Origin Dollars' $OUSD got exploited for $5.5M in ETH, around 11,800 ETH AND $2.2M in DAI

Attack: https://t.co/opyaZY2hjs

Attacker's Address:https://t.co/fkaUqphEqx

Share, stay vigilant pic.twitter.com/xHIdP1Md63

— Krisma (@KRMA_0) November 17, 2020

$117,934.00

-0.07%$2,960.51

-0.29%$2.80

0.47%$689.00

-0.79%$161.90

-1.04%$0.999804

-0.02%$0.199106

-1.58%$0.300262

-1.50%$2,958.75

-0.40%$0.740982

3.16%$47.77

2.11%$117,699.00

-0.32%$0.433436

14.28%$3,573.50

-0.25%$3.43

-0.15%$15.28

-0.10%$506.61

-2.22%$0.227123

14.49%$21.12

1.26%$9.07

-0.13%$3,171.68

-0.42%$0.00001322

-1.19%$3.00

0.38%$2,960.47

-0.41%$0.999654

-0.01%$94.36

1.15%$46.04

-1.32%$0.999881

-0.03%$338.27

1.53%$3.97

-0.68%$117,825.00

-0.17%$1.001

-0.15%$4.40

-0.49%$0.00001222

-2.07%$8.47

-1.31%$305.19

1.27%$389.81

-1.33%$0.470264

-0.46%$4.94

0.94%$0.10268

-2.01%$1.18

0.01%$2.52

-0.61%$48.87

0.49%$5.42

0.77%$196.95

-0.94%$1.00

0.00%$0.8905

-0.40%$18.23

-1.15%$0.085842

-0.50%$1.059

-0.01%$0.665277

4.87%$0.999766

-0.08%$4.66

-0.96%$0.02441659

-0.09%$0.329104

-1.59%$0.242363

9.27%$0.231217

-1.03%$0.409416

1.31%$4.48

0.68%$9.67

-1.51%$15.97

-1.44%$3.66

-0.36%$0.0000245

11.40%$0.713961

0.91%$0.325763

-1.44%$1.038

-0.66%$2,961.95

-0.29%$2.56

-0.97%$117,553.00

-0.15%$0.077875

-2.05%$114.23

-1.84%$4.72

-0.41%$172.07

-0.83%$0.485285

-0.80%$0.999797

0.02%$0.998496

-0.16%$11.38

-0.85%$0.02306142

-2.34%$3,102.59

-0.42%$1.51

-4.56%$3,374.47

-0.30%$1.00

-0.02%$1.88

-1.57%$1.28

-0.40%$4.33

-1.04%$1.23

-2.38%$12.56

-0.42%$0.072466

1.61%$0.762561

1.44%$0.01670679

-2.17%$0.354835

-1.97%$0.652544

-0.46%$3,176.60

0.15%$1.71

-2.41%$3,110.49

-0.41%$117,810.00

0.05%$1.00

-0.03%$0.999799

-0.05%$3,119.19

-0.34%$0.530769

4.37%$0.098155

0.36%$0.967152

-1.06%$117,576.00

-0.13%$1.11

