In brief

- Almost $180 million worth of Bitcoin is now locked on the Ethereum blockchain.

- WBTC, sBTC, and renBTC are leading the charge, each offering a slightly different take on the lockup trend.

- Less than $10 million is currently locked in Bitcoin’s Lightning Network.

Bitcoin may be the original, but it’s living in an Ethereum world.

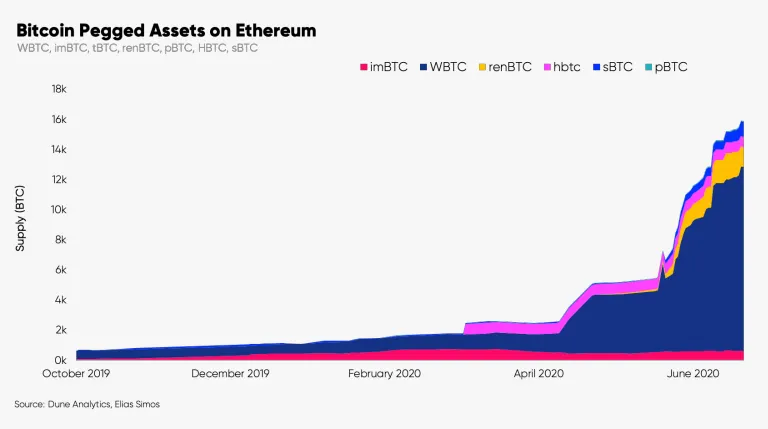

Nearly $180 million in Bitcoin is now locked on the Ethereum blockchain among formats like Wrapped Bitcoin (WBTC), Synthetix’s sBTC, and the Ren Project’s renBTC, according to data from Dune Analytics.

The rapid growth since the end of June, when Ethereum-locked BTC was just crossing the $100 million threshold, reveals how dominant Ethereum is becoming in the world of decentralized finance, as DeFi use cases and yield farmers hunting for more liquidity to increase their gains drive demand.

"The industry has seen significant efforts in bridging BTC to the world of decentralised finance (DeFi), most notably on Ethereum," crypto research firm Glassnode noted in its recent Q2 2020 report. "As of 20th July, there are 15.8k BTC (0.1% of the circulating supply) represented on Ethereum." That number has since swelled to 18.5 BTC.

Nearly 80% of Bitcoin currently locked on the Ethereum blockchain is in the form of WBTC. Developed in a collaborative effort between many partners, including several prominent DeFi protocols such as Kyber Network, Maker, Uniswap, and more. Wrapped Bitcoin uses a system of trusted third-party custodians to lock and distribute BTC being locked onto the Ethereum blockchain.

WBTC was added as a collateral asset for DAI loans on the Maker protocol earlier this year, currently making up more than 8% of assets backing loans on the platform, worth around $20 million. Since May, the number of Bitcoin locked on Ethereum as WBTC has increased more than 12x, driven by the desire to utilize the value of Bitcoin holdings on DeFi applications on Ethereum.

After WBTC, the second most popular Bitcoin lockup scheme is Synthetix’s sBTC, making up about 7.5% of Bitcoin on Ethereum, followed by renBTC at about 6%. sBTC, released by Synthetix in Q1 2019, represents one of the oldest approaches to accessing Bitcoin value on Ethereum, while the Ren Project’s renBTC launched in May 2020 and provides a similar custodial service to the WBTC system using smart contracts instead of trusted custodians.

Other forms of locked Bitcoin, including Huobi’s HBTC and imToken’s imBTC make up the balance of the $180 million total locked value. Notably, less than 1,000 BTC are currently locked in the Lightning Network, the payment system designed to speed up BTC transactions to the level of other competing blockchains.

Cross chain lockups like those facilitating WBTC and other alternatives are impressive technical feats in their own right. The bigger picture, however, shows the Ethereum blockchain pulling value away from the Bitcoin ecosystem at an increasing pace, as new applications open the door to healthy returns, collectable non-fungible tokens (NFTs), and other realized promises of blockchain technology.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.