In brief

- Bitcoin Futures have been booming recently, reaching more than $50 billion.

- Fiat investors often prefer futures contracts as they're a tool more akin to what traders use elsewhere.

- Futures contracts allow investors to profit even when the market is in decline.

Over the last few weeks, all eyes have been on Bitcoin’s market capitalization. And while that’s been no doubt impressive, harking back to the all-time-high days of 2018, there’s another part of Bitcoin’s resurgence that doesn’t garner the same attention.

Bitcoin Futures, bets on where the price of Bitcoin will head next, is having an increasingly larger impact on the way Bitcoin is bought, sold and held. Just last week, the global Bitcoin futures market hit a six-month high of $52 billion.

That’s up from $4.5 billion recorded on October 18, or a huge 1,055% increase over the last month. In today’s Market Watch, we’ll be taking you through why futures have become so important to investors, why all futures aren’t created equally, and what they mean for the future of the Bitcoin ecosystem.

What is futures trading?

First, it’s important to understand what we mean by futures trading. As a first distinction, spot trading is what most people who invest in crypto do right now. They buy or sell a cryptocurrency at the price it is at that moment. This is a spot trade.

A futures trade, or a futures contract, is an agreement between a buyer and a seller - there has to be both in order for a contract to be agreed upon - to speculate on what the price of an asset might be worth in future.

So for example, if you’d taken out a futures contract in March of 2020 saying that you’d buy Bitcoin in November for $5,000, and someone agreed to sell Bitcoin at $5,000 you’d be laughing as the seller has to sell their Bitcoin at that price.

If however, you’d speculated that the price of Bitcoin would be at say $30,000 you’d have to buy that Bitcoin at that price. The added difference here is that you don’t need to take delivery of Bitcoin, or hold some yourself, because futures contracts are settled in cash, rather than the underlying asset. However, some exchanges are now offering physical delivery of Bitcoin meaning the settlement will be in the underlying asset.

There are more complexities to futures trading than that, and if you’d like to know more about it, you can read more about it in our learn guide, here.

But what’s important to point out at this point is that Bitcoin futures have become an extremely popular trading instrument, as we’ll discuss below.

Why have futures become so important?

For many institutional investors, the thought of setting up a Bitcoin wallet, and using an exchange they’re not familiar with, and then buying and holding Bitcoin is an alien experience. Plus, many companies use accounting software that is currently incompatible with the data streams spot trading crypto generates. Futures trading on the other hand, is something most investors are familiar with.

“Futures contracts have opened the doors to more traditional investors who may not be ready to allocate funds to the asset itself, but who still want to benefit from its attractive price action,” says a spokesperson from AAX, the world’s first digital asset exchange powered by the London Stock Exchange.

Because a futures contract doesn’t require ownership of or settling in the underlying asset, an investor can speculate on the price of Bitcoin without ever touching or owning it. That's extremely useful when it comes to adhering to regulation and tax receipts. There are other benefits, too.

If you’re a spot trader, Bitcoin’s volatility can be a rollercoaster ride. That’s because if the price of Bitcoin goes down, the value of your asset goes down. With futures trading however, investors can make money even if the market goes down. That’s because futures trading allows investors to ‘short’ or bet that the price of a currency goes down and profit if they’re right.

As we mentioned earlier, there is some $50 billion worth of bets currently being placed on the price of Bitcoin. When you dig into how those bets are being placed, the overwhelming majority are confident the price of Bitcoin is likely to go up, giving investors a front-row seat to market sentiment.

That sentiment tends to be an aggregate measure of everything from news about Bitcoin, who is investing in Bitcoin, what regulators feel about Bitcoin and how available Bitcoin is to buy. Futures contracts effectively act as a bellwether which in turn can create a feedback loop that pushes the spot trading price up further.

Futures trading can also be used to insulate speculators from the volatility investing in crypto can bring.