0.06%$3,350.43

0.07%$0.00009655

-0.11%$688.78

-0.83%$0.15675

-2.34%$11.42

2.32%$0.57557

-24.20%$118,010.00

0.49%$3,186.10

-0.92%$0.999469

-0.02%$0.631872

0.04%$181.91

-1.00%$0.533161

-2.11%$3,351.22

0.05%$2.37

-5.88%$211.81

-0.88%$0.803466

-0.41%$0.203643

5.69%$0.01703187

-1.18%$0.819724

-1.95%$0.01514374

2.99%$10.74

0.00%$2.69

-1.23%$21.79

-0.61%$0.2941

1.23%$111.77

0.00%$0.120143

1.67%$42.78

-0.09%$0.997925

-0.00%$0.00000068

0.08%$1.93

-1.07%$0.00000172

2.94%$0.254438

1.93%$0.634304

0.33%$2,959.80

-0.40%$0.772385

-2.04%$47.75

1.84%$3,176.18

-0.10%$3.93

-0.65%$1.092

-0.24%$117,700.00

-0.11%$116,340.00

-0.47%$0.384425

-0.49%$2,960.86

-0.44%$3,061.36

-1.35%$0.313368

0.62%$0.00881198

-2.26%$0.999448

-0.00%$0.997665

-0.00%$0.01664307

-3.16%$3.08

2.30%$117,984.00

-0.02%$0.400484

-0.96%$1.70

-0.25%$0.541311

-3.27%$47.75

1.83%$0.054622

-3.95%$1.50

-0.52%$0.657789

-1.61%$0.487753

-4.07%$0.52279

-5.82%$26.25

-0.33%$0.10224

2.29%$0.999441

-0.04%$1.00

-0.02%$2,960.47

-0.42%$0.198616

-1.61%$0.138819

-2.18%$0.998693

0.02%$0.34026

22.93%$0.223055

0.02%$0.426886

-0.39%$3,148.97

-0.42%$0.00786245

-0.73%$0.064003

2.81%$0.605263

-1.03%$0.999804

-0.02%$0.00000045

-0.80%$0.00446148

-2.46%$6.31

-0.26%$15.59

1.22%$46.93

-0.07%$1.15

0.66%$7.56

-0.55%$0.36244

0.75%$3,265.31

-0.42%$6.50

2.43%$0.00002105

-0.84%$0.166841

-0.89%$0.00452135

1.78%$1.33

-1.08%$2.49

-0.26%$1.094

-0.01%$117,632.00

-0.28%$0.998615

-1.48%$0.055012

-1.94%$0.151654

-0.63%$1.004

0.06%$3,239.52

-0.42%$0.04037652

-0.59%$0.529292

-2.44%$2,956.69

-0.43%$1.54

-3.78%$0.999931

-0.02%$2,961.00

-0.36%$0.078751

1.46%$1.34

4.56%$0.03643463

-1.55%$2,957.55

-0.05%$0.01866134

0.68%$117,678.00

-0.10%$0.00677552

-1.44%$0.354721

-0.46%$0.359538

-1.79%$0.999787

-0.02%$0.768456

