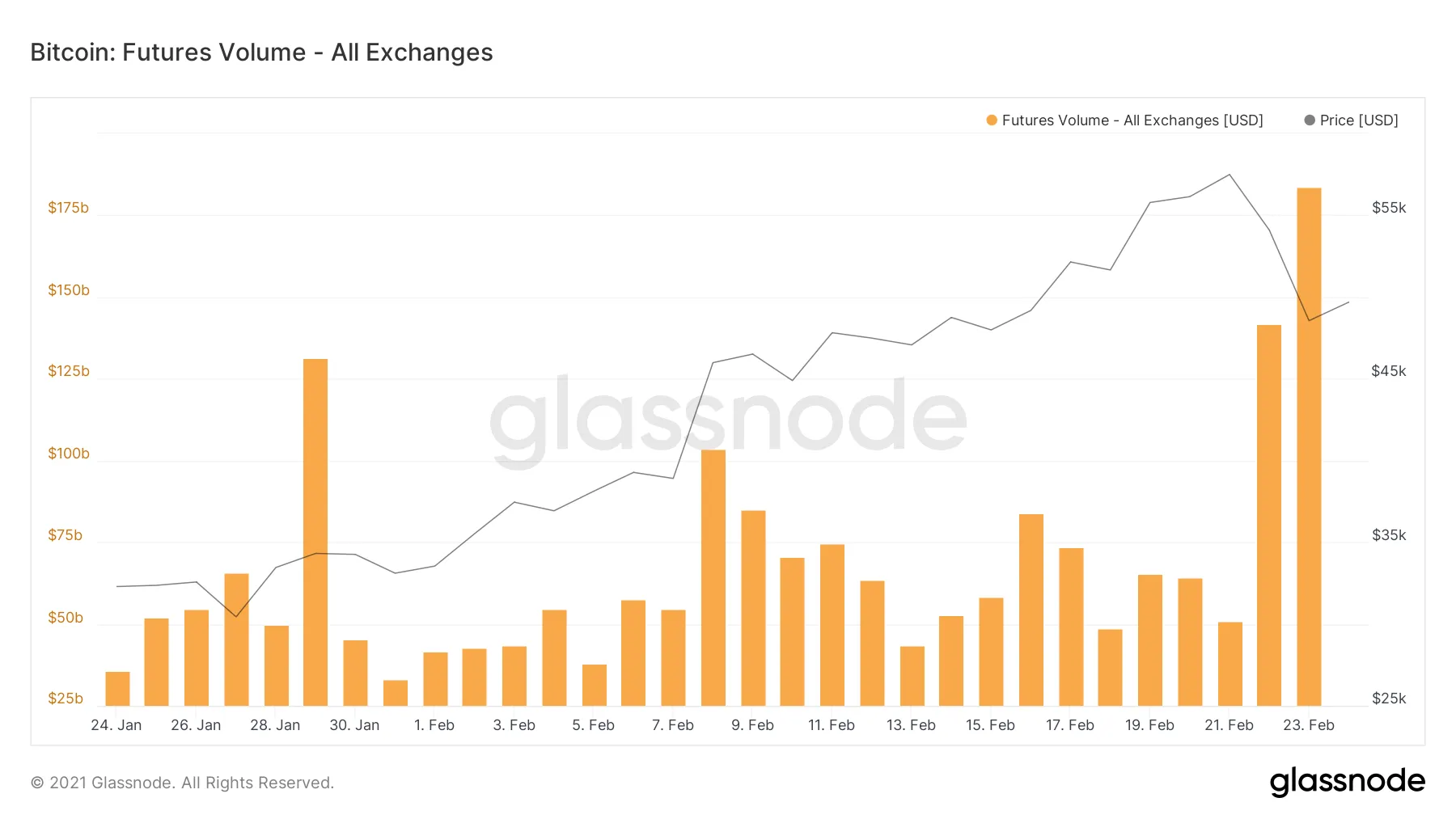

The total daily trading volume on various Bitcoin (BTC) futures markets has reached a new all-time high of $180 billion, crypto analytics platform Glassnode pointed out today. This comes as the price of Bitcoin has dropped below the $50,000 mark in the last few days, currently at $49,840.

