In brief

This Plus Token ETH migration of funds is interesting.

So far they've used >5,000 addresses in order to obfuscate the transactions.

Thankfully this is blockchain, so we can track them 😎

— Alex Svanevik 🧭 (@ASvanevik) June 25, 2020

$102,721.00

-1.14%$2,273.56

-6.91%$2.02

-5.39%$630.40

-1.81%$133.00

-6.56%$0.999838

0.00%$0.272517

-0.67%$0.155446

-4.91%$2,272.00

-6.97%$0.545126

-6.73%$102,586.00

-1.19%$33.74

-4.24%$2,726.40

-7.47%$465.14

-1.41%$2.53

-7.32%$8.97

0.60%$11.87

-6.40%$0.233093

-4.62%$0.999811

0.00%$16.63

-5.57%$48.57

-1.06%$2.82

-4.85%$0.00001079

-5.22%$1.00

0.03%$80.95

-2.78%$2,272.80

-7.01%$2,433.15

-6.91%$311.64

-0.80%$0.133137

-8.32%$1.001

0.01%$3.28

-5.43%$4.14

-3.90%$102,753.00

-1.10%$6.42

-7.34%$0.00000911

-8.97%$0.499819

-6.62%$229.23

-8.01%$1.18

0.04%$50.31

-2.39%$1.00

0.00%$303.13

-11.27%$4.02

-11.65%$0.082221

-6.30%$1.056

0.02%$4.63

-7.24%$161.17

-6.47%$1.91

-8.19%$15.37

-4.92%$27.87

-1.36%$0.999791

-0.04%$0.672138

-9.15%$0.609746

-4.33%$16.17

-3.71%$4.44

-0.01%$8.71

-5.86%$102,512.00

-1.10%$3.76

-4.95%$0.064395

-6.30%$0.01964007

-6.90%$0.174193

-6.69%$0.594632

-9.18%$0.072078

-6.04%$0.996675

-0.16%$0.244314

-8.97%$2.84

-8.50%$2.17

-5.26%$0.999986

0.01%$4.19

-3.06%$1.001

0.00%$2,273.77

-6.87%$0.838487

-4.86%$0.157838

-6.61%$10.84

-1.31%$92.29

-3.65%$0.269547

-6.53%$140.44

-6.79%$1.15

-3.59%$0.01635315

-5.21%$0.198679

-10.18%$2,588.38

-6.96%$2,379.56

-7.04%$0.177399

-7.46%$0.348847

-10.38%$1.00

0.04%$0.999884

0.00%$0.999837

0.05%$1.41

-11.21%$0.00001246

-8.88%$9.73

-12.01%$0.056651

-3.98%$0.976069

-8.94%$3,425.27

0.95%$102,500.00

-0.98%$0.498898

-8.48%$1.33

-14.60%$0.564582

-7.57%$0.848182

-9.76%$2,428.98

-6.69%$630.44

-1.81%$3,403.74

0.77%$2,384.10

-7.00%$0.260251

-6.06%$102,401.00

-1.32%$104,065.00

-0.77%$2.76

2.03%$1.11

-0.01%$2,393.00

-6.94%$0.473622

-6.15%$0.074599

-7.92%$0.530802

-7.07%$111.51

0.00%$0.370597

-6.04%$0.692978

-9.18%$2.02

-5.56%$148.73

-6.46%$0.998116

-0.03%$2.04

-5.96%$173.40

-6.44%$0.01015783

-11.16%$0.777027

-8.29%$2,458.36

-6.89%$1.091

0.10%$0.0000648

-9.79%$38.26

-4.93%$0.997752

0.00%$0.607412

-7.70%$0.673827

-5.93%$29.58

-3.86%$17.42

-7.65%$101,855.00

-1.21%$0.149084

-7.01%$0.233472

-6.62%$0.01263551

-9.26%$0.00000058

-3.38%$3.41

-7.31%$0.210517

1.48%$0.01121612

-8.28%$102,462.00

-1.14%$1.00

0.00%$0.498453

-4.29%$0.387692

-7.10%$0.00830128

-12.19%$2,274.10

-6.94%$2,274.99

-6.90%$1.87

-10.21%$0.086944

-6.37%$102,627.00

-1.19%$0.494163

-8.14%$0.998405

0.01%$0.309767

-7.98%$33.72

-4.09%$2,429.62

-6.67%$2,370.68

-5.41%$2,272.60

-7.01%$0.01376258

1.79%$0.426367

-5.20%$0.23495

-6.63%$7.85

-0.78%$0.559204

-9.53%$1.26

-6.66%$0.406516

-0.64%$0.061002

-0.29%$0.999807

0.01%$0.999793

0.02%$45.44

-4.86%$1.00

