In brief

- Bitcoin's price has been increasing for months, and there are several reasons behind the surge.

- High-profile figures and companies have expressed strong support for Bitcoin.

- Other reasons include the Bitcoin halving, which has had an indirect impact on Bitcoin's price.

The price of Bitcoin is above $22,000, having broken through the $20,000 milestone for the first time in its history yesterday. Its current price of $22,732 represents a 118% increase in value over the last three months. Bitcoin is now firmly in uncharted territory.

It’s been a rapid rise since March, when Bitcoin drastically fell to its lowest point of the year, touching as low as $4,000. The coin has continued to bounce back and has fought its way above the $10,000 price point, going on to make new recent highs—and hit values not seen since Bitcoin’s epic 2017 bull run. Yet this time, an entirely different set of circumstances are accelerating Bitcoin’s price to new highs.

Why is Bitcoin going up?

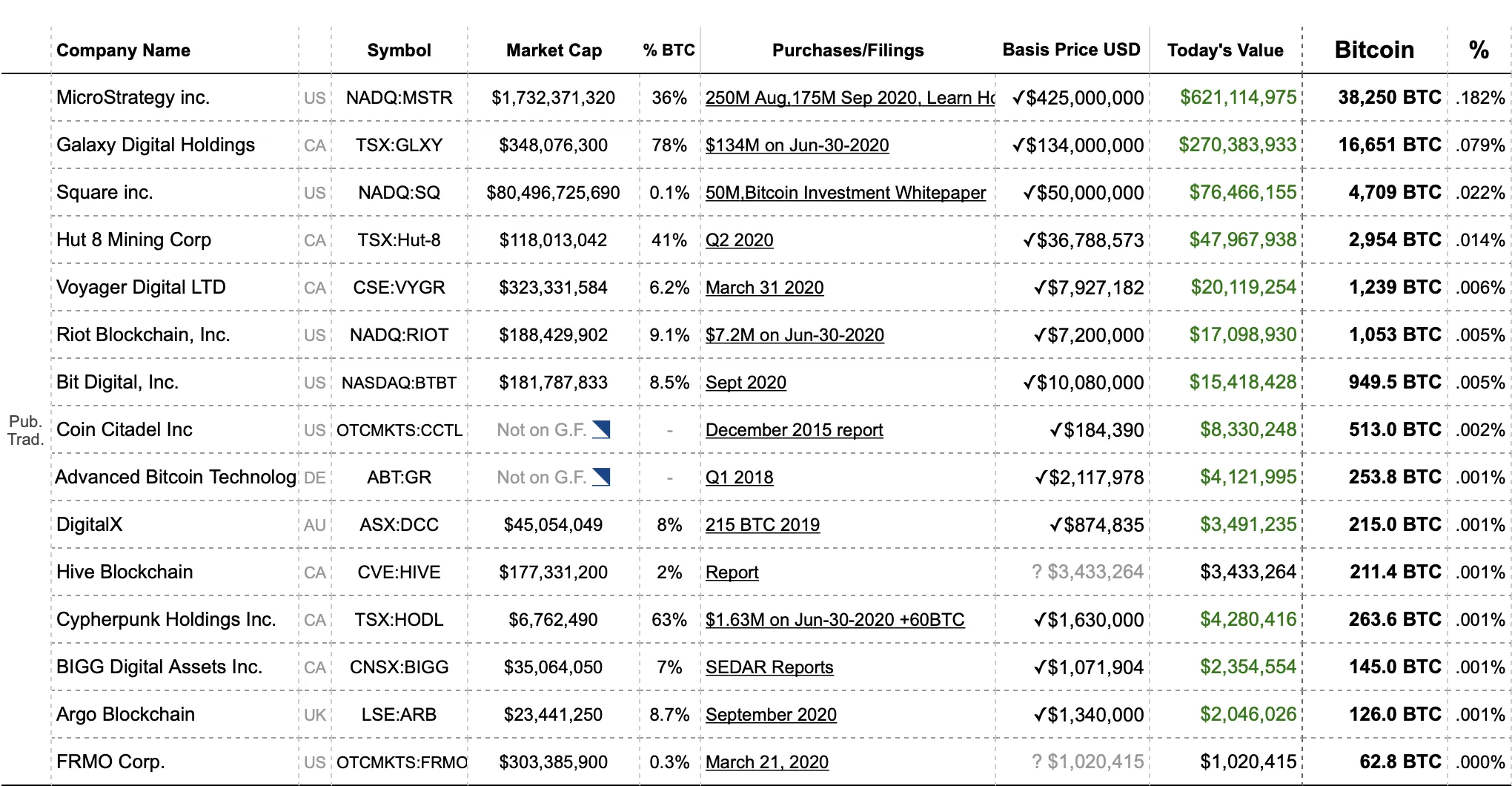

There are a multitude of reasons for Bitcoin’s price rise. Investment from large institutions like MicroStrategy have led the way, as have major companies like Grayscale managing Bitcoin for their own clients. What’s more, it’s now easier to buy Bitcoin since PayPal began letting people buy and sell Bitcoin.

