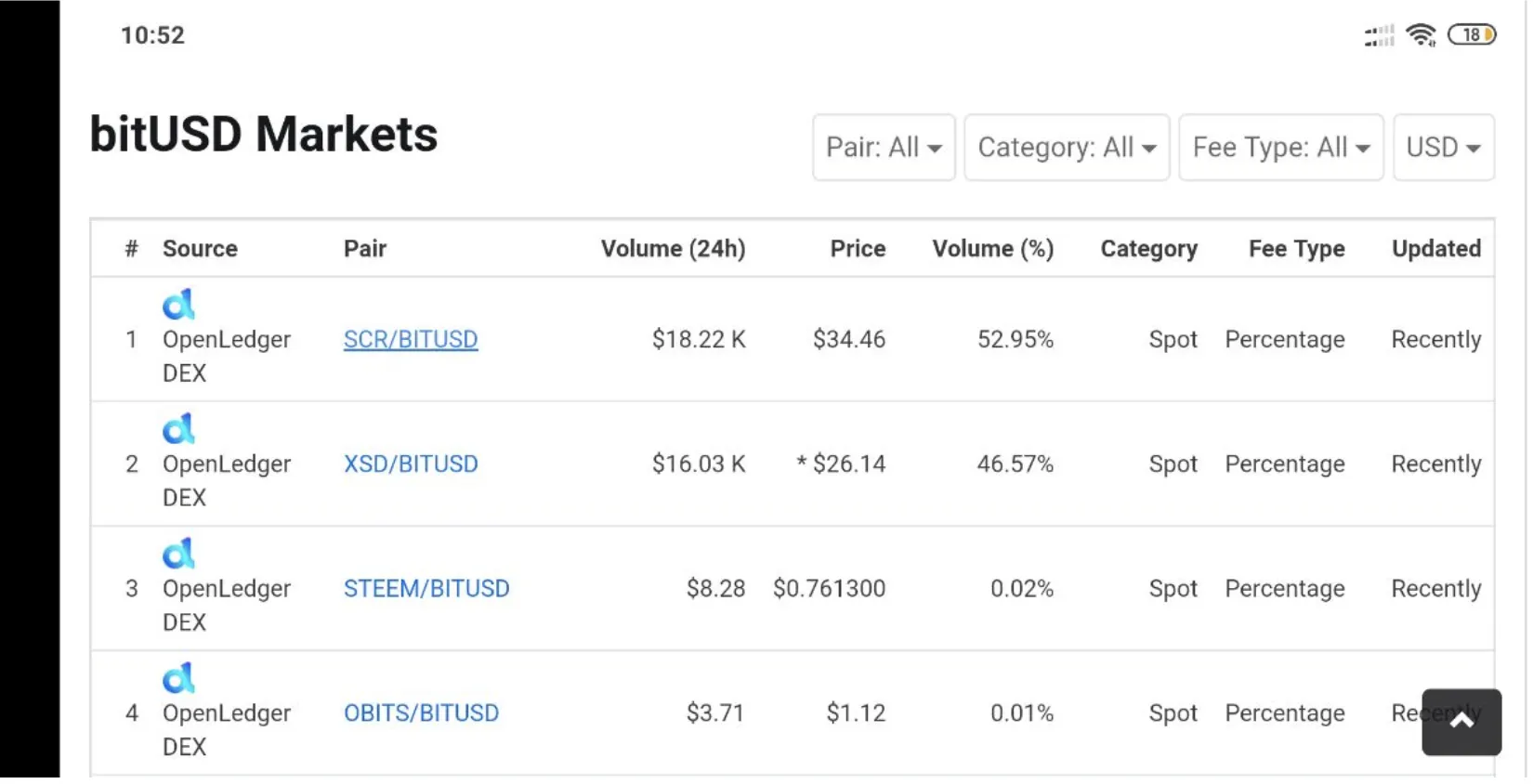

Below is CoinMarketCap’s view of how BitUSD is trading against various coins on the Bitshares-affiliated exchange OpenLedger, courtesy of Platt. The top two pairings, whose collective volume runs up to $34,000, account for 99 percent of BitUSD’s volume, meaning CoinMarketCap’s algorithm would defer primarily to them when gauging BitUSD’s price:

But as you can see, the second pairing has been manually excluded (hence the asterix), leaving only the top one, "Scorum" (SCR), with any influence.

That’s the pairing that shows BitUSD’s price trading at an alluring $34 premium.

So what's going on?

