In brief

- Dune Analytics is a web-based tool that lets users view and create charts depicting activity on the Ethereum blockchain.

- It reported receiving $2 million in seed funding in a round led by Dragonfly Capital.

- The institutional and individual investors are Dune users.

Dune Analytics, a free Ethereum data website run by a two-person team out of Oslo, is getting a cash injection to scale up its staff and expand its offerings.

The company announced today it has raised $2 million in a seed round. Dragonfly Capital led the round, with additional funding from Multicoin Capital, Digital Currency Group, Coinbase Ventures, and a smattering of other prominent projects, VC firms, and angel investors.

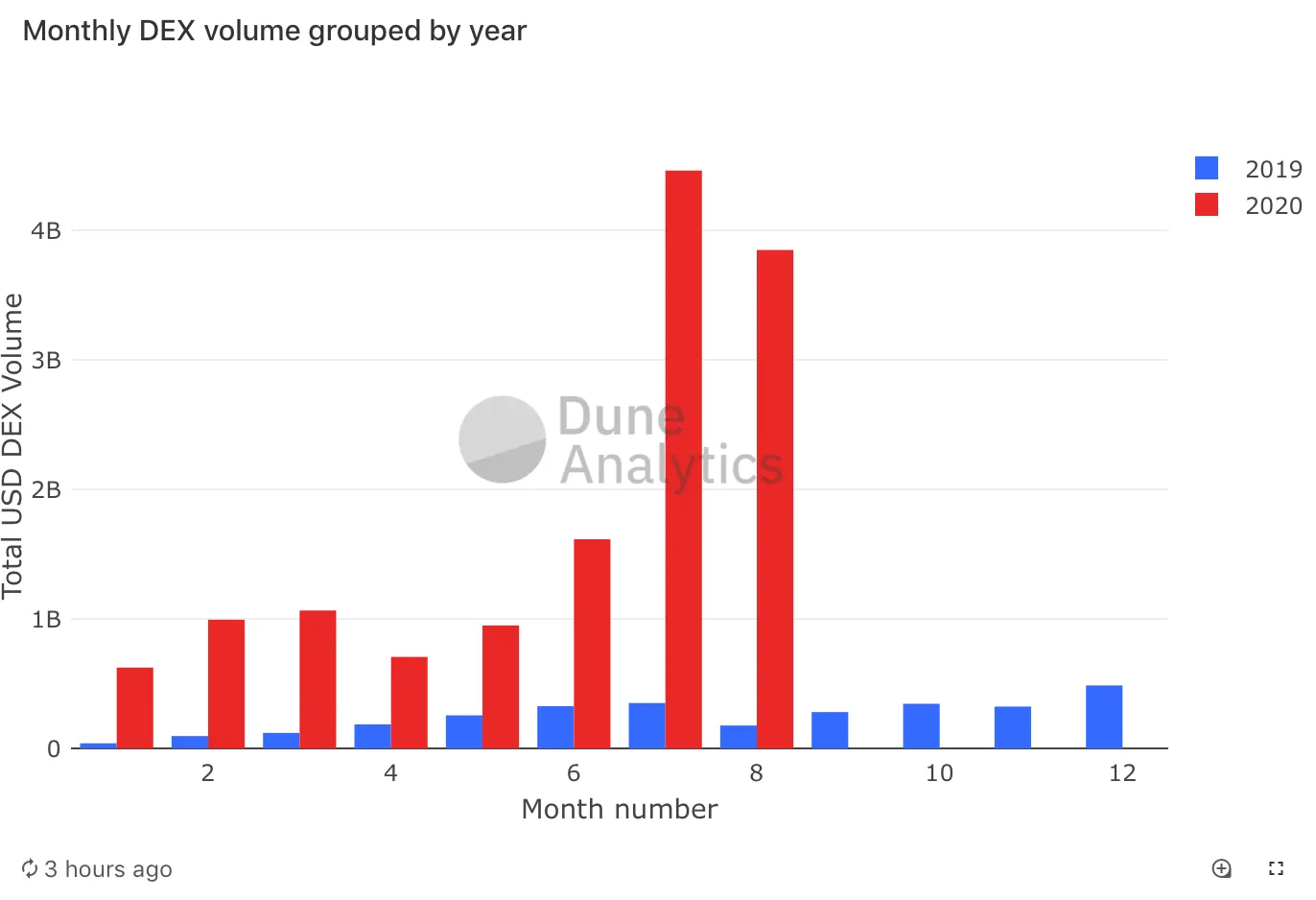

Dune is a website for data junkies trying to determine what's going on with the Ethereum blockchain and connected projects. It pulls data from Ethereum smart contracts and turns them into charts showing things like decentralized exchange volume, number of DeFi users, and transaction sizes. Whereas a block explorer like Etherscan provides a searchable history of blockchain transactions, Dune is more of a tool for interpreting that history.

Much of its appeal is that it allows people to create their own charts so they can explore individual projects like Compound or Curve. Some projects, such as Uniswap and Gnosis, purchase additional access, allowing them to create private analytics dashboards.

Its paid version likely would have been enough to keep Dune chugging along as a bootstrapped project, but founders Fredrik Haga and Mats Julian Olsen knew a seed round could help them do more.

"As a profitable company we've had the opportunity to be self-sustained but we've nevertheless decided to bring in more capital to meet the ever-growing demand, scale up the team and build out even more powerful tooling for the community," wrote Haga in a press release.

Tom Schmidt, a partner at Dragonfly Capital, told Decrypt Dune was easy to spot as a quality investment because of its ubiquity as a reference tool.

"Dune is hands down the best on-chain data platform on the market," he said. "You can just see the empirically when you look at which platform journalists use for their stories, investors use for research and diligence, and projects use for their dashboarding: it's always Dune."

In a Medium post announcing the investment, Schmidt noted that Dragonfly isn't just a Dune investor: "We personally use Dune for all of our articles at Dragonfly Research, and constantly use it to arrive at ground truth when making investment decisions."

Schmidt, who referred to the "forkable and remixable" site as "Github for data," further stated that its open, community-driven approach "allows Dune to cover projects faster and more accurately." And not just the big ticket items, but some of the emerging trends making their way from the margins into the crypto mainstream.

Indeed, Dune counts several well-known DeFi personalities as "power users," among them Stanislav Kulechov of Aave, Calvin Liu of Compound, and Matteo Leibowitz of Uniswap. All three, as well as several others, stepped up as angel investors for the seed round.

Dune's next step is to double its team: It's currently hiring remote front-end and back-end software engineers.