In brief

- Crypto markets recovered slightly from Wednesday's sell off.

- But older Bitcoin continues to enter the marketplace as long-term HODLers cash out.

- Stock markets are flat after the US government still hasn't agreed on a stimulus package.

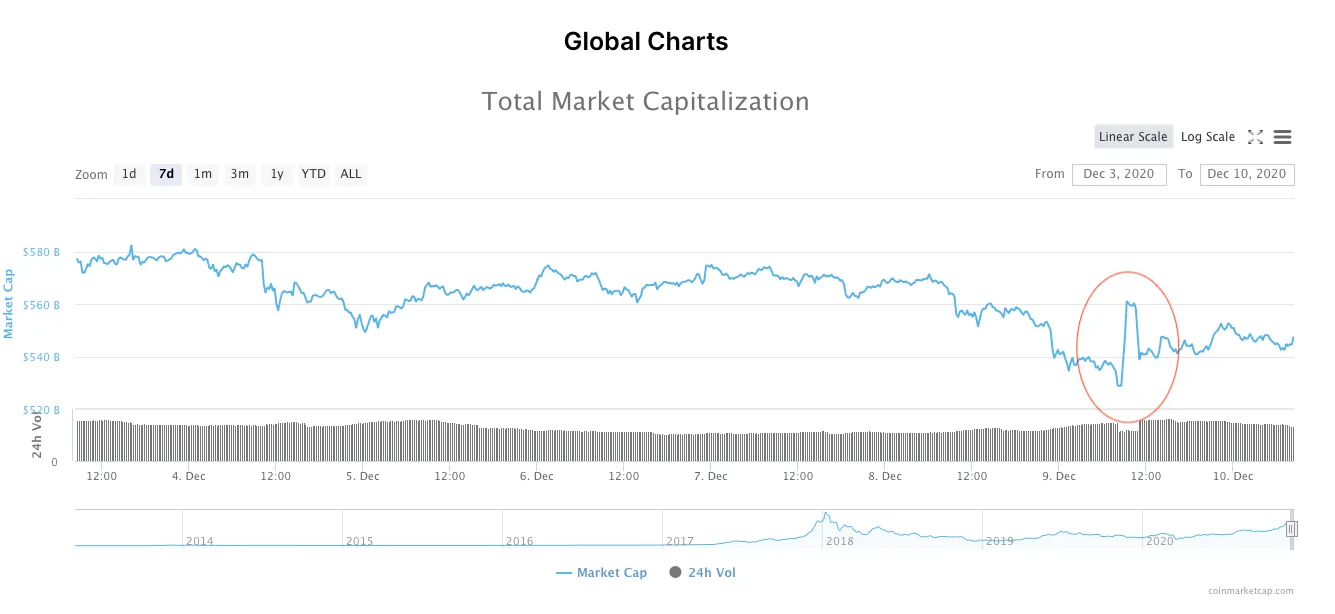

If you’re a chart reader (which we assume you are) you’ll know if a chart suddenly shoots all the way up and then all the way down, there’s something not quite right.

For traders using CoinMarketCap’s data yesterday, that’s exactly what happened. Within an hour, crypto market cap, according to the data provider, shot up from $528 billion to $561 billion. It stayed briefly before plummeting back down to the $540 billion range.

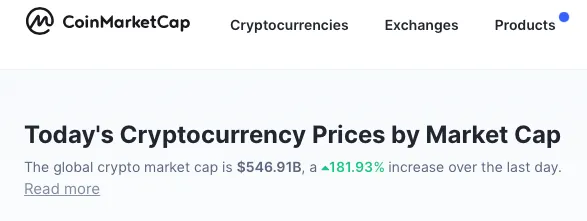

Great! You might have thought, the bulls are back. And indeed, looking at this chart, you could be right, as the blip says global market cap surged by 181%, which has never happened before.

