In brief

- Bitcoin lending firm BlockFi has raised $350 million in a Series D funding round.

- It's BlockFi's largest round to date, valuing the company at $3 billion.

Bitcoin lending firm BlockFi has raised $350 million in its largest funding round to date, according to a press release. The Series D fundraising round will help the firm to continue its core product offerings of high interest earning accounts.

New investors led this wave of funding, namely asset management firm Bain Capital Ventures, partners of investment firm DST Global, Pomp Investments—owned by Morgan Creek Digital partner Anthony Pompliano—and investment firm Tiger Global. The round follows three previous funding rounds, which added up to $100 million.

“We are in the early innings of retail and institutional crypto adoption; as demand grows, we see an enormous opportunity for crypto companies to offer a suite of sophisticated, scalable financial services to engage and empower clients,” said Stefan Cohen, partner at Bain Capital Ventures.

BlockFi’s main business is offering high yields on cryptocurrencies, both volatile ones like Bitcoin (BTC) and stablecoins like Tether (USDT). It offers 6% APY on Bitcoin and 9.3% on Tether.

BlockFi is also rapidly expanding. The firm recently launched its trading desk for institutional investors and is rolling out its Bitcoin rewards credit card across the US. It now has 225,000 customers, according to the release (although BlockFi CEO Zac Prince told Decrypt in December that it had more than 300,000 customers).

How does BlockFi generate yield?

Bitcoin lending firms pay high yields to those letting them look after their cryptocurrencies. But it’s important to know where the yield is coming from—and whether it’s safe.

“The yield comes from our lending activities. On the dollar side, we lend to both retail and institutions. On the crypto side, we lend to just institutions,” BlockFi CEO Zac Prince told Decrypt, in a previous interview.

BlockFi lends cryptocurrency in the spot crypto market, it lends physical Bitcoin to institutions and it’s active in the securities lending market for the GBTC. The firm owns 36.1 million shares ($1.8 billion) in the Grayscale Bitcoin Trust (GBTC), a popular vehicle for institutional investors to get exposure to the price of Bitcoin.

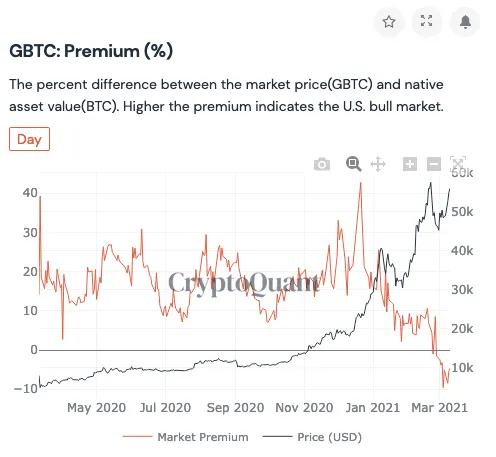

One way that institutions, particularly hedge funds, make money from GBTC is by capturing the Grayscale premium—this is the difference between the price of the shares on the market and the value of the Bitcoin underlying each share. For a long time this premium was positive, enabling this arbitrage opportunity. Recently, however, the premium has turned negative—falling as low as -9.5%, according to data provider CryptoQuant.

With the arbitrage opportunity gone—at least temporarily—this led to some concerns that BlockFi might not be able to generate enough yield. In response, BlockFi CEO Zac Prince tweeted, “We sized our activity there appropriately and always expected volatility in the premium / discount. It’s actually creating a new interesting [arbitrage] opportunity for some of our institutional clients now. Just another dynamic aspect of crypto markets!”