-0.00%$2.23

-6.63%$1.091

0.00%$0.00000041

-0.96%$1.00

-1.28%$0.15513

-4.98%$33.71

-4.24%$1.001

0.50%$0.381242

-0.73%$5.08

-6.10%$0.03603878

-10.60%$0.00001788

-4.69%$1.14

-6.99%$12.40

-7.59%$0.445685

-8.59%$0.168294

5.38%$2,414.41

-7.01%$0.475608

-5.67%$2,272.90

-6.78%$0.102167

-6.77%$0.067062

-6.44%$2.07

-6.69%$0.34098

-7.91%$0.00366619

-7.92%$0.03334928

-2.36%$0.278459

-8.68%$0.00568124

-8.65%$1.14

-4.52%$0.01703211

-1.84%$0.857486

-7.21%$102,497.00

-1.41%$0.316908

0.23%$19.36

-0.14%$2,508.96

-6.85%$102,300.00

-1.94%$1.019

-7.33%$0.03251796

-6.07%$0.999831

-0.00%$0.99914

-0.02%$0.03163547

-9.21%$0.999452

0.02%$0.119572

-10.17%$4.76

-6.79%$0.999899

0.00%$1.26

-8.21%$2,487.49

-7.01%$0.00340228

-14.05%$2,274.16

-6.91%$0.00005367

-7.18%$0.117398

-10.91%$0.00000074

-7.86%$144.74

-6.47%$0.00284153

-7.86%$0.00000139

-4.47%$0.673953

-7.24%$0.998221

-0.13%$0.42177

-6.77%$102,629.00

-0.97%$1.70

-0.74%$0.0032677

-5.31%$9.32

-1.51%$1.007

-6.96%$2,269.13

-6.97%$1.016

-0.01%$102.24

-6.19%$16.62

-5.62%$100,439.00

2.65%$0.055999

-8.59%$2,063.92

-1.08%$0.569852

-6.61%$0.174326

-6.66%$0.254604

-8.79%$99,966.00

-1.27%$0.486641

-4.65%$0.999736

0.03%$0.0046073

-10.19%$0.01527058

-6.82%$13.83

-4.31%$0.514139

-11.23%$0.166501

-8.49%$5.54

-9.02%$18.39

-6.39%$1.19

0.00%Reading

Funds connected to the alleged PlusToken Ponzi scheme have been filtered through 6,000 separate addresses and counting. Experts believe this may be an attempt to evade detection.

In July 2019, PlusToken, a now-defunct, South Korean-based crypto wallet was accused of appropriating over $3 billion from users in what's been dubbed the biggest Ponzi scheme in crypto history.

PlusToken, a supposedly South Korean-based crypto wallet, is accused of scamming users out of an estimated $3 billion, according to Chinese media. That would make it the biggest crypto Ponzi scheme to date. However, according to news site 86btc, the wallet is actually developed by a Chinese company based in the northern city of Jiaxing. PlusToken launched in 2018 as an international crypto project, claiming to be supported by a South Korean team, with ex-Samsung and Google employees. It’s mar...

Yesterday, $185 million worth of Ethereum originating from a PlusToken wallet sprung to life. The funds were divided among 52 addresses. Now it seems that the funds have split up even further, spreading across to 6,000 addresses.

"It would be speculation, but it certainly seems like they are trying to obfuscate the funds," said data scientist Alex Svanevik, co-founder of blockchain analytics platform Nansen.

"It seems like a highly orchestrated operation to move these funds, but it's still relatively easy to track the new wallets. exchanges that accept funds from these new wallets can be easily tracked," he added.

