In brief

- Ethereum transaction fees are down significantly, while Bitcoin fees are up.

- Bitcoin fees have increased right along with trading activity surrounding its price rise.

- Meanwhile, with the summer of DeFi now over, usage of the Ethereum blockchain network is down considerably.

As Bitcoin’s dominance in the crypto market increases along with its price, activity on the Ethereum network is cooling down. One metric that explains the shift? Transaction fees: Average Ethereum fees are well below the elevated levels of this summer, while Bitcoin’s are through the roof.

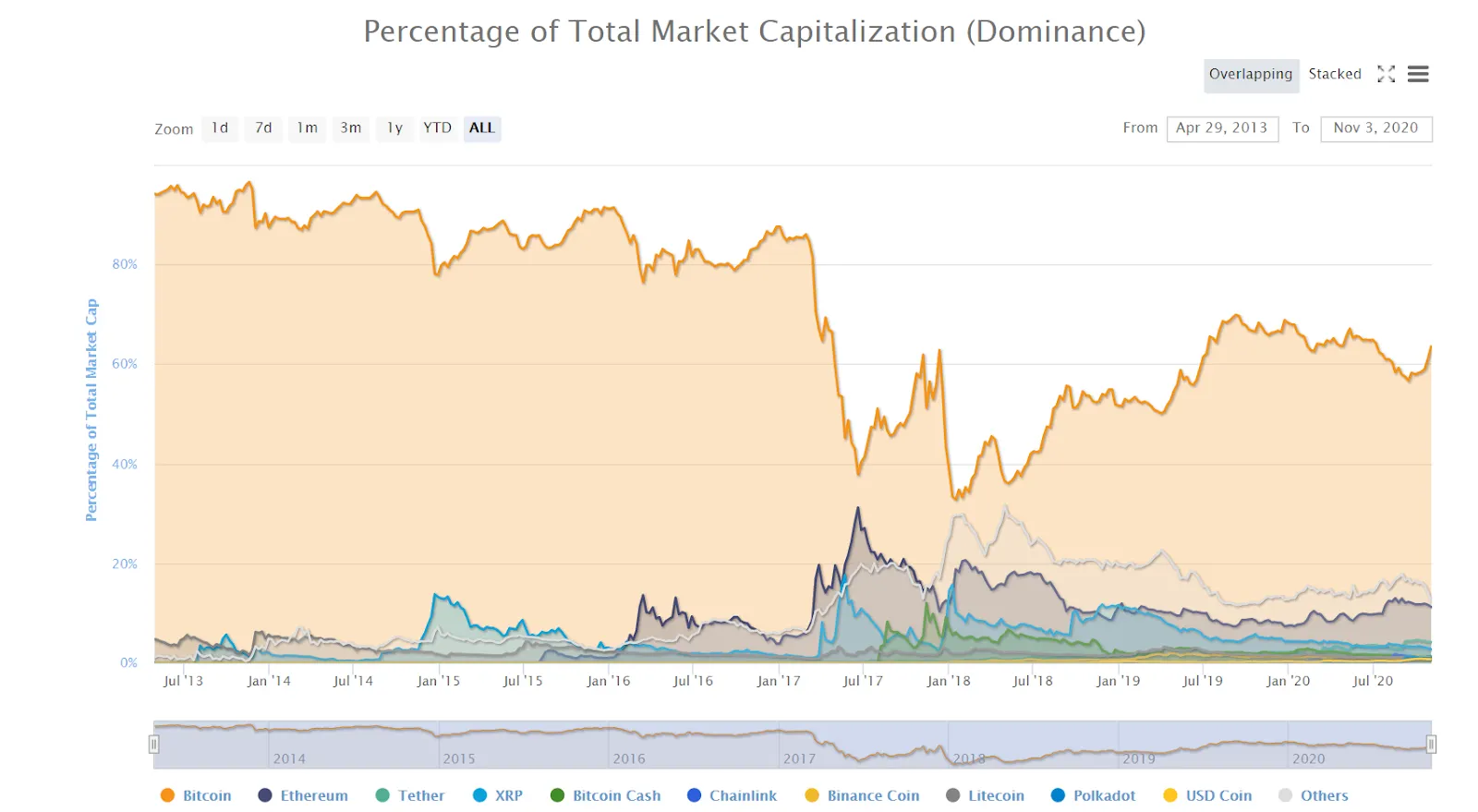

According to CoinMarketCap, Bitcoin has increased its dominance over the market capitalization of the entire cryptocurrency market. On September 14, it comprised 56.67% of the crypto market cap, the lowest levels since June 2019.

