In brief

- The total number of Bitcoin on exchanges has started dropping again recently.

- This trend indicates that Bitcoiners are holding their assets for the long term.

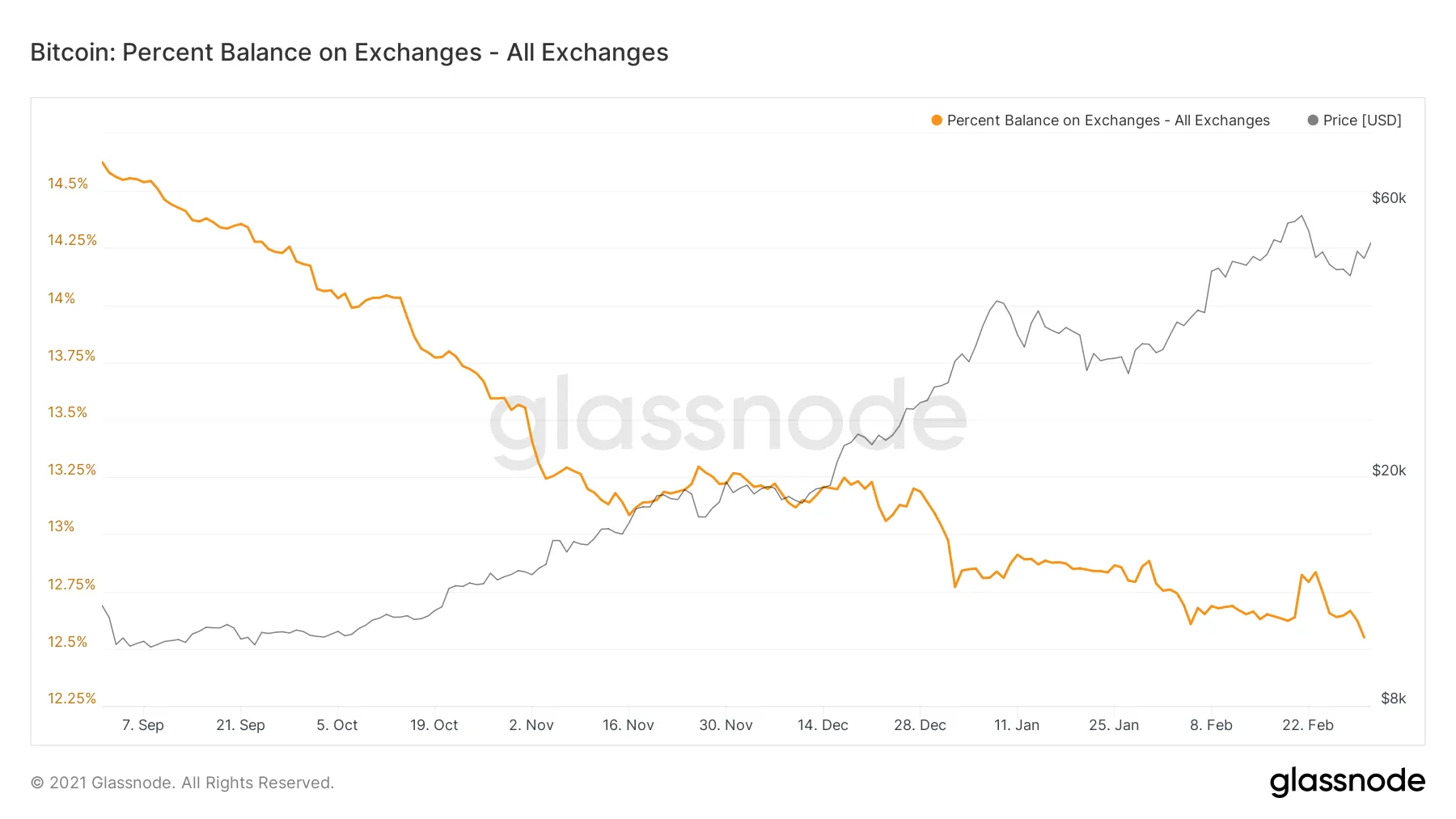

The total number of Bitcoin on exchanges is starting to fall more steeply, having gradually declined since the start of 2021, according to data from data analytics website Glassnode.

Knowing how much Bitcoin is held on exchanges can tell us a lot about the current state of the Bitcoin market, as well as give us insights into what Bitcoin investors are thinking. If Bitcoin is coming off exchanges en masse, it tends to imply that investors are saving their holdings for the long term instead of looking to trade for short-term gains.

“The data clearly shows an asset that is in high demand and one that appears to have the confidence of traders, further implying that resale of the newly acquired Bitcoin is not on the table in the short term,” Jason Deane, Bitcoin analyst at market analysis company Quantum Economics, told Decrypt.

Between February 23 and March 2, there was a 2% decline in Bitcoin held on exchanges. This corresponds to 52,900 Bitcoin ($2.7 billion) being removed from exchanges. This continues a year long downward trend as more Bitcoin continues to get sucked off exchanges into long-term storage.

