In brief

- A CryptoPunk sold this morning for over $136,000.

- The sector has experienced massive growth in the past year.

- However, not everyone is impressed by the overpriced NFTs.

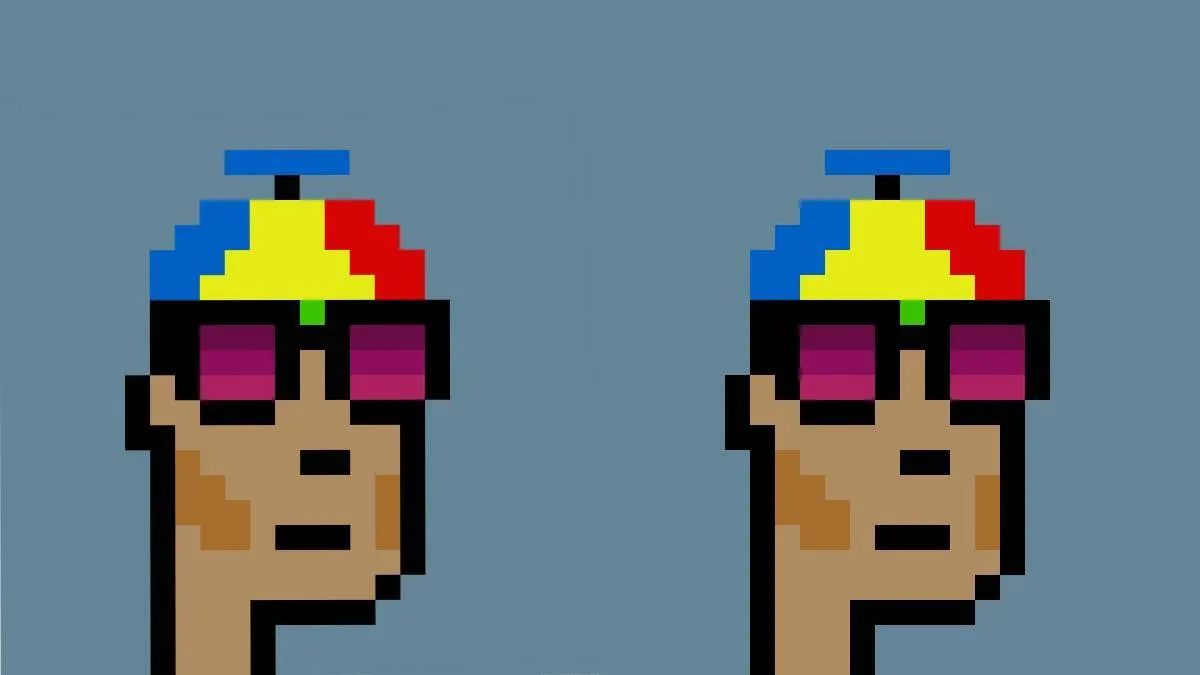

A pixelated picture of a male “punk” sold for over 78 ETH (≈$136,000) this morning, as per a tweet by Ethereum-based digital art app CryptoPunks. The sale is just the latest sign of the increasing popularity of the non-fungible token (NFT) market, one that has gained lots of steam in the past year.

NFTs are a cryptographic representation of tangible or intangible items on the blockchain. They represent ownership of whichever asset they are linked to (this can be real estate, art, comic books, or just about anything). But all focus is on punks—the original NFT.

Called the “Punk #1651,” the six-figure CryptoPunk features punk rock-styled facial sideburns, maroon sunglasses, and a rainbow hat. It is one of 6039 male punks (out of the total of 10,000)—a rare commodity in NFT circles.

Punk #1651 was claimed for free by 0x0ed6fe (the previous owner) in 2017. They seemed to have rejected multiple bids for the art piece for $14 and $54,000 in the years since, before finally selling it this morning.

The great big punk market

This morning, “Pranksy NFT,” a popular, anonymous collector of digital art, bid over $500,000 on Punk #4156—one that didn’t even feature sideburns or a beanie. If this bid is accepted, it would become one of the largest NFT sales ever.

The big money bids don’t end there. Last month saw Punk #2890 sell for over 605 ETH, or over $760,000 then. Some market participants heralded the sale at the time, but some others were more skeptical, stating the punks were simply being bid at a high price to generate hype for the project.

Buyers, however, aren't shying away yet. Data from CryptoPunks shows that the cheapest punk on the open market is selling for over 9.48 ETH (≈17,188), or the price of an average sedan.

Is it sustainable?

Such sales are a big step for the relatively small NFT sector, which accounts for less than 2% of the entire crypto market. NFTs accounted for less than $50 million in sales in 2019, but 2020 saw over $250 million in total sales. The hype increased even further in 2021, with data showing over $100 million worth of NFT art exchanged hands in the past 30 days alone.

Not everyone is sold on the promise, however. Litecoin creator Charlie Lee criticized the NFT market in a tweet yesterday, stating that unlike real-world art, NFTs take little-to-no effort or money to issue.

Even some NFT proponents are now criticizing the huge sums involved. Piers Kicks, head of gaming at crypto research firm Delphi Digital (which picked up over $162,000 worth of digital art last year), told Decrypt that the astronomical prices of some NFTs were making them unattractive to newcomers, and that there seemed to be a large overlap in the players of these high-stakes signaling games.

He stated that the main draw of CryptoPunks, for now, was their historical collectability as they were the first-ever NFTs on Ethereum. But it’s a point that loses significance in the long-term: “How many people know who Tim Berners-Lee is or what the ARPANET was?” Kicks said, referring to the relatively low fame of the World Wide Web inventor among the younger populations.

He added, “Very few people actually care about their digital heritage. In 10 years, when there are billions of NFTs, even CryptoPunks could well be lost in the void.”

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.