Facebook is set to reveal its own cryptocurrency next week.

What we know so far is that Libra coin, or GlobalCoin depending on who you ask, is rumored to be a stablecoin backed by a basket of fiat currencies. It is likely to be integrated into Facebook—getting exposure to its two billion users—and WhatsApp. And, like JP Morgan, IBM and other industry heavyweights getting into crypto, Facebook’s interest is a sign that it believes crypto is here to stay.

But this move isn’t just a vote for crypto, it’s a sign that big tech believes it can leverage its sizable influence to create a clear path of regulation, and that’s a good thing.

In Deloitte’s 2018 and 2019 surveys of senior executives, regulatory issues were cited as the biggest barrier to new investment in the crypto industry. Concerns ranged from securities law and money laundering to the legality of smart contracts. In short, businesses are scared to get involved because they fear the potential repercussions.

And they’re right to be afraid. U.S. agencies have provided conflicting information on the status of cryptocurrencies—as both commodities and securities. This has caused confusion, raising questions over how much tax should be paid on cryptocurrency transactions. Even more, the SEC has cracked down on anything ICO-related, most recently throwing down a $100 million gauntlet on messaging platform Kik for running an “unregistered security offering.”

Facebook bets big on blockchain

This is where Facebook steps in.

Facebook has been actively investing in blockchain. It has reportedly hired 100 staff to work on Libra coin, including nabbing two of Coinbase’s former compliance managers in May. It has acquired companies including blockchain startup Chainspace, a company focused on building smart contracts, and has been having lunch with the Governor of the Bank of England to understand the country’s thoughts on the matter.

According to the New York Times’ Nathaniel Popper, Facebook has also been looking for VCs to pour as much as $1 billion into Libra coin—although this money might be used as collateral rather than pure investment. Still, if these funds are raised, it puts a lot of financial pressure on Facebook to ensure that the project succeeds. It’s also trying to rope in other companies to help the coin work.

The Information writes that Facebook will offer companies the opportunity to act as validator nodes, for a princely $10 million a pop. Presumably, these companies will gain something from this, either in the way of data collection or some kind of fee. Libra coin will reportedly have free transactions within Facebook-owned platforms but there could be fees outside of them.

While all this seems like a big bet on an industry famed for exaggerating its potential, Facebook has done the maths. Mobile payments are big business. In China, the mobile payments market is worth a trillion dollars thanks to the ongoing battle between Alibaba and WeChat. Barclays analyst Ross Sandler has suggested Libra coin could bring Facebook as much as $19 billion in new revenue by 2021.

But despite all of this, if there isn’t regulatory clarity, then Facebook will have its hands tied and be unable to bring its cryptocurrency to its massive user base.

But if anyone can do it, Facebook can.

Building a lobbying army

Despite the scandal that rocked the company in 2017 and the repeated testimonies made to Congress, Facebook has continued to see its revenue grow. In the first quarter, this year, it brought in $15.08 billion in revenue, up 26 percent year-over-year. During 2018, it brought in $56 billion, a 37 percent increase from 2017. It now has $44 billion sitting in the bank.

And it’s likely that Facebook will use this money to encourage crypto friendly legislation and guidance to be made quickly—especially with Libra coin slated to be launched in 2020.

Facebook has long advocated for its own causes, both to the general public and to legislators. Last year, it set records—alongside Google and Amazon—for lobbying spending, showing just how influencing governments is on its agenda. This was not surprising considering how much attention has been put on Facebook since the Cambridge Analytica scandal broke.

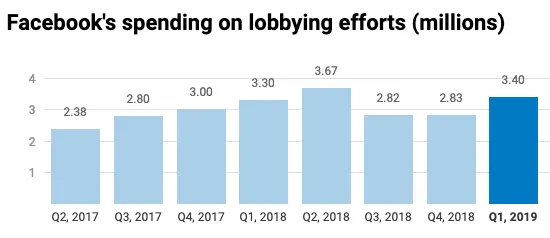

In 2018, Facebook spent nearly $13 million on lobbying efforts, up from $11.5 million in 2017. In the first quarter of this year, it shelled out $3.4 million. The graph below shows spending on lobbying per quarter for the last two years.

Facebook has recently beefed up its lobbying efforts, hiring former U.K. deputy Prime Minister Sir Nick Clegg as its head of global affairs. The heavy focus on lobbying by Facebook and other tech giants led the Washington Post to describe this new force as a “lobbying army”.

The extent to which Facebook is prepared to lobby on behalf of its own interests, was revealed by The Guardian in March. It claimed Facebook had promised investments and incentives to politicians around the world, including the former UK chancellor, George Osborne, for them to act in Facebook’s interests. The company even went so far as to threaten to withhold investment from the countries if they failed to comply, the report claims. While this may not be the most ethical strategy, it appears to be effective.

With an army of lobbyists behind them, a ton of money riding on Libra coin, a war chest in the bank, and a lot of money to be made, expect Facebook to lead the charge for succinct and positive crypto regulation. Love them or hate them, crypto needs Facebook to win the regulatory fight.