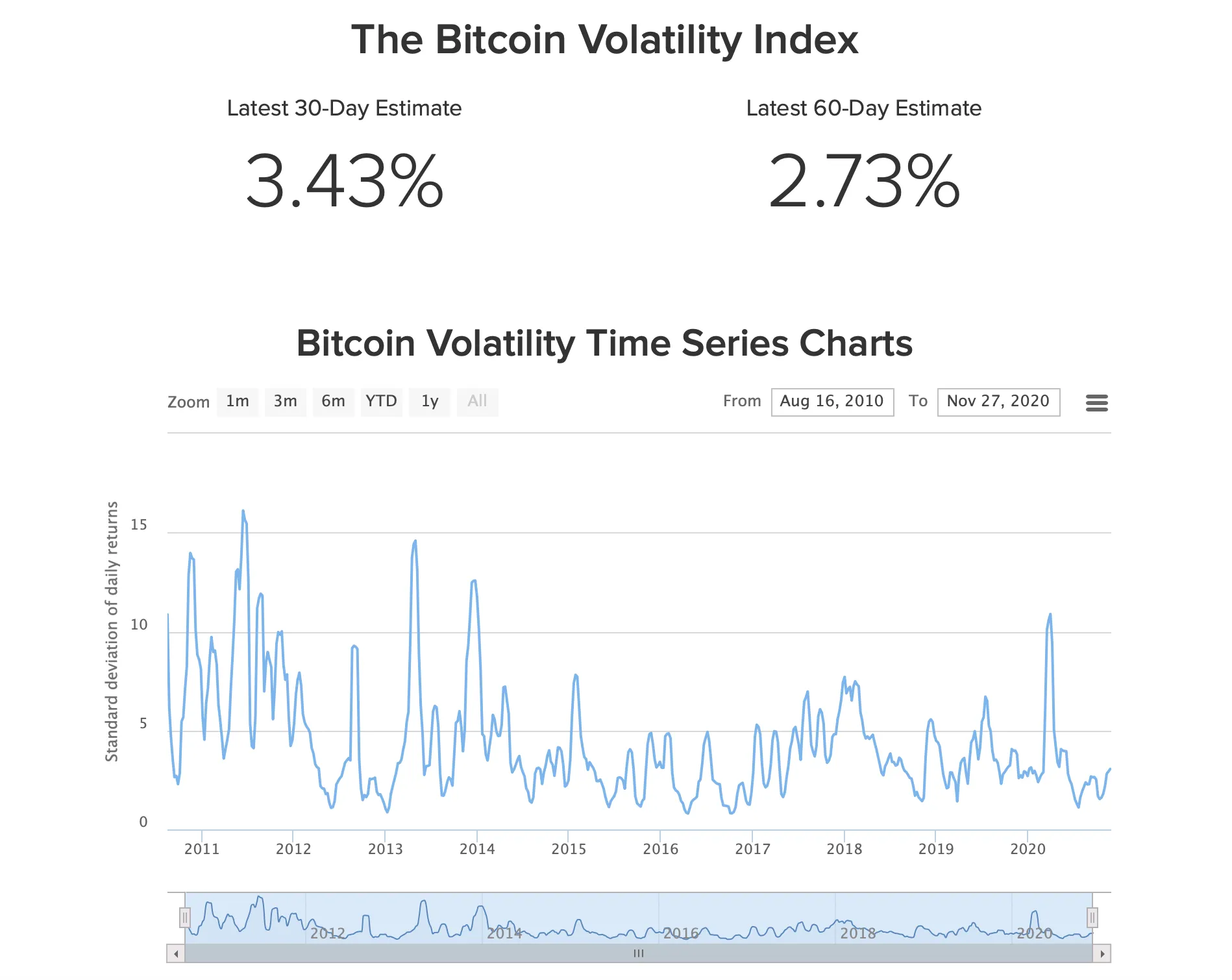

While Bitcoin’s volatility has stabilized recently, in March this year it had swings of more than 10%, which would make it too unstable for most investment portfolios. As a result, many traders hedge their bets by taking out multiple futures contracts that bet on the market moving in either direction.

Depending on their confidence in which way the markets will move, futures traders typically allocate more contracts in their favoured direction while placing few contracts the other way. If they’re right, the profits offset the contracts they placed going the other way. If they lose, it softens the losses.

“The futures market enables you to trade in all market conditions. You can make a profit in a bull market, as well as in a bear market,” says our AAX spokesperson. Futures also allow investors to amplify their profits (and their losses) through leverage.

Leverage allows an investor to put down an amount of money and gain access to a greater amount. For example, if you put in $1000, you can effectively enter the market with $100,000 in markets that offer 100x leverage.

If you enter the market with $1000 USD and close your position once the price has risen by 2%, you will have made $20 profit. If, however, you trade with a 100x leverage, that 2% would have yielded 2000 USD, doubling your initial investment.

Futures trading is important for Bitcoin because it provides an additional layer of sophistication to the underlying asset, much like you see with other assets like oil, and gold. While Bitcoin’s initial appeal lay in its simplicity, investors are increasingly looking for more nuanced tools to give them exposure to the world’s largest cryptocurrency.

The future

Futures markets have become an on-ramp for many investors to get involved in Bitcoin. Thanks to the tighter regulation that is required in order to offer futures contracts to investors - AAX being one such example - it's seen as a more investor-friendly way of getting your feet wet with crypto.

As more investors see the potential for adding Bitcoin to their portfolio, so the growth of Bitcoin futures is likely to continue. In particular, perpetual futures contracts. These are bets that have no closing dates. Instead, the contracts are kept open by charging fees. These are often preferred by investors as they don't mean they have to keep repeating the trade every week or however long the contracts are set for.

If you’re looking to get started with Bitcoin futures trading, you will need to find an exchange that lists futures contracts. AAX allows you to trade bitcoin futures in a compliant and secure environment.

Also, AAX allows you to trade with up to 100x leverage when trading Bitcoin futures. You can sign up now to get started with trading Bitcoin futures on AAX.

Brought to you by AAX

Learn More about partnering with Decrypt.