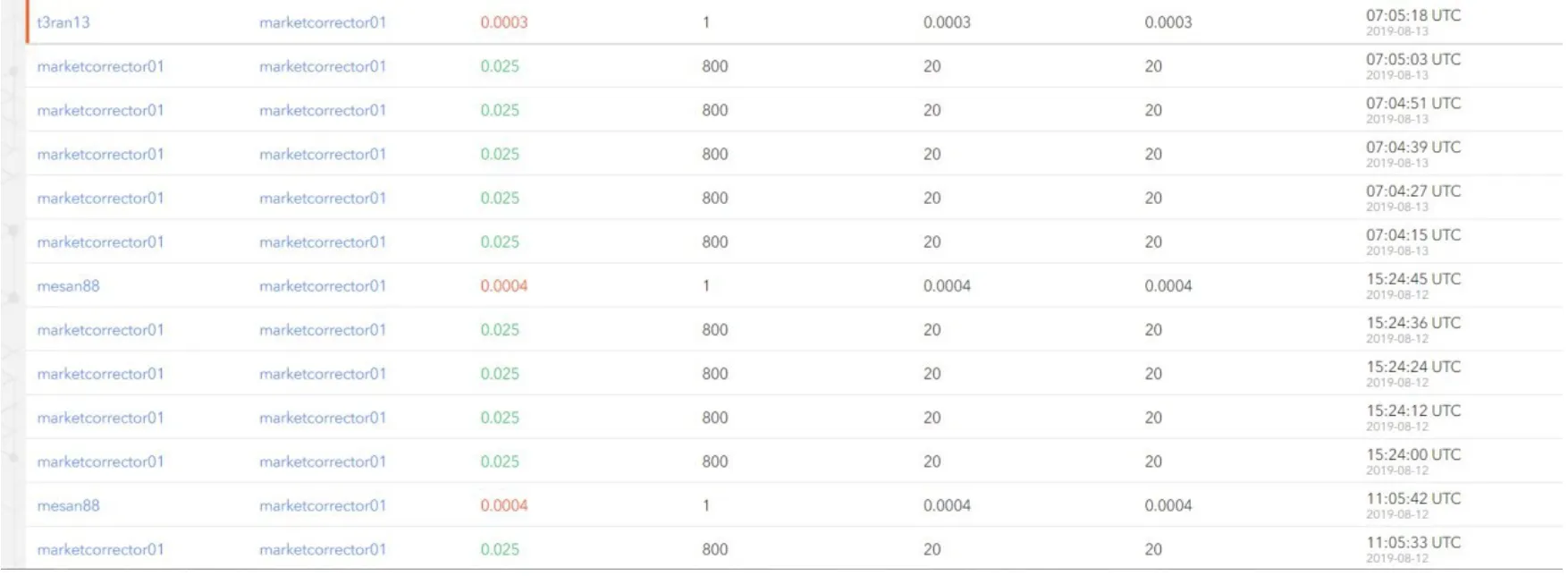

Platt did some digging, and found that there’s only one entity trading SCR against BitUSD, “marketcorrector01,” which has been blithely trading SCR for BitUSD with itself since Sunday—suggesting it’s probably a bot.

Most of the time, the bot buys and sells SCR at a price of $0.025, paying in BitUSD. But occasionally, the bot sells it at a far lower price, around $0.0004, to “t3ran13” and “mesan88":

Here’s what Platt thinks happens next: CoinMarketCap, scraping data for its rendering of BitUSD’s price, sees SCR’s abrupt fall against BitUSD and interprets it as BitUSD strengthening. Devoid of better metrics, the index misleadingly reports a massive increase in BitUSD’s price.

CoinMarketCap, in an email to Decrypt, appeared to confirm this. A spokesperson said that the fluctuating exchange rate enjoyed by a “certain market pairing” caused the mispricing. This, we assume, was the BitUSD/SCR pairing.

There's certainly more than a whiff of sketchiness here. Are marketcorrector01's weird maneuvers another egregious case of market manipulation? Are “t3ran13” and “mesan88" master arbitrageurs, buying up SCRs at low, low prices and flogging them on the market for a mean profit?

"Profiting," scoffed Platt. "They would have taken home just over a penny."

But at least we (Platt) seem to have gotten to the bottom of it.

So, to conclude: owing to CoinMarketCap’s omitting of crucial liquidity metrics, BitUSD’s price appears to have been derived entirely from the notional dollar-value of an asset that’s being mostly self-traded by a bot.

Fine.