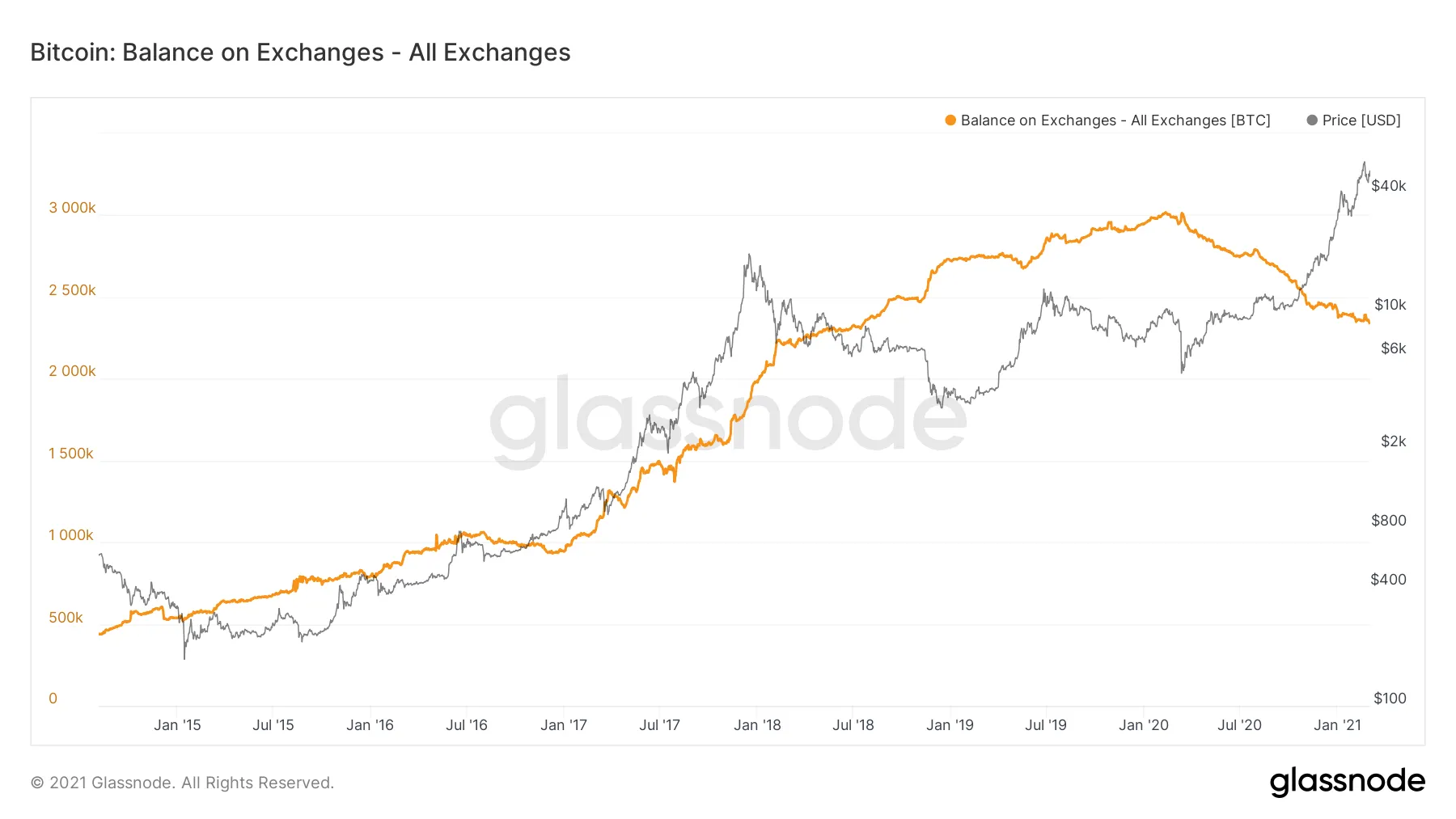

There is now 2.3 million Bitcoin remaining on exchanges, the lowest amount since July 2018, when Bitcoin was worth about $7,400.

“The continued removal of Bitcoin from exchanges would appear to indicate that ‘buy and hold’ is a prevalent sentiment among investors,” Deane added.

This downward trend is going against the grain of history. For most of Bitcoin’s existence, the total amount of Bitcoin held on exchanges had been increasing. According to Glassnode data, Bitcoin held on exchanges generally increased between August 2014 all the way up to March of 2020.

But in March 2020, this historical trend changed course, and Bitcoin has mostly been flowing off of exchanges ever since. Part of this can be attributed to Bitcoin’s growing popularity during the wake of the COVID-19 pandemic. However, during the last 12 months, many large institutions like MicroStrategy, Square and Tesla have bought massive amounts of Bitcoin to keep in offline storage, exaggerating the trend.