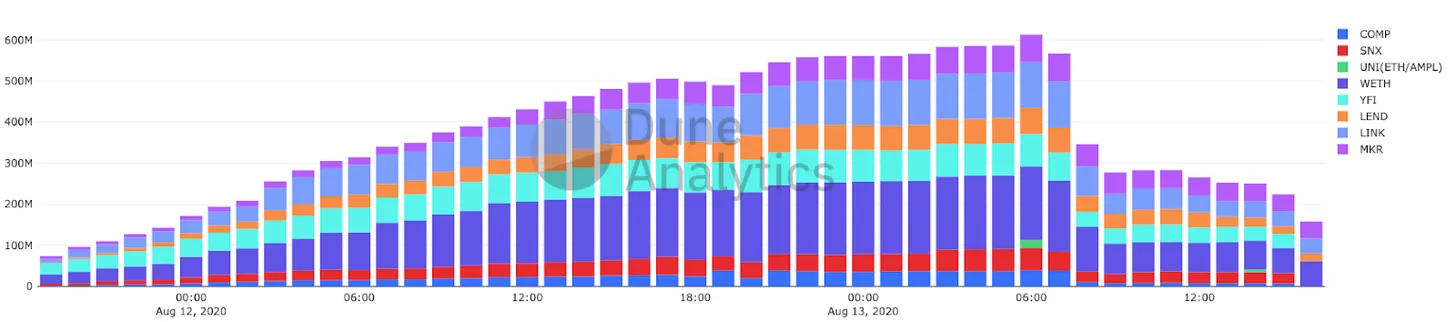

Yam Finance TVL went from $0 to as high as $500M, before falling to $280. YAM token jumped over $150 and is now trading at just below $1. The team discovered a bug in the code, which the community organized to fix, but ultimately made governance impossible.

And all of that happened in less than 48hrs.

i’m sorry everyone. i’ve failed. thank you for the insane support today. i’m sick with grief

— belmore🍠 (@brockjelmore) August 13, 2020

Yam Finance aggregated more than $400M worth of DeFi tokens from traders seeking to farm YAM in the hours after its launch, while its token soared many times over its $1 peg to as high as $157.

Then, the project underwent its first rebase as programmed, in which the supply inflated by roughly 10x to bring the token to its target peg of $1. Note that similar to AMPL, the number of tokens in holders’ wallets changes with each rebase, so while the price of YAM drops, the amount of YAM held by each investor increases.

Bug Found

It was at this time that a bug was found in the unaudited code where the YAM reserve inflated by 10x more than what was originally anticipated. The reserve is designed to purchase funds from Uniswap’s YAM/yCRV pool, but the inflated supply meant it would be impossible to reach quorum as the new YAM doesn’t have voting rights. Governance would be blocked, and so would funds in the treasury.

“There will be so much YAM printed that quorum will be impossible,” the team said in a blog post.

The community of YAM holders rallied to pass a governance vote in which rebases are paused and governance is migrated to a new contract. YAM token holders were called to delegate their voting power in exchange for added rewards so that the team could submit the bug fix, and while the vote count was low at first, the YAM count quickly picked up, culminating in a nail-biting event which came down to the wire.

We have been contacted by various benevolent YAM whales.

Many are farming the Uniswap Pool until 7am UTC to accrue extra YAM to delegate.

Progress toward our 160k goal will appear slow but then speed up rapidly as we approach 7am UTC.

Help us. We are all in this together #DeFi

— Yam Finance (@YamFinance) August 13, 2020

Smashed YAM

Ultimately, not even the fix could save Yam governance.

“We concluded that the rebaser bug would interact with the governance module and prevent this proposal from succeeding,” the team wrote in a blog post.

So where does YAM go from here? The token will continue to exist, with its supply expanding and contracting to keep its $1 peg, and YAM can still be farmed from staked tokens, but there will be no governance possible. The YAM/yCRV Uniswap pool, which now holds $1.4M in liquidity, remains unsafe and traders should withdraw their funds.

The hardest hit by the YAM collapse were Uniswap LPs. For those in the YAM/ETH pool, they did not receive the rebase and therefore had their supplied ETH drained as farmers rushed to squeeze every last drop of liquidity out of the project.

Holding Bags

There remains just north of $230M of assets staked in YAM, many of which are likely small farmers who are stuck holding the bag with cost averaging $30 to withdraw from any given pool. The return on these staked assets has dropped by 99%.

The Yam team will look to relaunch following a community-funded audit.“If the funding goal is reached, upon the completion of the audit, we plan to support the launch of YAM 2.0 via migration contract from YAM.”

Power of the Token

While unsuccessful, the experiment shows the power that token incentives and an open, global ecosystem have to create active communities. YAM holders didn’t exist three days ago, yet they were able to quickly coordinate to try to save the project they had rallied behind.

But let’s not shrug off the risks. Yam Finance issued YAM tokens with no pre-mine, no VC investments, distributing them completely among users to ensure decentralized governance —but also with no audits or value proposition other than accumulating YAM. Still, hordes of yield-hungry traders jumped in, while others looked on with dread. It turns out the latter now have good reason to say I told you so.

[This story was written and edited by our friends at The Defiant, and also appeared in its daily email. The content platform focuses on decentralized finance and the open economy and is sharing stories we think will interest our readers. You can subscribe to it here.]