As Bitcoin’s price edges skyward, from about $10,000 back in September to highs of $14,000 over the weekend, so does its dominance increase. Bitcoin, as of this writing, comprises 63.5% of the crypto market cap.

While autumn may be Bitcoin’s game, summer was all about Ethereum. Ethereum-based decentralized finance (DeFi) protocols, such as lending protocols and exchanges, were all the rage, since they offered investors attractive bonuses for using the platforms. Ethereum increased its dominance from about 9.8% in July to highs of 13% in late August.

As some of those incentives washed away, so did interest in DeFi. Now, Ethereum’s dominance over the crypto market cap, which today stands at $395 billion, is 11.65%.

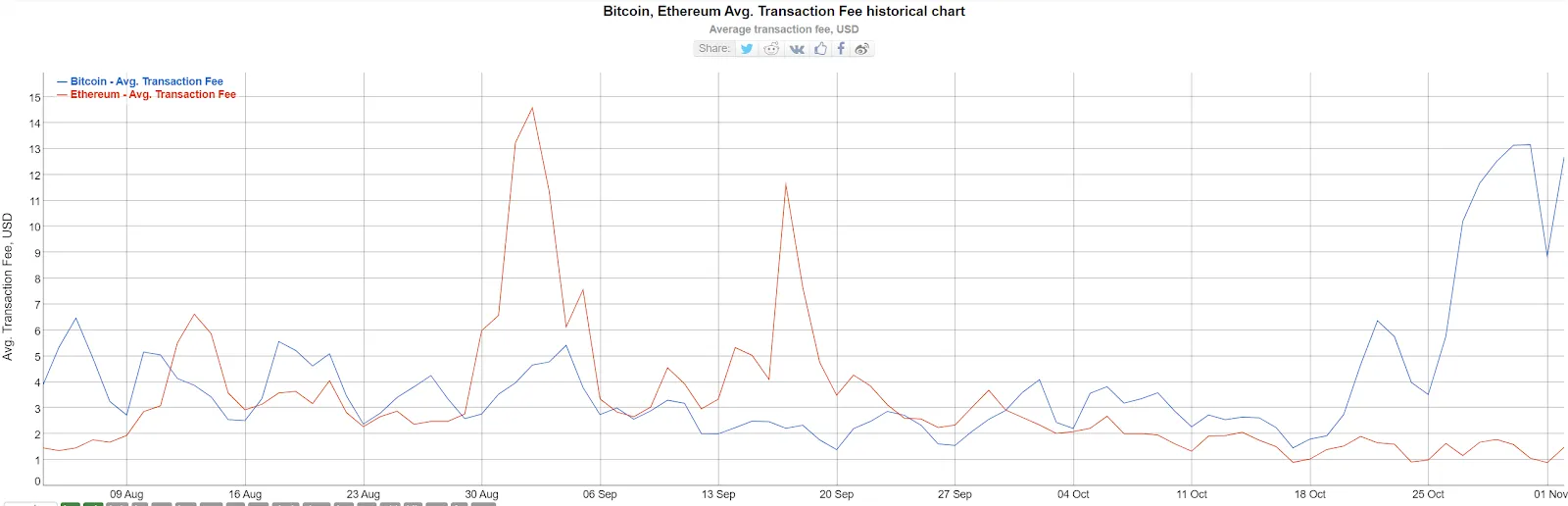

One visualization of all the excitement around Bitcoin is its average transaction fee. This is the average cost of processing a Bitcoin transaction. Fees rise when the demand for processing fees outstrips the capacity of Bitcoin miners to process those fees—simple supply and demand economics.

Bitcoin fees hit their highest levels since January 2018 this weekend, just like Bitcoin’s price. On October 31, the average Bitcoin transaction cost $13. Meanwhile, Ethereum fees, which spiked to highs of $14.5 on September 2, fell to $0.89 on Sunday.