In brief

- Proper institutional adoption of cryptocurrencies hinges upon four key barriers.

- Insufficient market capitalization was identified as the major barrier.

- Despite all the challenges, institutional investors are still getting involved.

When BlackRock filed two statements with the SEC yesterday, opening the possibility for two of its funds to start engaging in Bitcoin futures trading, it highlighted one key issue: a lack of liquidity.

And a new report published today seems to confirm exactly that worry.

According to a new report by advisory firm Aite Group and investment platform eToro, the key barrier to wider participation in the crypto ecosystem is the lack of liquidity. This comes alongside other barriers, such as regulatory uncertainty, immature market infrastructure, and concerns over reputational risk and security issues.

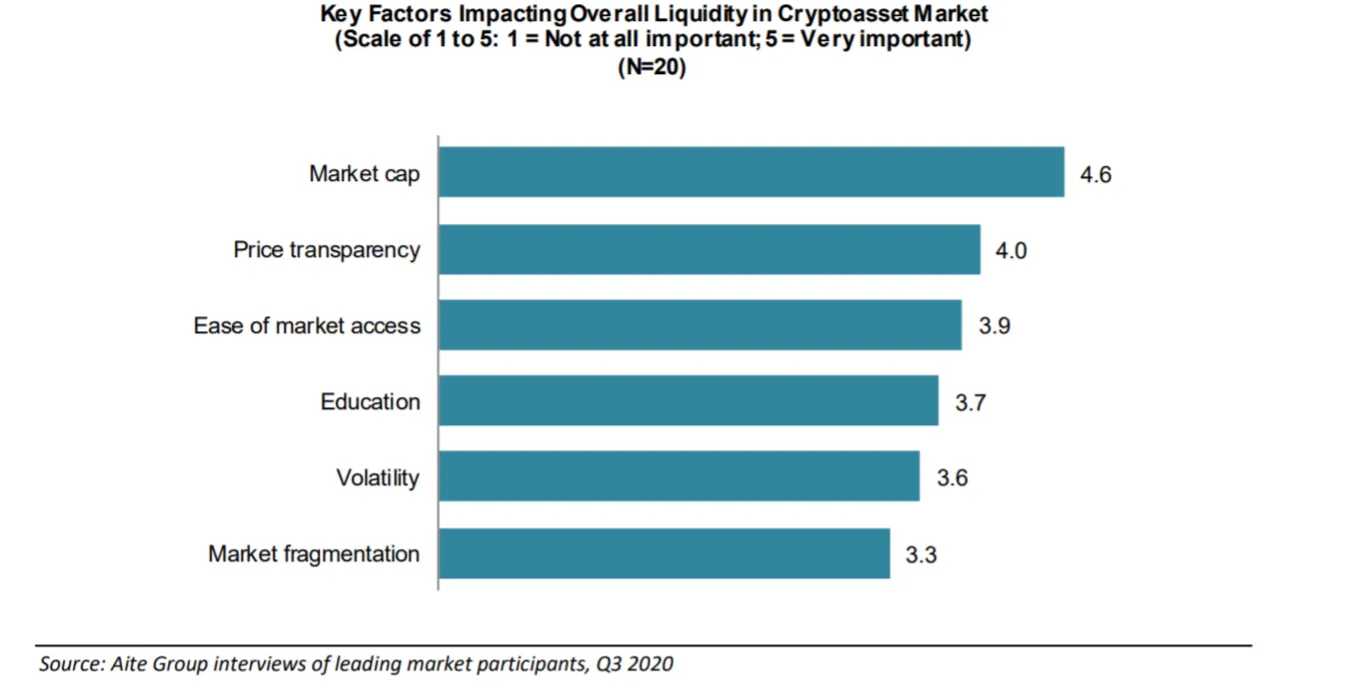

“A high degree of liquidity is a good indicator that the market structure has matured for a particular instrument. Respondents note that when considering various factors that can positively impact overall liquidity in the crypto asset market, market cap came out on top with an average score of 4.6 out of 5,” said the report.

The researchers conducted in-depth interviews with 25 institutional market participants. Overall, market cap is a “very important” factor for institutional participation for 56% of respondents, with 28% more calling it “important.”

The survey also highlighted price transparency as another important aspect for the growth of the cryptocurrency market. The general consensus is that the overall reliability and accessibility of prices will help traders continue to engage in the highly volatile market.

While liquidity providers tend to believe that price volatility and market fragmentation help attract more investors and thus contribute to the overall market’s liquidity, traditional financial institutions and asset managers see volatility and market fragmentation as deterrents to a larger participation and increased liquidity.

The survey results also demonstrate that regulatory uncertainty, immature market infrastructure, and concerns over reputational risk and security issues are among other major impediments to further growth of the crypto market.

“After years of hesitation driven by regulatory uncertainty and reputational risk, most of the traditional institutional market participants have been sitting on the sidelines, and many interview respondents of all types mention that there is limited first-mover advantage in this space from an institutional participant perspective,” said the researchers. ”The ups and downs of the last three years, such as industry scandals, crashing market value, and high market volatility seem to validate that position.”

Development of a standardized global regulatory regime is specifically pointed to as the most urgent and necessary step since even common terminology for cryptocurrency is not determined yet. “Virtual currency” might be the most common term among the regulators, but other terms include virtual assets, electronic currency, digital currency, or digital financial asset.

The good news, however, is that despite all the above mentioned concerns and a relative insignificance of the crypto market capitalization (even though it recently crossed $1 trillion), traditional firms are seeking to gain first-mover advantage and are getting stuck in.

According to the analysts, “an unprecedented long period of quantitative easing around the globe and the COVID-19 pandemic and commensurate response by central banks, on top of the ongoing search for alternative sources of yield, are certainly contributing to strong interest in bitcoin and, subsequently, cryptoassets more widely.”

No wonder BlackRock is getting involved.