According to Svanevik, the funds were sent out in waves, with each surge sending the funds to a swathe of new addresses. At press time there have been approximately five waves, but Svanevik believes there will be more.

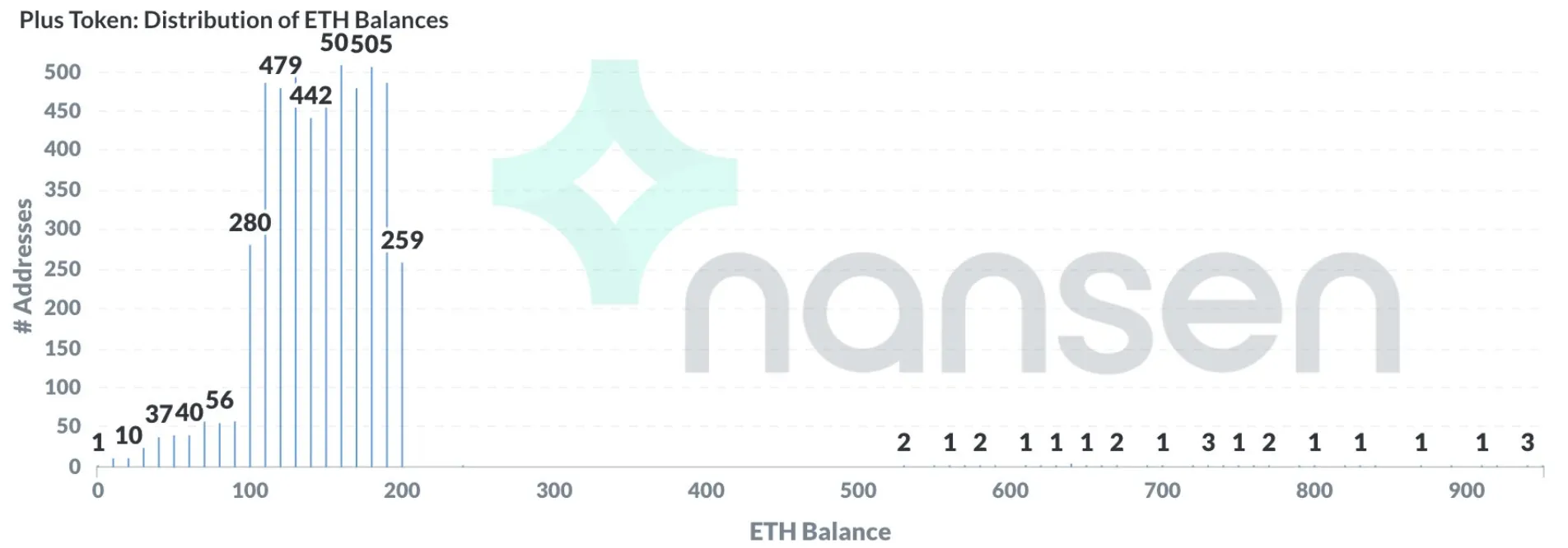

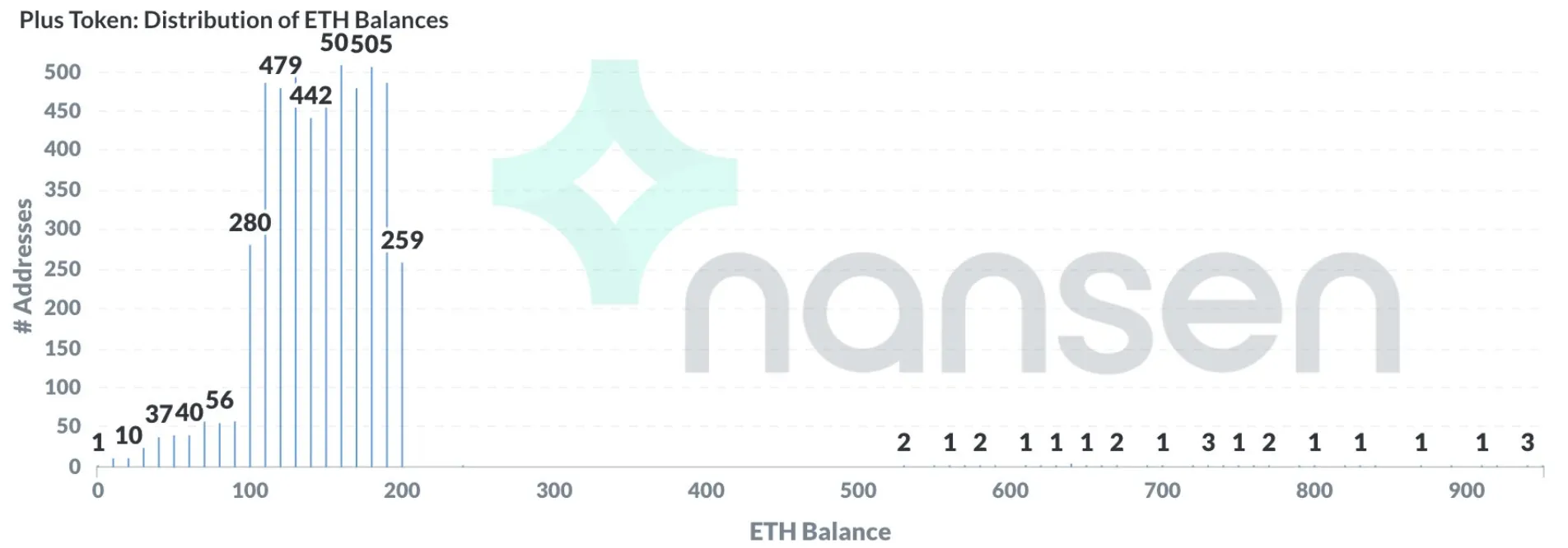

With every wave, funds are split up into smaller amounts, making it hard to keep track of them. Svanevik suggested that eventually, most wallets will end up with 100 - 200 ETH apiece.

"This shows the number of addresses for different ETH balances,” he explained. “You see how it's concentrated in 100-200 ETH, and that there are some addresses between 500 and 1000 as well."

"Funds have been moving almost continuously in the last 18 hours," Svanevik said, adding that funds are likely still being moved at this moment.

This Plus Token ETH migration of funds is interesting.

So far they've used >5,000 addresses in order to obfuscate the transactions.

Thankfully this is blockchain, so we can track them 😎

— Alex Svanevik 🧭 (@ASvanevik) June 25, 2020

Svanevik found no signs to suggest any funds had been moved to exchanges. And although the funds have been split up across thousands of addresses, it’s still relatively easy to keep track of them, in order to stop them going to exchanges and getting sold.

"Now that we have them tracked, we'll be able to see right away what they do next," he said. Perhaps having a transparent blockchain isn’t so bad after all.