Futures are a type of financial derivatives where parties agree to sell/buy an asset at a specific price on a set date. Unlike options contracts, where buyers might choose to not purchase the asset, futures are contractually binding and must be settled on the expiration date.

According to the chart, Bitcoin futures trading volumes have been steadily growing since last November, with several massive spikes that corresponded with Bitcoin’s big price swings.

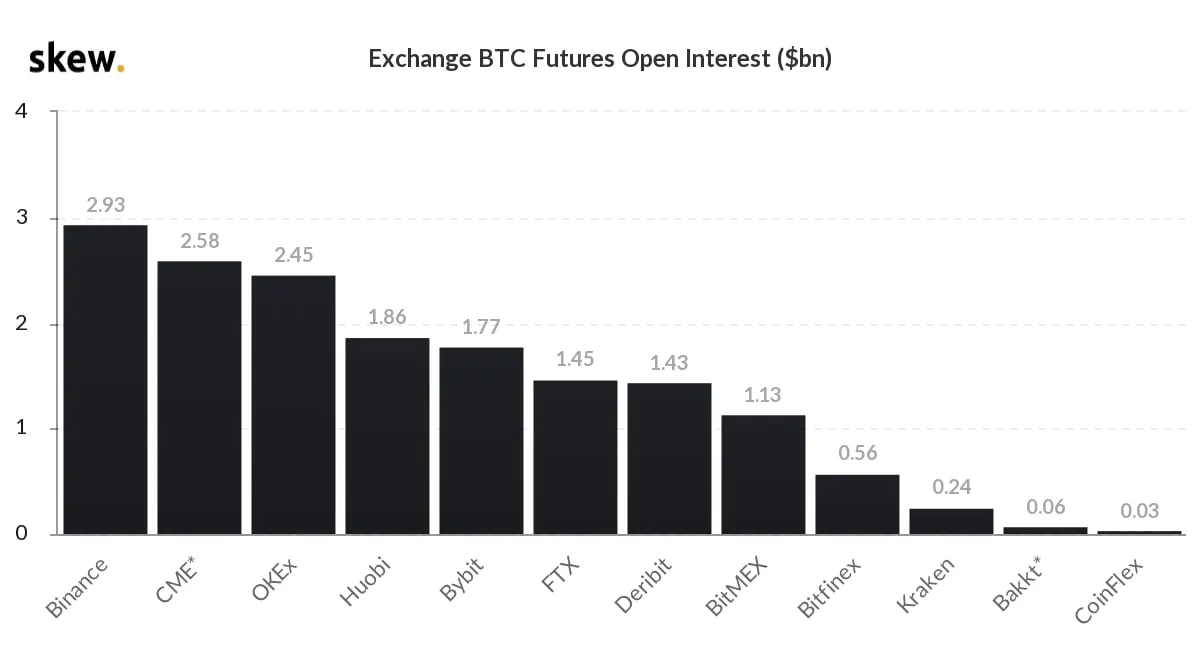

At press time, the open interest (the combined value of all unsettled contracts) on Bitcoin futures platforms amounts to roughly $16.5 billion, according to crypto derivatives metrics platform Skew.

Binance is leading among the set of crypto exchanges with $2.93 billion in Bitcoin futures open interest. It is followed by CME ($2.58 billion), OKEx ($2.45 billion), and Huobi ($1.86 billion).

At the same time, the funding rate of perpetual Bitcoin futures is trending down and has reached its lowest levels in nearly a month, Glassnode added.

The funding rate is a small fee that one party of a perpetual contract periodically pays the other. A positive funding rate means that longs pay shorts while a negative one means the opposite. Typically, funding rates tend to be positive in bull markets and negative during bear markets, according to crypto exchange Kraken—but it’s not a definitive indicator.