In brief

- Bitcoin's limited maximum supply of 21 million coins makes it unfit to replace fiat money, says Yanis Varoufakis.

- Central bank digital currencies, on the other hand, are "the way to go."

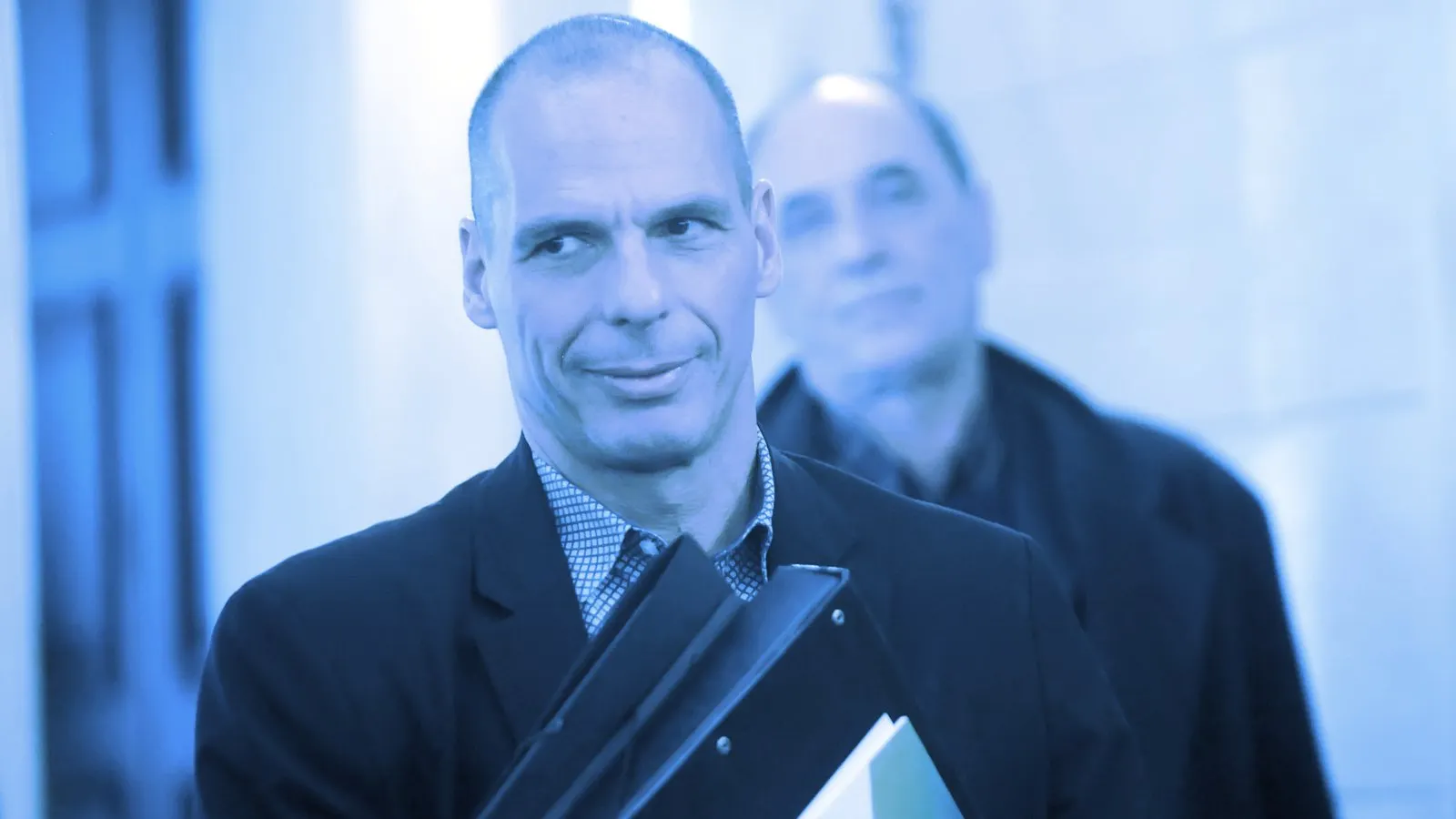

Former Greek finance minister Yanis Varoufakis has argued that Bitcoin creates “a kind of feudalism run by the early adopters” and that it would be outright “catastrophic” if it replaced fiat currencies. However, he said, there is still a lot of good that digital assets can bring to the world.

In an interview with Greek Reporter, published yesterday, Varoufakis opined that Bitcoin’s greatest strength—its finite supply of 21 million coins—is also its biggest weakness. “Given its fixed supply and given the fact that there is no democratic mechanism to determine who gets and how many Bitcoins, it creates a kind of feudalism run by the early adopters of Bitcoin,” he said.

This is because “money is always political,” he added, and “the question is whether it will be democratized or not.” Ultimately, Bitcoin proponents who believe that it will democratize money are “are completely wrong,” said Varoufakis.

Bitcoin 'catastrophic’ in times of crisis

Bitcoin’s fixed supply also makes it unsuitable for times of crisis, Varoufakis argued. Pointing to the coronavirus pandemic as an example, Varoufakis explained that governments around the world need the ability to increase the supply of their currencies to tackle emergencies.

“Suppose that with a magic wand Bitcoin replaces fiat money. This will be catastrophic,” Varoufakis told the outlet. “We would all be now in very dire straits. What will happen when we have a pandemic and you need to increase the money supply? You cannot increase the supply of Bitcoin because it is of fixed supply.”

https://www.youtube.com/watch?v=sKW7_cTtsjQ

Indeed, while “money printing” is often cited by Bitcoin advocates as one of the main flaws in the existing monetary systems, governments often use this tool to counteract various calamities. Not only that, but using Bitcoin as currency can also result in a modern-day financial “feudalism,” Varoufakis argued, thus it “can never be a currency and it should never be a currency.”

Blockchain and CBDCs are ‘the way to go’

While cryptocurrencies and even stablecoins are ill-suited to be used as currencies, there is still a way that blockchain can revitalize payment systems—via central bank digital currencies (CBDCs), said Varoufakis.

According to him, CBDCs are “the way to go” and “would kill more than two birds with one stone.” For example, they would allow users to cut out middlemen such as private banks that charge fees for effectively “doing nothing.”

“Why are we assuming that when you want to buy a book from Amazon, you should go through some private bank? Why should the private bank be cut into your deal with Amazon? Why should they charge a fee when they do nothing? They do charge because banks have the monopoly of the payment system,” Varoufakis argued.

Since blockchain-based CBDCs can effectively operate “on their own” as a stand-alone system, there is no need for any third-party banks to facilitate such transactions, he argued. Instead, private banks would then focus on offering “real” services to their customers.

“We need to cut out the middleman: The Federal Reserve gives money to the banks they lend to corporations,” Varoufakis said. “Now, what if the Fed wants to stimulate the economy and gives every taxpayer in the U.S. a digital account? The money goes directly to the Federal Reserve. The whole point is cutting the middleman.”

“Politicians and governments could not pull a fast one over you as a citizen, while at the same time you will preserve complete anonymity,” he concluded.