In brief

- Current open interest in Bitcoin futures contracts is relatively high.

- If investors are betting on price gains, that's a bullish sign for Bitcoin.

- Volatility due to the US elections could be bearish for Bitcoin, however, says Messari.

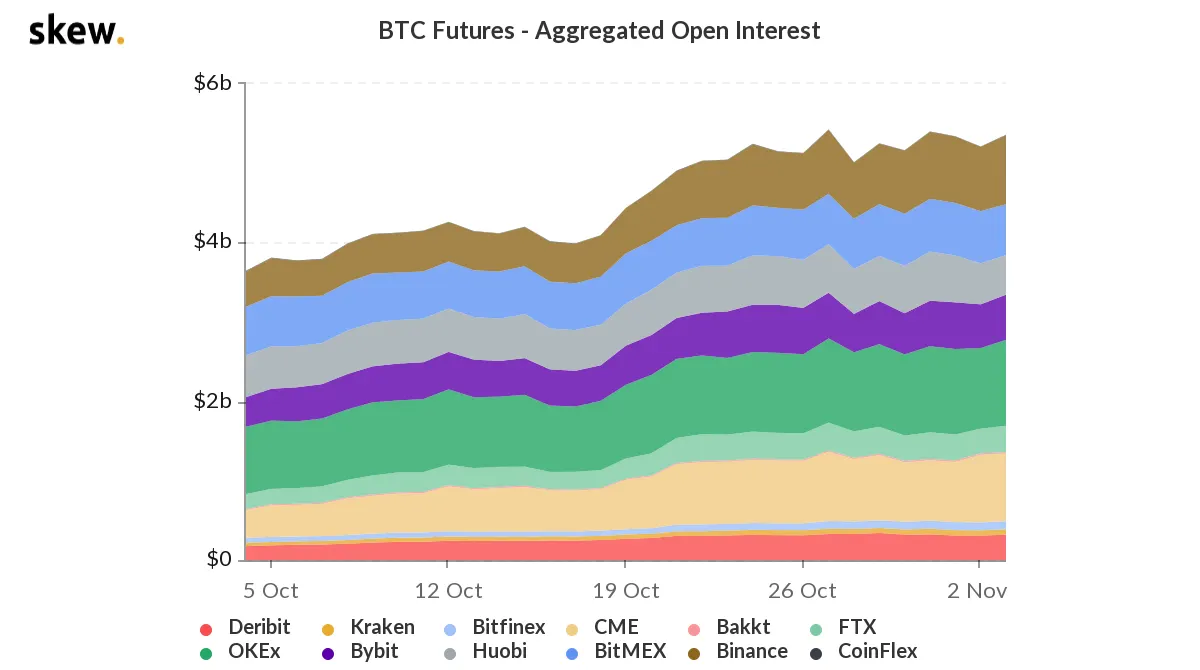

According to data from Skew Analytics, open interest in Bitcoin futures reached $5.4 billion on Tuesday, November 3, nearing its all-time high of $5.7 billion.

The daily open interest figure has stayed above $5 billion for the better part of two weeks, indicating investor interest in the digital asset.

Futures are a type of Bitcoin derivative in which traders agree to buy an asset in the future at a predetermined price; essentially, they’re one method of betting on whether the price will rise or fall, as successful traders pocket the difference between the predetermined price and the actual selling price.

Open interest is simply the number of derivative contracts that haven’t been settled. Futures contracts settle at some point in the future, when each trader gets what they want. Physical settlement means the buyer gets the actual asset, whereas cash settlement means they get the cash value of that asset.

While open interest generally correlates to how interested investors are in a financial product, it’s hard to know for certain whether buyers are interested in the asset failing (short) or succeeding (long).

According to a report published today by Messari, “Macro Outlook: Bitcoin and the U.S. Election,” the high rate of open interest combined with Bitcoin’s surging price—it’s moved from near $4,000 in March as the global economy all but shut down because of COVID to $14,000 today—could be good for Bitcoin:

“Rising prices during an uptrend while open interest is also on the rise could mean that new money is coming into the market (reflecting new positions). This could be a sign of bullish sentiment if the increase in open interest is being fueled by long positions.”

If those are short positions, not so much.

However, open interest is just one data point in many for the digital asset economy. In the same report, Messari writes that election results—or, more accurately, uncertainty over the results and their meaning—feed into a possible bearish case for Bitcoin. Should Trump lose, the thinking goes, he’ll have little incentive to craft a stimulus bill before leaving office in mid-January. Moreover, some investors might fear the effect of a President Biden tax plan on capital gains.

Regardless, concludes Messari, “While volatility could increase in the near term due to uncertainty, bitcoin has emerged as a macro asset that is now being mentioned seriously in the corporate and investing worlds.”