4.33%$21.13

0.68%$177.11

-0.94%$0.00006276

-0.97%$0.519553

-1.01%$0.838267

-1.51%$127.80

-0.04%$0.231428

-0.93%$11.37

0.26%$3,576.29

-0.40%$25.69

1.24%$1.12

-2.49%$0.999234

-0.01%$0.00372487

-2.05%$0.751351

-0.88%$0.999714

-0.07%$0.99948

-0.02%$0.676734

0.80%$21.14

1.21%$0.02907666

-1.50%$0.089969

17.27%$0.999629

-0.18%$117,892.00

0.20%$2,367.74

-0.12%$0.0042184

-0.19%$1.02

-0.01%$0.475122

2.25%$3,090.53

-0.84%$16.81

-1.74%$0.283187

-8.41%Reading

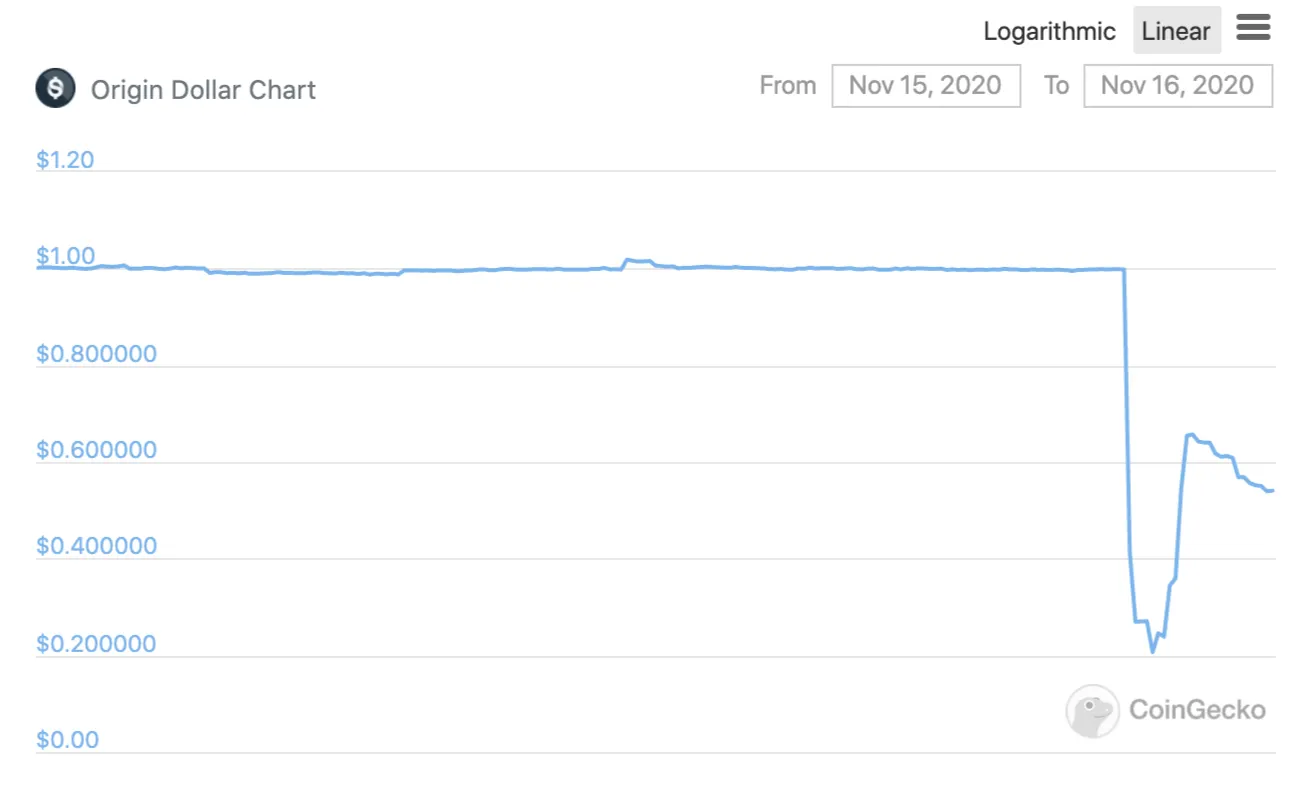

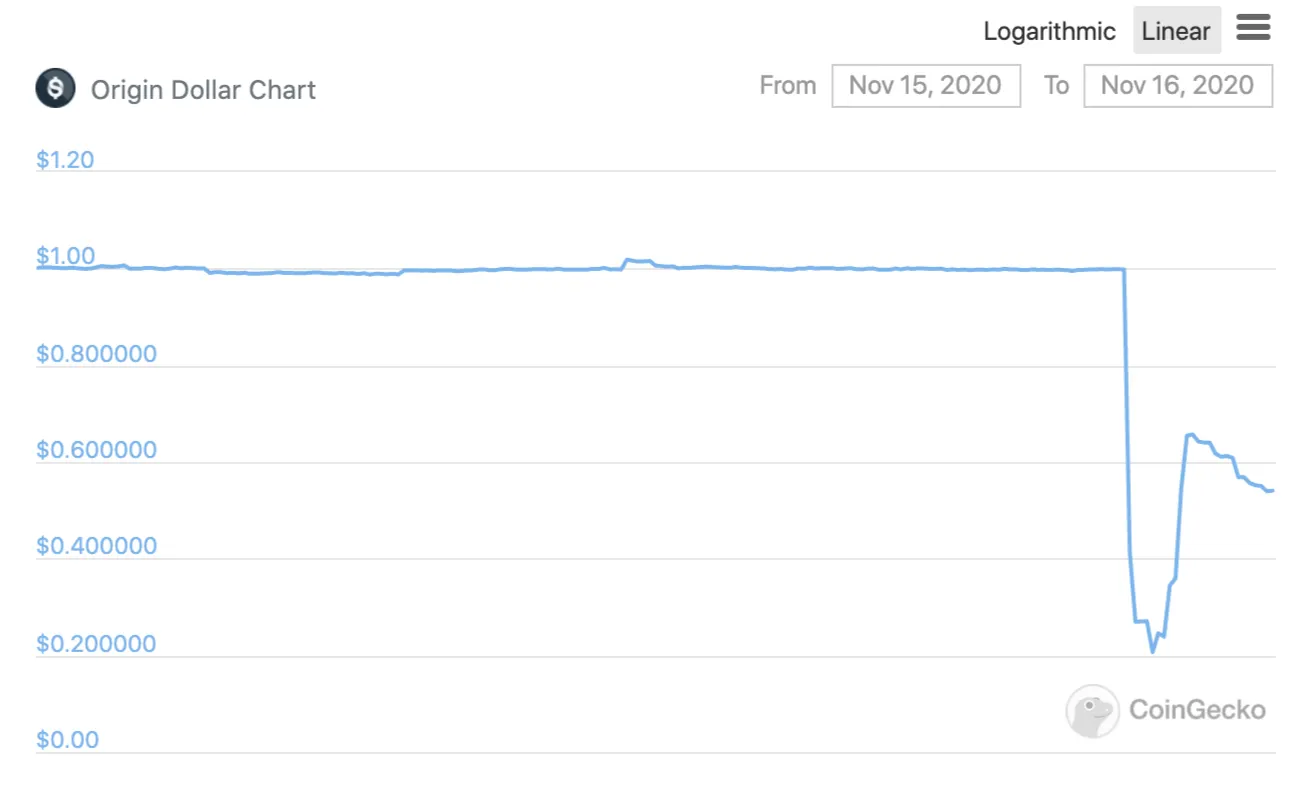

Origin Protocol co-founder Matthew Liu on Monday night confirmed an attack on the Origin Dollar (OUSD) vault.

"The team is all-hands on deck attempting to figure out what vulnerability was exploited and how the hacker was able to access users’ deposits," he wrote.

Though the exact exploit—some form of flash attack—isn't yet known, the Origin team estimated $7 million—a combination of ETH and DAI stablecoin—had been taken.

Origin Dollars' $OUSD got exploited for $5.5M in ETH, around 11,800 ETH AND $2.2M in DAI

Attack: https://t.co/opyaZY2hjs

Attacker's Address:https://t.co/fkaUqphEqx

Share, stay vigilant pic.twitter.com/xHIdP1Md63

— Krisma (@KRMA_0) November 17, 2020

Liu indicated he wasn't yet certain whether the funds—over $1 million of which he said came from Origin employees and founder—could be recovered.

To quell rumors, Liu said, "This is not a rug pull or internal scam. Despite this setback, it is very much in our intention to make OUSD a safe, secure, and successful product that builds on the broader Origin mission of peer-to-peer commerce."

Origin is a blockchain-based e-commerce platform. It introduced the OUSD stablecoin at the end of September; it's backed not by fiat but by other stablecoins, including DAI.