Rektguy didn’t mint out its free NFTs on the Ethereum blockchain in 2022—but three years later, the brand has become incredibly familiar with the phrase “sold out,” with the Rekt Drinks brand clearing out successive drops and reaching more and more consumers along the way. The brand, which weathered a brutal crypto bear market thanks in part to the strength of its fervent community, has now sold more than 600,000 cans of Rekt Drinks, a non-alcoholic, flavored sparkling water that comes in a vari...

Two top Wall Street analysts are confident many top altcoins ETFs will imminently be approved for trading—so confident, they’ve now estimated the likelihood of such spot approvals coming before the end of the year at almost 100%. Solana, XRP, and Litecoin spot ETFs are near-locks at 95% odds of approval from the U.S. Securities and Exchange Commission by the end of 2025, the analysts, Eric Balchunas and James Seyffart of Bloomberg, wrote Friday. Dogecoin, Cardano, Polkadot, Hedera, and Avalan...

Bitcoin holding company Nakamoto Holdings, the firm founded by crypto media entrepreneur David Bailey, has raked in an additional $51.5 million to establish a Bitcoin treasury—a corporate strategy that has become increasingly popular among public companies. The funds were raised in a private-investment-in-public-equity deal closed on Friday by Nakamoto's merger partner KindlyMD, according to KindlyMD's statement. The healthcare data firm sold its common stock at $5 per share in the raise. "Ad...