Bitcoin’s level of inflation has also halved, and this has also played a role in Bitcoin’s price increase. Each of these individual factors have combined to generate an impressive bull run for Bitcoin during the second half of 2020. But it all began with MicroStrategy.

The MicroStrategy Effect

From August to September of this year, business intelligence firm and international giant—MicroStrategy—invested $425 million in Bitcoin.

Following MicroStrategy’s investment, Square invested $50 million—1% of the company’s total assets—into Bitcoin on October 8, 2020.

Since these investments, MicroStrategy and Square have made significant profits of 103% and 113%, with each company’s Bitcoin now worth $864 million and $106 million respectively.

Another major investment in Bitcoin comes from hedge fund One River, that has reportedly bought more than $600 million in cryptocurrencies. But One River’s plans don’t stop there. Not only has it joined forces with Alan Howard, co-founder of Brevan Howard Asset Management, but One River’s CEO Eric Peters has committed to having Bitcoin and Ethereum holdings of $1 billion by early next year.

These are major investments, but the minds behind MicroStrategy and Square have also become some of the most outspoken advocates for Bitcoin in recent months.

#Bitcoin is a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth, exponentially growing ever smarter, faster, and stronger behind a wall of encrypted energy.

— Michael Saylor (@michael_saylor) September 18, 2020

MicroStrategy CEO Michael Saylor has been praising Bitcoin publicly. When his company first announced its investment intentions, Saylor described Bitcoin as “digital gold,” saying that the cryptocurrency is “harder, stronger, faster, and smarter than any money that has preceded it.”

Similarly, Amrita Ahuja—who was Square’s chief financial officer when the company made their Bitcoin investment—said, “We believe that Bitcoin has the potential to be a more ubiquitous currency in the future,” adding that, “For a company that is building products based on a more inclusive future, this investment is a step on that journey.”

These investments and moments of great public praise for Bitcoin seemed to begin with MicroStrategy’s first investment, and has thus been dubbed the “MicroStrategy Effect” by Jason Deane, Bitcoin analyst at Quantum Economics. Deane added that these moves have “kick-started an institutional scramble to secure as much Bitcoin as possible.”

These statements have also been accompanied with very public support for Bitcoin from other parts of the investment world.

Public support for Bitcoin investments

Bitcoin’s positive run in the second half of 2020 has seen some major names embrace the cryptocurrency.

JPMorgan is one of the biggest examples of this. In 2017, JPMorgan’s CEO, Jamie Dimon, labelled Bitcoin a “fraud.” This October, the investment bank said Bitcoin is solidly competing with gold, and that “the potential long-term upside for Bitcoin is considerable.”

Paul Tudor Jones, a giant in the hedge fund industry, likened buying Bitcoin to investing early in tech. “Bitcoin has a lot of the characteristics of being an early investor in a tech company, and I didn’t realize it until after unfortunately I came by your show and got besieged by God knows how many different people on Bitcoin,” Jones said on CNBC’s Squawk Box (which partner show CNBC Fast Money has also been particularly bullish).

What’s more, Stanley Druckenmiller, a billionaire investor who was previously dismissive of Bitcoin, said the famed cryptocurrency might just be better than gold. “I own many many more times gold than I own Bitcoin, but frankly if the gold bet works, the Bitcoin bet will probably work better,” Druckenmiller said this month.

While it seemed that Keith McCullough, CEO of risk management firm Hedgeye, was turning bearish on Bitcoin—selling it on October 6, he later revealed that he actually bought it back on October 12. That means he actually rode the Bitcoin wave from $11,500 up to the current price today (unless he has sold it since).

Bought #Bitcoin back OCT 12 and went big in The Maestro @michael_saylor $MSTR stock too https://t.co/piqDtCydkc

— Keith McCullough (@KeithMcCullough) November 19, 2020

McCullough added that he invested a large sum of money in shares of MicroStrategy, which is heavily invested in Bitcoin. So, in a way, he's now twice invested in the cryptocurrency.

Scott Minerd, CIO of global investment firm Guggenheim Partners, offered arguably the most optimistic assessment of Bitcoin when he spoke to Bloomberg on December 16. “Our fundamental work shows that Bitcoin should be worth around $400,000,” Minerd said.

His view is based predominantly on Bitcoin’s scarcity, and its similarity with gold. “Bitcoin has a lot of the attributes of gold, and at the same time has an unusual value in terms of transactions.”

And as McCullough, and other investors, proclaim Bitcoin’s virtues, many institutional investors are following suit.

