In brief

- The amount of crypto locked in decentralized finance protocols ended the month in the red.

- That's the first time this has happened since the DeFi craze began this summer.

- While DeFi stagnates, Bitcoin's growing.

October’s done, two more months left of 2020 to go. Looking back at the past month, many close to reflect on Bitcoin’s success; the coin ended this month at one of its highest price-points ever. A technicality, sure, but a victory nonetheless.

Forgotten in the Bitcoin-mania was decentralized finance, also known as DeFi, the once-new and bustling industry of non-custodial financial products, such as exchanges and lending protocols.

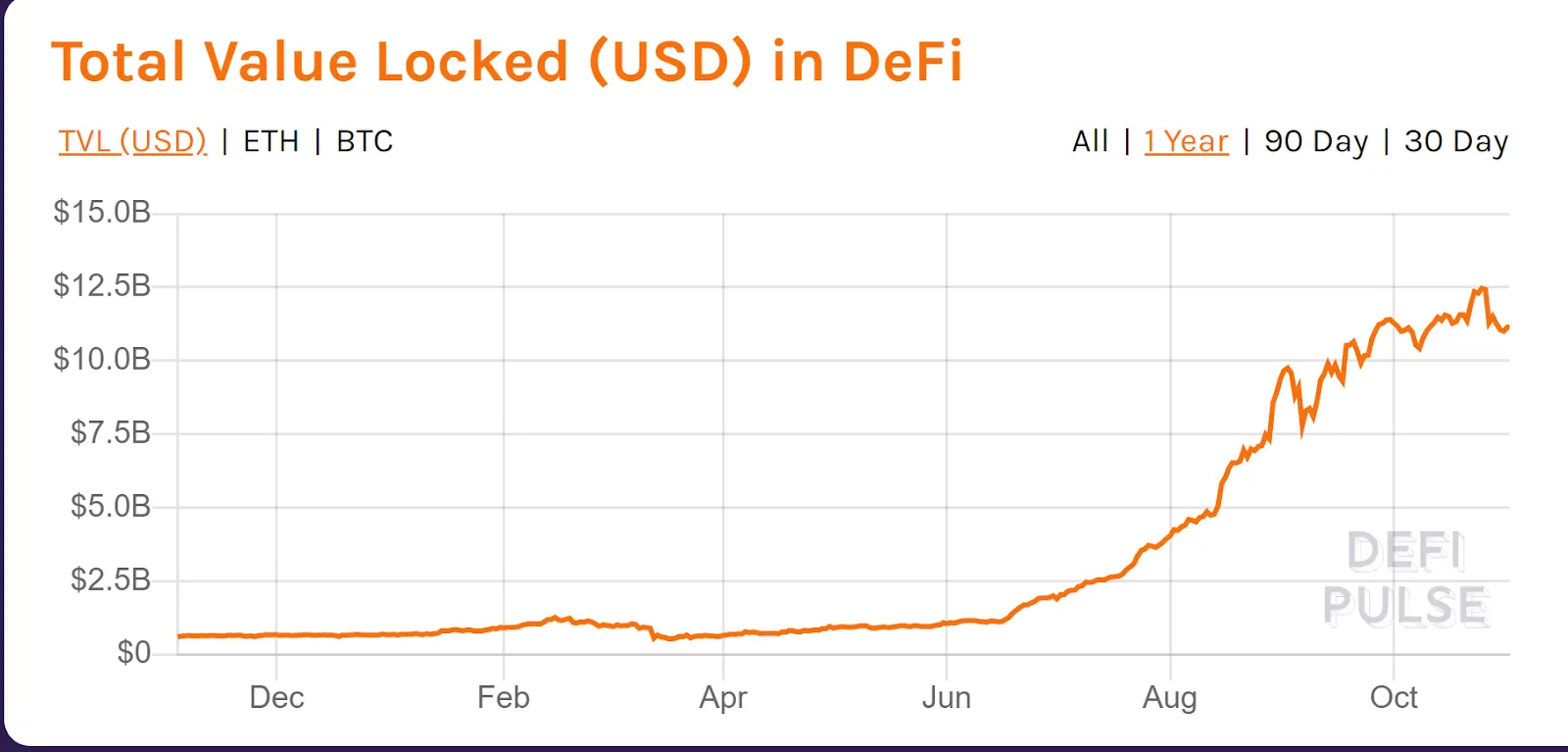

DeFi was all the rage this summer, and investors poured billions upon billions of dollars into these smart contracts to earn highly lucrative rewards. Using the same metric, it’s clear that DeFi’s growth rate is slowing down.

