In brief

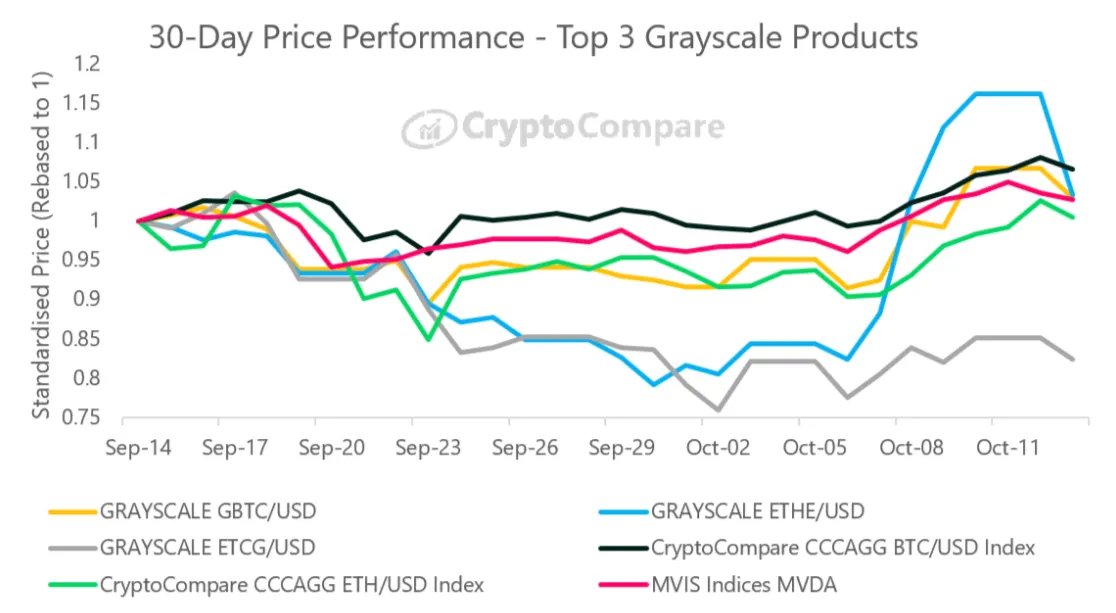

- CryptoCompare reports that Grayscale's exchange-traded products are generally underperforming the market this month.

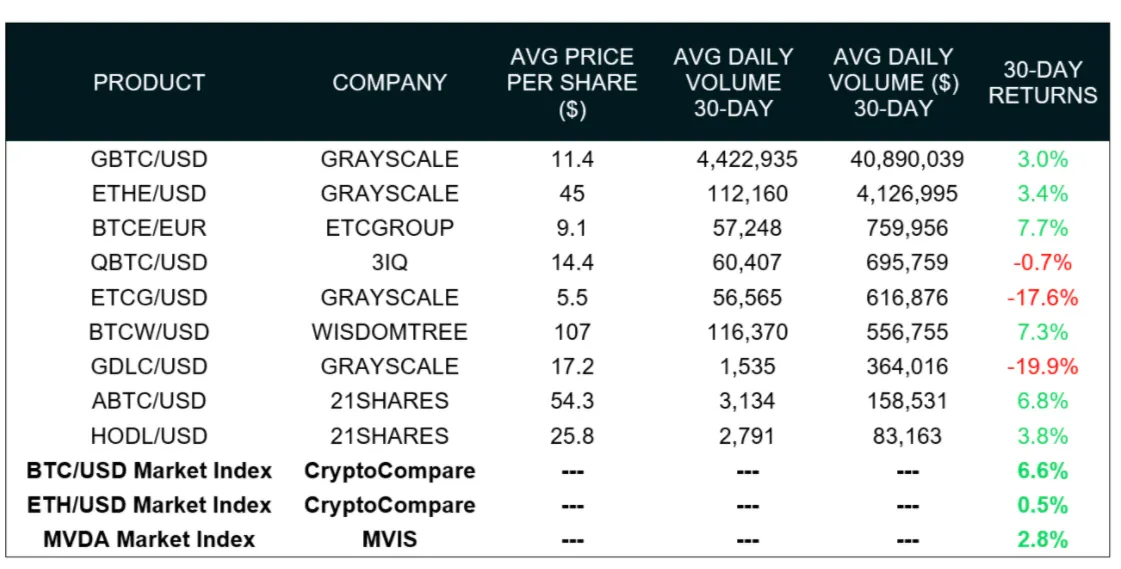

- The Digital Large Cap Fund (GDLC) experienced a 19.9% loss over the previous 30 days.

- Grayscale nonetheless has the highest market cap and daily trading volumes for crypto ETPs.

Grayscale, a digital currency investing firm that exposes traditional investors to cryptocurrency assets, is having a lackluster October after bringing in $1 billion in investments from July to September.

That’s according to CryptoCompare’s most recent Digital Asset Management Review, released today. It found that “Grayscale’s products generally underperformed compared to the market.”

Exchange-traded products, or ETPs, are investments whose prices go up and down depending on the value of the underlying product, in this case, cryptocurrencies. They’re popular with investors who want exposure to the asset but don’t want to be responsible for owning and storing it.

Though they’re meant to track the price of the underlying asset, ETPs’ price movements can nonetheless differ because as in the product can trade at a premium or discount.

In terms of size, Grayscale is the market leader for cryptocurrency exchange-traded products. Its Bitcoin Trust has a market cap of $5.8 billion and its Ethereum Trust product is at $1.25 billion. That dwarfs ETC Group’s and Wisdom Tree’s Bitcoin products, which have market caps of $60.1 million and $34.5 million, respectively.

Nonetheless, the latter two did better for investors in October.

In fact, ETC Group’s and WisdomTree’s ETPs outperformed spot markets over the previous 30 days, gaining 7.7% and 7.3%, respectively, compared to a spot market improvement of 6.6%. That means, fees notwithstanding (consumers pay the ETP-provider for storage), those funds gave higher returns than investors would have gotten by putting their money into the actual cryptocurrency.

Grayscale’s Bitcoin Trust and Ethereum Trust, meanwhile, logged 3.0% and 3.4% improvements over a 30-day period, the first one underperforming the market and the second beating it.

"Grayscale’s ETHE/USD trust product experienced poor price performance throughout the 30-day period, underperforming by up to ~10% below the equivalent CCCAGG ETH/USD spot price performance," wrote CryptoCompare. "However, there were better than market price returns (up to 16%) in the second week of October as ETH began to rise in value."

Grayscale’s diversified product didn't improve, however. The Grayscale Digital Large Cap Fund (GDLC), which is tied to the price of Bitcoin, Ethereum, XRP, Bitcoin Cash, and Litecoin, experienced a 19.9% loss. Unlike the single-asset trusts, the GDLC Fund uses a “rules-based portfolio construction process,” meaning that its allocation percentages shift.

With volumes rising 2.2% this month to $66.6 million per day, there's slightly more interest in the products. And most of that is going to Grayscale. According to CryptoCompare, "Grayscale’s Bitcoin Trust product still represents the vast majority of daily ETP volume at an average of $57.2mn in October."

And it’s important to remember that this is just a snapshot of a short time period. Whether users continue to trust Grayscale, however, depends on whether its trusts keep underperforming the market.