In brief

- Chainlink (LINK) has been the best performing token of the year.

- Its meteoric rise finally came to a halt over the weekend, and the token has now dropped by 16% in the last day.

- Despite the price crash, LINK is still up 20% over the last 7 days.

The great Chainlink pump of 2020 might finally be over.

Just days ago, Chainlink was among the best performing tokens in the top 10 coins by market cap in terms of daily gains (and is still, by far, the best performing token of the year). But now, it has suffered its worst crash since the mid-March market meltdown.

LINK is down more than 16% and trading for just under $16 per coin.

The token has experienced a strong surge during 2020, rising from $1.8 on January 1, 2020, to $19.99 on August 16. But what goes up must come down.

That $20 per coin mark has proved to be a powerful barrier, even for the Link Marines—despite high-profile soldiers like Barstool Sports President Dave Portnoy doing his best to shill the crypto and pump up his latest investment.

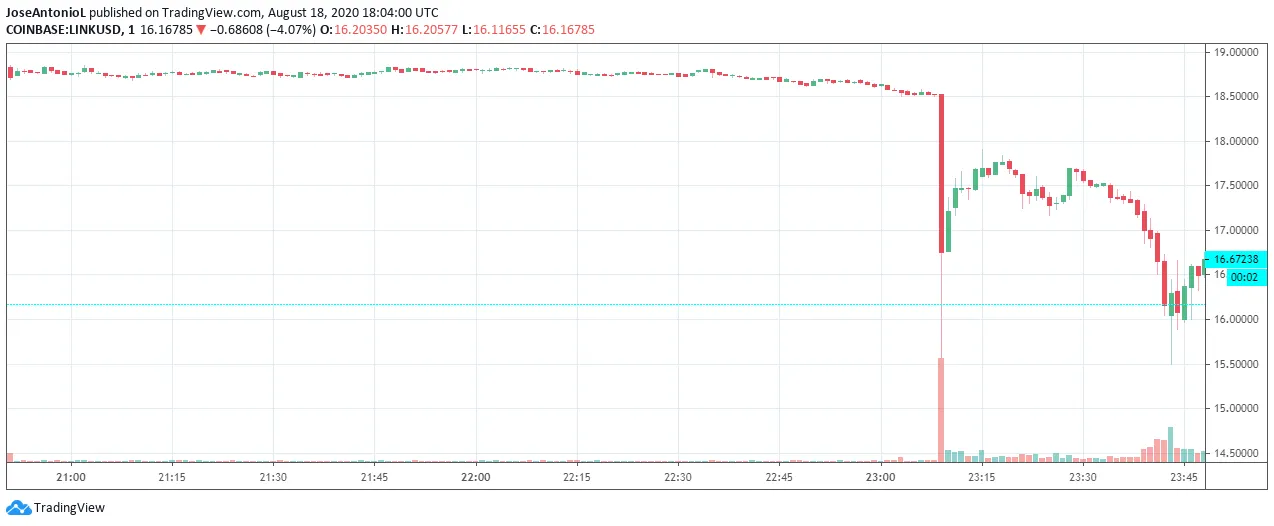

As soon as the token approached $20 on Saturday, a much anticipated downward correction began. The token fell to $14.75 the next day, corrected a bit upwards, and then tested that minimum again yesterday before settling at $16.

The drop seems to point to a massive selloff. The token fell almost 20% on Coinbase in one minute, in what appears to be a gigantic sale triggered by LINK touching the $18.50 mark.

But even a steep price drop like this can be healthy for markets. Corrections help balance the equation, and this could be the case for the Chainlink hype. Looking at LINK’s run so far, the coin has respected support at precisely $14.75 and is currently trying to break a resistance of $16.70 that could decide its fate over the next few days.

The dump also served to alleviate the pressure being built up around its trading as reflected by its relative strength index, or RSI (a measure that demonstrates an imbalance in the market and indicates whether a token is oversold or overbought). The token was in a zone of excessive overbuying and has now fallen back to more reasonable levels.

Besides the market doing what markets generally do, another possible reason for the precipitous price drop could be the sale of some $40 million in LINK tokens by Chainlink developers themselves, according to a recent report from Trustnodes. It’s not unlike the way Ripple occasionally sells off XRP, only far less transparent.

According to the report, Chainlink devs have used various obfuscation techniques to dump their coins.

Say it ain’t so, Link Marines?

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.