At one point its rise appeared unstoppable: the amount locked into DeFi contracts rising almost a billion each week; the industry peaked this week at $12.4 billion, up from about $1 billion in May.

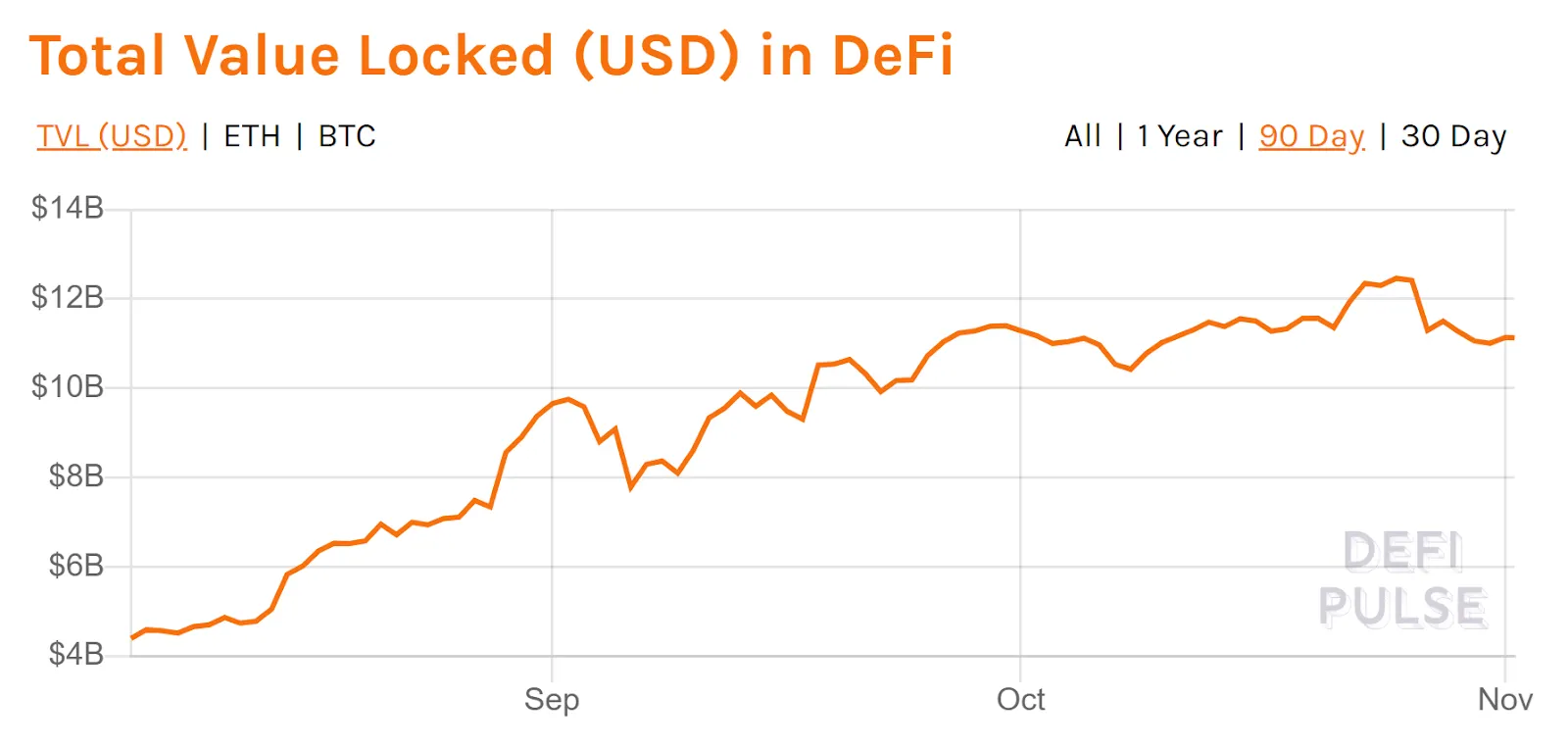

But the growth has slowed: the amount of cryptocurrency locked in decentralized finance smart contracts at the end of October was less than when the month started. That’s the first time this happened since this summer’s DeFi craze began.

On October 1, there was $11.28 billion locked up in DeFi protocols, according to metrics site DeFi Pulse. On October 31, there was $11 billion locked up in DeFi protocols.

Seems like splitting hairs, but consider that in August, the market doubled. On August 1, there was $4.04 billion locked up in DeFi smart contracts; on August 31? $9.37 billion.

The slowed growth may be down to the fact that lots of these protocols aren’t as profitable as they used to be, and that new protocols aren’t coming out as thick and fast as before.