As a result of the hack, the stablecoin—meant to be equivalent to $1.00—dropped to $0.54.

The attack may further undermine confidence in the security of decentralized finance protocols, many of them built on Ethereum. In the last month, Harvest Finance, Akropolis, and Value DeFi have all been attacked via flash loan vulnerabilities that have led to over $40 million in losses.

Stablecoin issuer Tether is ending its USDT support for five blockchains effective on September 1, the company announced on Friday, ending redemptions and freezing the remaining assets on those blockchains. Last June, the firm ended its minting function on Algorand and EOS (now called Vaulta), meaning it would no longer issue new stablecoins on those chains. In 2023, it announced the same for Bitcoin Cash, Kusama, and Omni Layer Protocol. Now, Tether has put a hard end date on its stablecoin s...

Solana token launchpad Pump.fun is prepping for its initial coin offering, aka ICO, on Saturday, July 12. With U.S. and UK citizens banned from participating, traders are eagerly awaiting its full launch to purchase PUMP—but will it pump or dump once it starts trading? The token is set to go on sale via six centralized exchanges (Bybit, Kraken, Bitget, MEXC, KuCoin, and Gate.io) as well as the Pump.fun website Saturday, with 150 billion tokens up for grabs at $0.004 each. Within 48 to 72 hours a...

U.S. spot Bitcoin exchange-traded funds pulled in over $1.17 billion on Thursday, notching their second-highest day of inflows ever as institutional capital flooded into digital assets. The massive inflows to Bitcoin ETFs were led by BlackRock's IBIT with $448.5 million, followed by Fidelity's FBTC at $324.3 million and ARK's ARKB with $268.7 million, according to Farside Investors data. Even with $40.2 million in outflows from Grayscale’s GBTC, total net flows turned sharply positive. The infl...