In brief

- Bitcoin could see its dominance decline over the next decade, according to Citi.

- An analyst at the investment bank argues that Bitcoin's value will be "affected by the usefulness of other cryptocurrencies."

While the digital asset industry is set to grow as a whole, Bitcoin could see its dominance decline over the next decade, according to an analyst at investment bank Citi.

“Bitcoin’s value is going to be buffeted, is going to be affected by the usefulness of other cryptocurrencies,” Ronit Ghose, global head of banks at Citi, told Decrypt.

Ghose’s comments come on the heels of Citi’s newly released "Future of Money" report. The report analyses how cryptocurrencies and fiat money might evolve in the future, and how Bitcoin should be valued.

The report states that Bitcoin has a different value as a payment mechanism than as a store of value like gold. And if it becomes a widely used payments network, this could be far more valuable than simply storing wealth.

“The ability to move value, whether it’s in large sums, as a financial asset, or in small sums, as a payment for a good or a service, that creates the value,” said Ghose.

Bitcoin's payment problem

The problem is that Bitcoin isn’t widely used for everyday payments. Ghose acknowledged that it has found some use in emerging nations, or where payments infrastructure is still lacking, but that it’s not typically used to buy everyday items. And not only is Bitcoin relatively slow and expensive to use, there’s a catch-22: if its value constantly rises, people might be unwilling to spend their coins.

For this reason, he argued that there are two alternatives that might disrupt Bitcoin’s market share for digital payments. First, he pointed to alternative cryptocurrencies like Ethereum and Polkadot, which offer faster payments and programmability through smart contracts. Second, he said that the emergence of central bank digital currencies (CBDCs) might provide a way to spend money seamlessly without the volatility of cryptocurrencies.

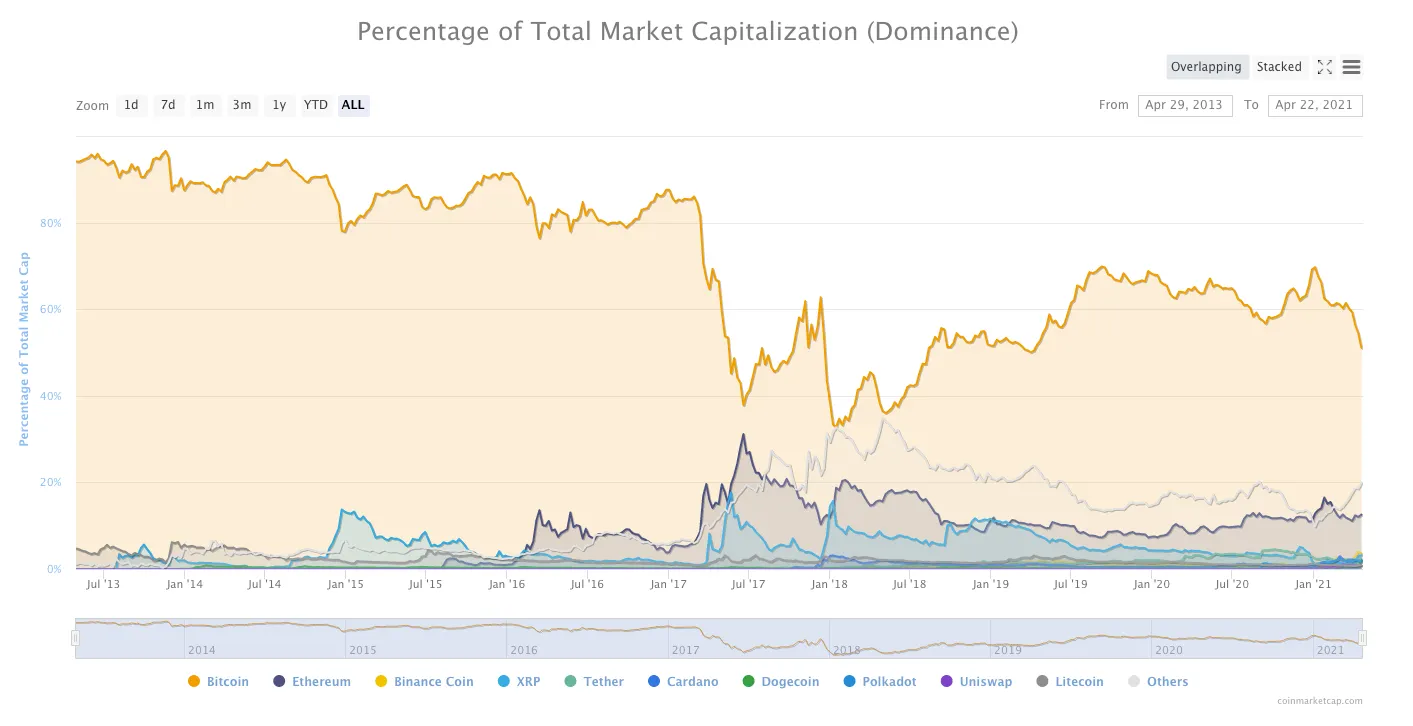

Ghose said there’s a lot of money sitting in electronic formats, waiting to be turned into digital currency—but it’s hard to know if that will move to Bitcoin. “Relatively it’s possible that Bitcoin could grow slower than some of the next generation,” Ghose said.

On the other hand, Ghose acknowledged that the difference between CBDCs and decentralized currencies like Bitcoin is the level of decentralization. He said that CBDCs, in theory, could be used in a dystopian way, with governments potentially able to alter their citizens’ balances depending on how they’re designed. But with decentralized currencies, that’s not an option—and this gives Bitcoin a different kind of value, one that’s hard to define. He noted, “Bitcoin’s use case is somewhat less prosaic, somewhat more conceptual.”