In brief

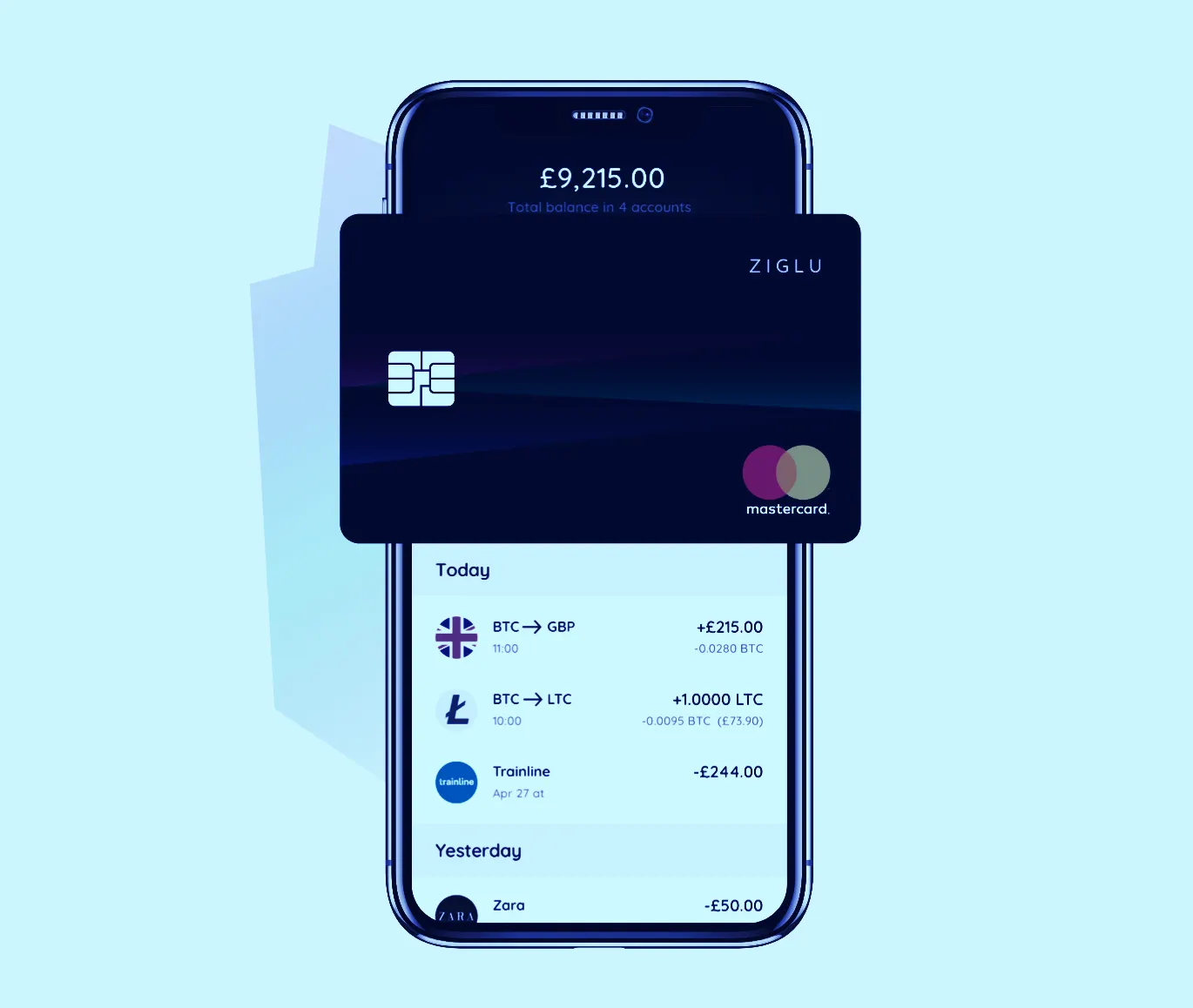

- Challenger bank Ziglu has announced that you can use its app to send cryptocurrency to other people, as well as buy and sell crypto. B

- But you can’t send your crypto to regular cryptocurrency wallets, only to other Ziglu customers.

