In brief

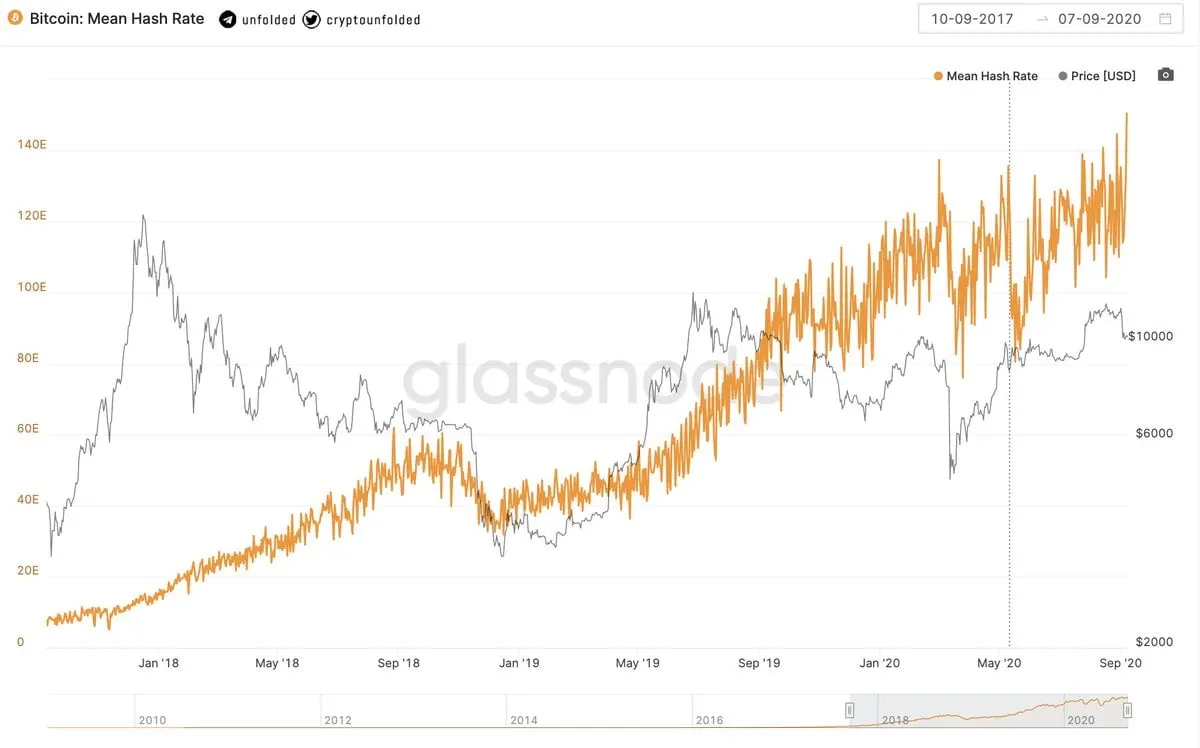

- Glassnode data shows the Bitcoin hash rate has increased to over 140 EH/s.

- The rise is part of a steady rise for the hash rate throughout 2020.

- The higher hash rate is good news for Bitcoin, since it is now harder to attack the blockchain.

The Bitcoin hash rate has hit an all-time high, according to data from Glassnode.

The hash rate measures the processing power of the Bitcoin blockchain. For the integrity of the decentralized system to exist, complex mathematical calculations have to take place quickly. As Bitcoins are mined, blocks of verified transactions are given a new hash, and added to the blockchain.

The hash rate has now broken above 140 exahashes (EH/s) per second, an increase from 129 EH/s reached last month.

It has been a positive year for the Bitcoin hash rate, after starting at 105 EH/s during the first week of January, 2020. However, there have been two pitfalls, with the hash rate falling to lows of 95 EH/s and 91 EH/s on March 16, 2020, and May 4, 2020.

What does this mean for the price of Bitcoin?

When the Bitcoin hash rate increases, there is always talk about whether or not a price increase will follow. This is because there is an expectation that miners will react to rising hash rates by holding onto coins, rather than mining new ones. This, in turn, can put pressure on Bitcoin, resulting in a boost to the cryptocurrency’s price.

However, this correlation is not always obvious. This chart from BitInfoCharts shows that the price of Bitcoin can rise and fall despite little change to hash rate. Ingo Fiedler, co-founder of the Blockchain Research Lab, told Decrypt that other aspects, such as lending infrastructure, market sentiment and miner competition, can all have an impact on Bitcoin’s hash rate.

“The maturing lending market allows miners to borrow more capital at cheaper rates against both their mining proceedings and their hardware. This is fostered by the increased Bitcoin price over the past month and the generally more positive market sentiment,” Fiedler said.

“This additional capacity to borrow funds expands the room for maneuvers by miners in competition games to gain market share,” he added.

This increase is good news for blockchain security. The higher the Bitcoin hash rate, the safer the blockchain becomes. If anyone ever tried to damage or attack the blockchain, they would need to control at least 51% of the world’s hashrate, which, as the rate goes up, becomes increasingly unlikely.