The crypto market has bounced back. Prices have been building up steadily this month with Bitcoin leading the way—on its journey back to having a $100 billion market cap. And in turn, trading volumes have returned as traders look to make a quick buck on the rising fortunes.

A report—obtained by Decrypt—by independent crypto analyst TokenInsight—which has investment from venture capitalist Tim Draper—reveals that trading volume on three major crypto exchanges rose by 30 percent in Q1, this year.

Independent crypto analyst TokenInsight says that trading volume on three major crypto exchanges rose by 30 percent in Q1, according to a new report provided to Decrypt. This matches similar movement in the Bitcoin over-the-counter market (where large institutions trade Bitcoin) which rose significantly this quarter, according to Binance CFO Wei Zhou.

While trading volumes are not the most reliable source of information—as Decrypt reported recently—the overall picture seems to show renewed growth in the crypto market.

According to the report by the Palo Alto-based firm: “The trading volume of Binance, OKEx and Huobi Global increased by more than 30%, while Coinbase Pro, Bitfinex and other exchanges did not change significantly from January to March.”

What tokens have been leading the charge?

Crypto exchange tokens rose 244% on average

A growing trend this quarter has been “initial-exchange offerings,” where currency exchanges run an ICO for a favored startup’s project. Binance has been one of the early adopters of this approach, with its BitTorrent token sale having raised $7 million, and selling out in 15 minutes. These token sales often involve the use of the exchange’s native token—increasing use of the token.

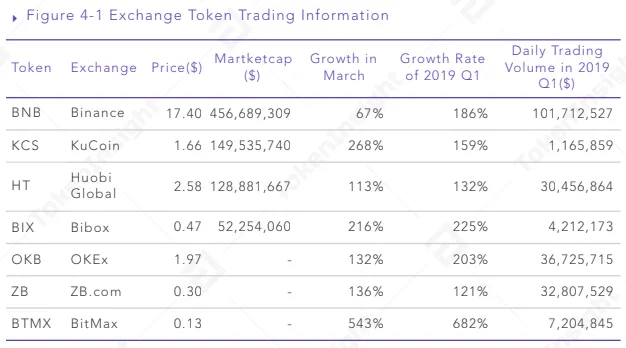

As a result, native tokens belonging to crypto exchanges have experienced solid growth across the board.

Bibox token rose 225 percent in Q1, with OKEx’s token OKB up 203 percent. Binance’s native coin BNB has also enjoyed strong growth, but this was partly due to its quarterly price burns. On top of all this, BitMax token is up a whopping 682 percent but this may be due to low volumes which can easily inflate numbers.

“At present, the exchanges are no longer staying in the secondary market, and are striving for the primary market,” says TokenInsight.

Furthermore, with the rise of initial-exchange offerings, gone are the days when all of the exchange’s native coins are Ethereum-based tokens. On Tuesday this week, Binance released the mainnet for its Binance Chain, whose native asset is BNB. The exchange will be using this chain for launching new token offerings—further increasing the use of BNB.

The report notes that OKEx and Gate.io are similarly planning to issue blockchains of their own.

At a time when crypto exchanges are seen as having too much power, and are kingpins of their own, perhaps this is a sign that their influence over the crypto market is only growing stronger.