- Revolut and Ziglu are attempting to out-maneuver traditional banks with their crypto offerings.

Ziglu, a new British crypto-first challenger bank, today announced that you can send cryptocurrency to other people, as well as buy and sell crypto from its app. In this, Ziglu joins Revolut, another challenger bank that also supports peer-to-peer cryptocurrency transactions.

But there’s a catch—you can’t send your crypto to regular cryptocurrency wallets. Instead, you can only send it to other Ziglu customers. The same is true for Revolut’s offering.

This seems strange: Isn’t the whole point of cryptocurrency to release oneself from the shackles of traditional finance and do whatever you please? And isn’t sending Bitcoin between wallets incredibly easy to set up? Indeed, there are dozens of wallet apps on the market.

It’s complicated, Nick Turner-Samuels, Ziglu’s Chief Product Officer, told Decrypt.

Sending crypto to external wallets “is something that we will be looking into,” said Turner-Samuels. A Revolut spokesperson told Mashable in July that such functionality is “a focus for the product team going forward.”

Ziglu's compromise was, in part, “to get to the market fast,” Turner-Samuels said. Ziglu, which only launched on June 15, wants to “prove that we can find a relative product-market fit sooner, [and to] test the app, and to integrate [crypto] as quickly as possible," said Turner-Samuels.

Ziglu’s CEO, Mark Hipperson, told Decrypt earlier this year that the bank is playing a kind of “regulatory arbitrage.”

Challenger banks—small, retail banks in the UK—like Revolut, Ziglu, Starling and Monzo, aim to undercut traditional retail banks by out-maneuvering them. So far, this means lower currency conversion fees, easy-to-use apps, robo-advisers, and so on.

Ziglu and Revolut hold a special money transmitter license, issued by the UK’s chief regulator, the Financial Conduct Authority, that lets them process cryptocurrency transactions alongside regular banking activities. They’re the only two challenger banks to hold such a license, meaning that they are leading on the crypto-front in what could be a winner-takes-all market. Ziglu only received its license in the past couple of weeks and Revolut received its license in May 2016.

Ziglu thinks that crypto is the next milestone, and it wants to be the first to corner the market. “We’re focused on an ambitious roadmap to get crypto out there to move into the challenger banking space,” said Turner-Samuels. Ziglu’s pitch is to undercut other cryptocurrency brokers by acting as a kind of power-user on cryptocurrency exchanges, allowing it to get the best price for Bitcoin.

“Now that we've got our FCA license, we're launching additional features, such as peer to peer payments. And we're going to be rolling out cards fairly soon as well. We're starting to build out the entire package for customers,” he said. But Revolut, five years old, is still miles ahead—it extended its crypto offering to the US this summer.

There’s another reason why Ziglu isn’t rushing things: It doesn’t want to upset regulators. There are “darker sides of the crypto world,” said Turner-Samuels, full of fraudsters, hackers and money-launderers.

“What we want to do is to make sure that we are really on top of our game when it comes to following the money, making sure that everything is above board—from where the money comes from, to the source of funds, to where the money goes to,” he said. Turner-Samuels added that Ziglu is working with anti-money laundering technology companies, though he did not disclose which ones.

And mistakes are expensive, both in pecuniary terms and in reputation: “You can look into the world of crypto and see that there have been issues with various companies or various cryptos. [They] have been tainted by the fact that they have been hacked,” he said.

Another thing: Ziglu is, like Revolut, targeting its services at newcomers to crypto. Blockchains are notoriously unforgiving when it comes to sending funds to the wrong addresses or losing private keys, and Ziglu’s initial control over its users’ funds could help resolve issues for newbies. “It's very easy to make the wrong wallet address inputs if you're not careful,” said Turner-Samuels. And it’s “also very difficult for everyday customers to find out where their money has gone if they have made a mistake.”

Hence Ziglu’s decision to rush to the market with its neutered crypto offering. “Ultimately, it's going to be customers voting with their wallets about who they want to trust,” he said.