In brief

- Nearly 80,000 Bitcoin options contracts are set to expire today.

- This could lead to an increase in the volatility of Bitcoin's price.

- Bitcoin's price is recovering from a recent market crash.

Around 78,000 Bitcoin (BTC) options contracts, worth around $1.3 billion at current prices, will expire today, according to crypto analytics platform Skew.

78k #bitcoin options expiring today, ~$1.3bln notional pic.twitter.com/THIhj1rLBC

— skew (@skewdotcom) November 27, 2020

Options contracts give buyers the right—but not the obligation—to purchase assets at a specified price on a set date in the future, for which they pay sellers a “premium.” If the asset’s price is higher than the agreed price on the expiration date, buyers can execute the contract and receive profit, or refuse and lose the paid premium.

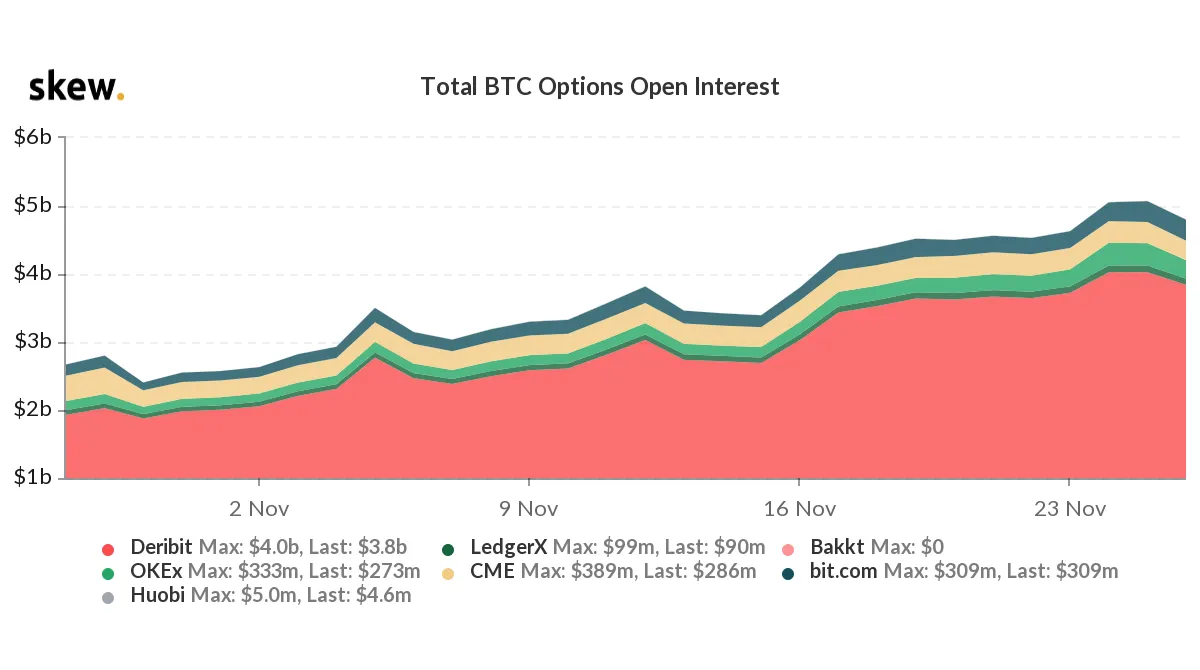

At press time, the total Bitcoin options open interest amounts to $5 billion, signifying an increase of nearly 100% in just one month. According to Skew’s data, the open interest hovered at around $2.7 billion on October 31.

Bitcoin was trading at roughly $13,500 per coin in early November, surging to over $19,000 in the last couple of days. This means that an increase in the open interest is partly due to the growth of Bitcoin’s price.

Unregulated crypto derivatives platform Deribit is still leading in terms of total BTC options open interest with $3.8 billion worth of outstanding contracts, according to Skew’s charts. In comparison, institutional investors-focused CME has $286 million in BTC contracts while OKEx and Bit.com have $273 million and $309 million respectively.

Judging by how BTC options are distributed among various platforms, hedge funds and retail investors still make up the bulk of BTC options activity.

“I would say that for institutional investors, one will have to track volume growth on CME. Deribit will mostly be crypto hedge funds and retail investors,” Bobby Ong, COO of crypto analytics platform CoinGecko, told Decrypt.

Over the past month, the total BTC options open interest on Deribit surged from $2 billion on November 1 to $4 billion on November 25, according to Skew’s data. In contrast, CME saw an increase in its open interest from $247 million to $286 million during the same time.

When such a large volume of Bitcoin options expires in one day, it could lead to an increase in the volatility of its price.

“Every last week of the month as Bitcoin monthly options expire, we tend to see wild swings in Bitcoin prices and this month is no different,” Ong added.

Although what could be more volatile than a $3,000 drop?