Grayscale Investments and Bitcoin custody

Grayscale Investments, an asset management company, is at the forefront of providing custodial services for wealthy Bitcoiners.

In October, Decrypt reported on how Grayscale Investments had picked up over 40,000 Bitcoin—worth over $600 million at the time of writing—for its clients. Yet, Grayscale is not the only player in town.

A total of 85,000 Bitcoin, worth approximately $695 million, has been bought up by both Grayscale and CashApp, a mobile payments service owned by Square. During the same period—Q1 of 2020—a total of 163,800 Bitcoin had been mined, meaning that both companies collectively bought the equivalent of about half of the total Bitcoin mined in that quarter.

Similarly, Fidelity Digital Assets, which provides custody services for investors, is showing that it's committed to this industry. On November 24, Christine Sandler, head of sales and marketing at Fidelity Digital Assets, said that Bitcoin and other cryptocurrencies are seeing a large push towards adoption from institutional investors.

“What we did see in 2020 was a broader adoption of that ‘digital gold’ narrative, it began to resonate with other pockets of institutional investors, namely hedge funds, ultra-high net worth individuals and subsequently family offices,” said Sandler, adding, “So we saw a broadening of the base in terms of the types of clients that we were seeing engaging with the ecosystem.”

On December 16, two more major events hit the crypto custodial industry.

First, Northern Trust and SC Ventures, the innovation and ventures arm of Standard Chartered, reportedly launched Zodia Custody, a cryptocurrency custodian for institutional investors.

In addition, American Express—one of the largest financial corporations in the world—invested in FalconX, a platform for institutions trading cryptocurrencies.

These events are prompting concern that Bitcoin will soon be in short supply, as such massive amounts of the cryptocurrency are being snapped up by wealthy investors and giant companies, rather than your average Joe.

Bitcoin halving: Squeezing the supply

The Bitcoin halving likely had an impact on Bitcoin’s price. The Bitcoin halving happens every four years and cuts the number of coins miners receive for adding new blocks to the Bitcoin blockchain in half. So from May onward, only half as much Bitcoin was being created as in previous months.

“With the Bitcoin halving in May, this stream of supply has halved, meaning that fewer Bitcoin are put up for sale by miners. This can contribute to a shortage of supply and therefore to a rising Bitcoin price,” Elias Strehle, researcher at the Blockchain Research Lab, told Decrypt.

This is basic economics, and not simply confined to Bitcoin mining, or the wider cryptocurrency industry as a whole. If demand stays the same but the supply decreases, this puts upward pressure on the price.

“Think of apples: If this year's harvest is extraordinarily good, then prices of Apples will fall. If, however, apples are scarce due to a bad harvest, then prices of Apples go up,” Ingo Fiedler, co-founder of the Blockchain Research Lab, told Decrypt.

It's possible that PayPal has been buying up a significant amount of Bitcoin being produced, squeezing the supply even further. Inference from the company that PayPal uses to buy Bitcoin, it may be buying up to 70% of newly mined Bitcoin. That's on top of the huge amounts that Grayscale and Square are picking up.

All of these reasons have positively impacted Bitcoin’s price over the last few months, but one factor—which is also best suited to generate mass Bitcoin adoption—still remains.

PayPal and cryptocurrency

PayPal, the international payments giant, announced this October that it would launch cryptocurrency buying and selling features on its platform. It then confirmed yesterday that all of its customers could now access Bitcoin—and plans to bring this feature to Venmo.

This launch included the ability to buy and sell four cryptocurrencies, namely: Bitcoin; Bitcoin Cash; Ethereum; and Litecoin.

As giants of the finance industry like MicroStrategy, Square, and Grayscale Investments have contributed to perceptions of Bitcoin as a legitimate asset, PayPal’s arrival on the scene holds the most promise for Bitcoin’s hopes to hit the mainstream.

“Just bought Bitcoin on Paypal, they made it super easy. This is how Bitcoin goes mainstream,” said a Twitter user under the pseudonym BitcoinBF.

Just bought Bitcoin on Paypal, they made it super easy. This is how Bitcoin goes mainstream.

— Ms Bitcoin aka Bella 🚀 (@BitcoinBF) November 12, 2020

PayPal will also be making it possible for its users to spend their crypto with any merchant that accepts PayPal. On November 23, PayPal CEO Dan Schulman said, "Early next year, we're going to allow cryptocurrencies to be a funding source for any transaction happening on all 28 million of our merchants."

PayPal used to question Bitcoin’s suitability as a currency, but now, it’s just one of many big names jumping on the Bitcoin bandwagon. And as it plows in alongside everyone else, it’s no wonder that Bitcoin’s price has been on fire.

Update: This article has been updated on December 17 with the latest prices and relevant news.