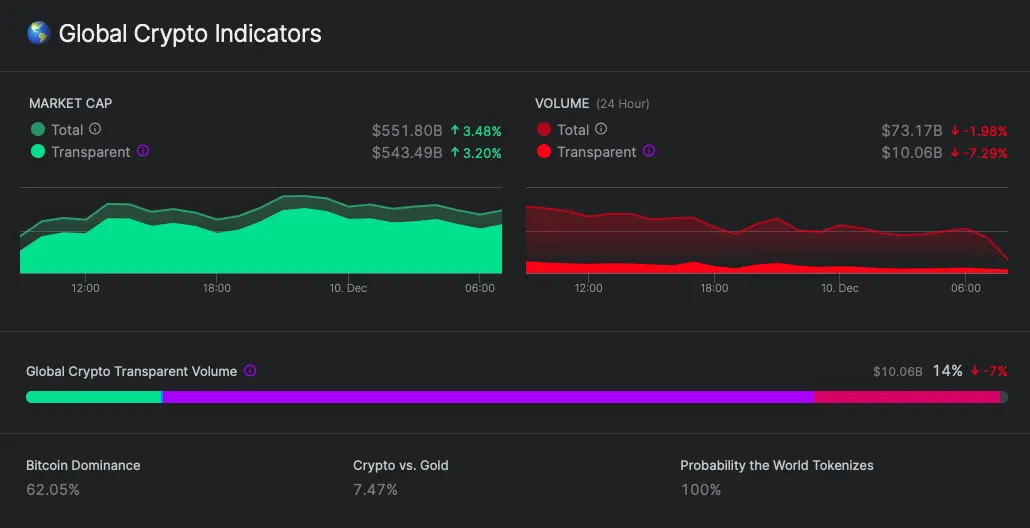

But not all charts are created equally. Heading over to data company Nomics, its data tells a very different story.

Global market cap was up yesterday, but by 3.48%, not 180%. Data always comes with quirks, and thankfully, no damage was caused by the up and down data points. But here at Market Watch, we’re subscribers of the mantra, check, check, then check again before putting your life savings on crypto. Anyway, on with the show.

Bitcoin picked up the pace yesterday, recovering most of its losses from the day before’s sudden market drop. Trading and fiat volumes were both down sharply too yesterday as it appears the sudden sell-off has passed. But there was something interesting about who was selling yesterday.

As Bitcoin has been flirting with the $20,000s, the amount of ‘old’ Bitcoin being sold has been shooting up. Bitcoin Coin Days Destroyed is a metric that measures when dormant Bitcoin is sold. The older, and the greater amount of Bitcoin, the higher the metric goes.

Over the last few weeks, the amount of old BTC has gone up 162%, suggesting those who have been in the game for a long time are ready to enjoy the fruits of their HODLing labour. For everyone else waiting for higher prices, you’re not alone.

Institutional investors continue their slow march into Bitcoin, with BIGG Digital Assets adding $3.6 million worth of the cryptocurrency to its long-term holdings.

Elsewhere in the crypto markets, currencies are still correcting, with Ethereum down 6.35%, Ripple 6%, Litecoin 11.8% and nearly every other project in the top 20 seeing losses. The only gains yesterday came from NEM up 5.2%, Monero up 3.2% and stablecoins USD Coin (up 2.91%) and Tether (up 5%).

Markets split over stimulus package as new tech stocks boom

It’s the financial world’s biggest will they/won’t they, and as of yesterday, it’s looking more like they won’t. We’re of course talking about the US government’s much spoken about stimulus package.

Futures markets were in a huff as Republicans and Democrats still don’t agree on how much the stimulus package should be for and who should get it. The S&P 500 was down, and the Nasdaq suffered a 2% drop after Facebook became the target of an FTC antitrust lawsuit filed yesterday.

But despite Wednesday’s stock market slump, DoorDash debuted its IPO 78% above its initial public offering price of $102 per share.

Airbnb is set to follow as its shares go live on the Nasdaq today. The company said in a filing earlier this week it was targeting raising up tp $3.1 billion in an IPO to give the company a fully diluted valuation of about $42 billion.

Sponsored post by AAX

Learn More about partnering with Decrypt.